Form 7004 Instructionspdffillercom 2016

What is the Form 7004 Instructionspdffillercom

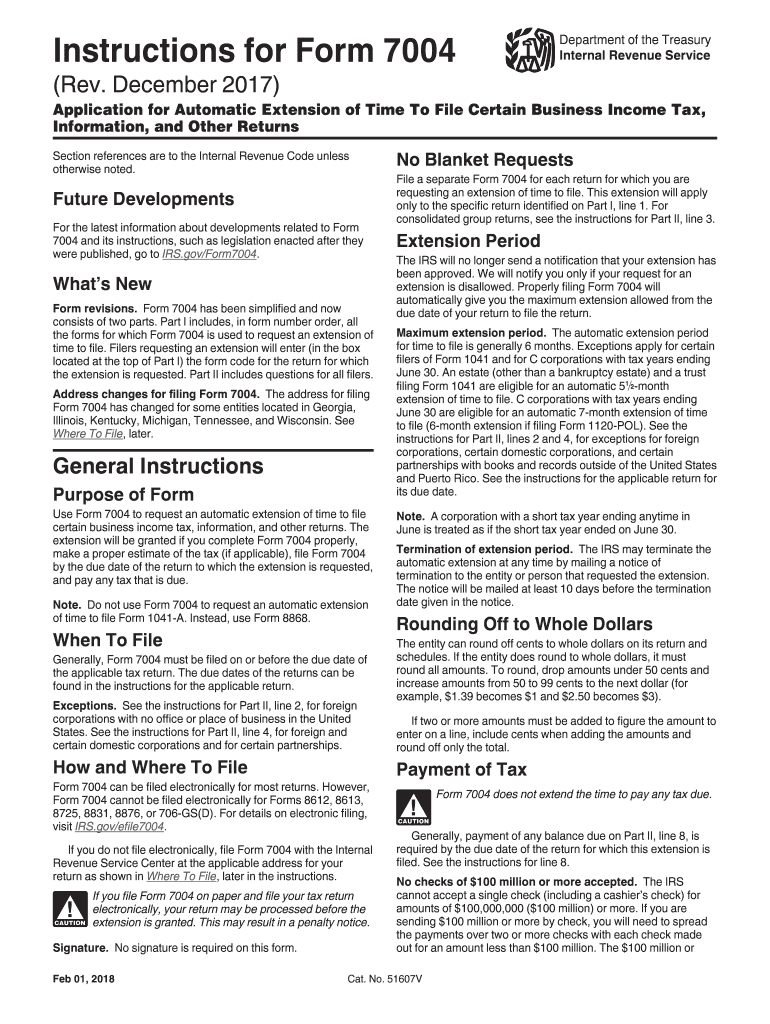

The Form 7004 is an application for an automatic extension of time to file certain business income tax returns. This form is crucial for entities such as corporations, partnerships, and certain trusts that require additional time to prepare their tax documents. By filing Form 7004, businesses can receive an automatic six-month extension, allowing them to focus on accurate and thorough tax preparation without the pressure of immediate deadlines.

How to use the Form 7004 Instructionspdffillercom

To effectively use the Form 7004, begin by gathering necessary information about your business, including the type of entity, tax year, and estimated tax liability. Complete the form by providing accurate details in the designated fields. Once filled out, the form can be submitted electronically or via mail, depending on your preference and the requirements of the IRS. Ensure that all information is correct to avoid delays or issues with your extension request.

Steps to complete the Form 7004 Instructionspdffillercom

Completing the Form 7004 involves several key steps:

- Identify the correct form for your business type, whether it’s for a corporation, partnership, or trust.

- Fill in the business name, address, and Employer Identification Number (EIN).

- Indicate the type of return for which you are requesting an extension.

- Estimate your tax liability and provide the amount.

- Sign and date the form, ensuring all information is accurate and complete.

Legal use of the Form 7004 Instructionspdffillercom

The legal use of Form 7004 is governed by IRS regulations. When filed correctly, it grants an automatic extension for filing business tax returns. It is important to note that while this form extends the filing deadline, it does not extend the time to pay any taxes owed. Businesses must still pay any estimated taxes by the original due date to avoid penalties and interest.

Filing Deadlines / Important Dates

Filing deadlines for Form 7004 vary based on the type of business entity. Generally, the form must be filed by the original due date of the tax return. For corporations, this is typically the fifteenth day of the fourth month after the end of the tax year. For partnerships, the deadline is usually the fifteenth day of the third month after the end of the tax year. It is essential to keep track of these dates to ensure compliance and avoid penalties.

Required Documents

When preparing to file Form 7004, certain documents may be required to ensure accurate completion. These documents include:

- Your business’s tax identification number (EIN).

- Previous year’s tax return for reference.

- Records of estimated tax payments made throughout the year.

- Any additional documentation that supports your estimated tax liability.

Quick guide on how to complete form 7004 instructionspdffillercom 2016

Complete Form 7004 Instructionspdffillercom effortlessly on any device

Online document management has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Form 7004 Instructionspdffillercom on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 7004 Instructionspdffillercom effortlessly

- Obtain Form 7004 Instructionspdffillercom and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 7004 Instructionspdffillercom and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 7004 instructionspdffillercom 2016

Create this form in 5 minutes!

How to create an eSignature for the form 7004 instructionspdffillercom 2016

How to create an eSignature for the Form 7004 Instructionspdffillercom 2016 online

How to generate an eSignature for the Form 7004 Instructionspdffillercom 2016 in Chrome

How to make an eSignature for putting it on the Form 7004 Instructionspdffillercom 2016 in Gmail

How to make an eSignature for the Form 7004 Instructionspdffillercom 2016 right from your mobile device

How to generate an electronic signature for the Form 7004 Instructionspdffillercom 2016 on iOS

How to create an eSignature for the Form 7004 Instructionspdffillercom 2016 on Android OS

People also ask

-

What is Form 7004 InstructionssignNowcom, and how does it work?

Form 7004 InstructionssignNowcom is an online tool designed to simplify the process of filing Form 7004 for tax extensions. By using this platform, businesses can easily fill out the necessary information, ensuring accuracy and compliance with IRS requirements. The user-friendly interface allows for quick navigation, making it ideal for all users.

-

How much does it cost to use Form 7004 InstructionssignNowcom?

Form 7004 InstructionssignNowcom offers competitive pricing based on your business needs, with various subscription options available. Users can choose from monthly or annual plans, ensuring cost-effectiveness for both small and large businesses. Additionally, there are often promotional offers that can help reduce your overall expenses.

-

What features does Form 7004 InstructionssignNowcom provide?

Form 7004 InstructionssignNowcom includes essential features such as step-by-step guidance for filling out the form, electronic filing capabilities, and secure storage options for your documents. Users can also access templates and examples to help streamline the process. These features make it a comprehensive solution for managing tax extensions.

-

Can I integrate Form 7004 InstructionssignNowcom with other software?

Yes, Form 7004 InstructionssignNowcom offers seamless integrations with popular accounting and business management software. This allows users to sync their data efficiently, reducing the need for manual entry and minimizing errors. Integration enhances workflow productivity and ensures that all your financial information is in one place.

-

What are the benefits of using Form 7004 InstructionssignNowcom for my business?

Using Form 7004 InstructionssignNowcom streamlines the tax extension process, saving time and reducing stress for business owners. The platform ensures compliance with IRS regulations, which helps avoid penalties. Additionally, its user-friendly features allow users to focus more on their core business activities instead of paperwork.

-

Is Form 7004 InstructionssignNowcom secure for my business data?

Absolutely, Form 7004 InstructionssignNowcom prioritizes the security of your business data. The platform uses advanced encryption technology to protect sensitive information, ensuring that your documents are secure during transmission and storage. You can have peace of mind knowing that your data is handled with the utmost care.

-

How does Form 7004 InstructionssignNowcom compare to other tax filing solutions?

Form 7004 InstructionssignNowcom stands out due to its ease of use and comprehensive features tailored specifically for Form 7004. Unlike other tax filing solutions, it offers a more intuitive interface and dedicated support for users. This makes it an ideal choice for businesses looking for a straightforward and efficient way to manage tax extensions.

Get more for Form 7004 Instructionspdffillercom

- Membership development grant application cecil aultman fund amvets form

- University of alaska anchorage download official transcript 2012 form

- Common application pdf 2014 form

- Georgia form app 2010

- Adoption paperwork for mass printable 2007 form

- Get homebuilt boat builder certificate form

- Superior court of california county of riverside 701426459 form

- Petition for reconsideration sample form

Find out other Form 7004 Instructionspdffillercom

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template