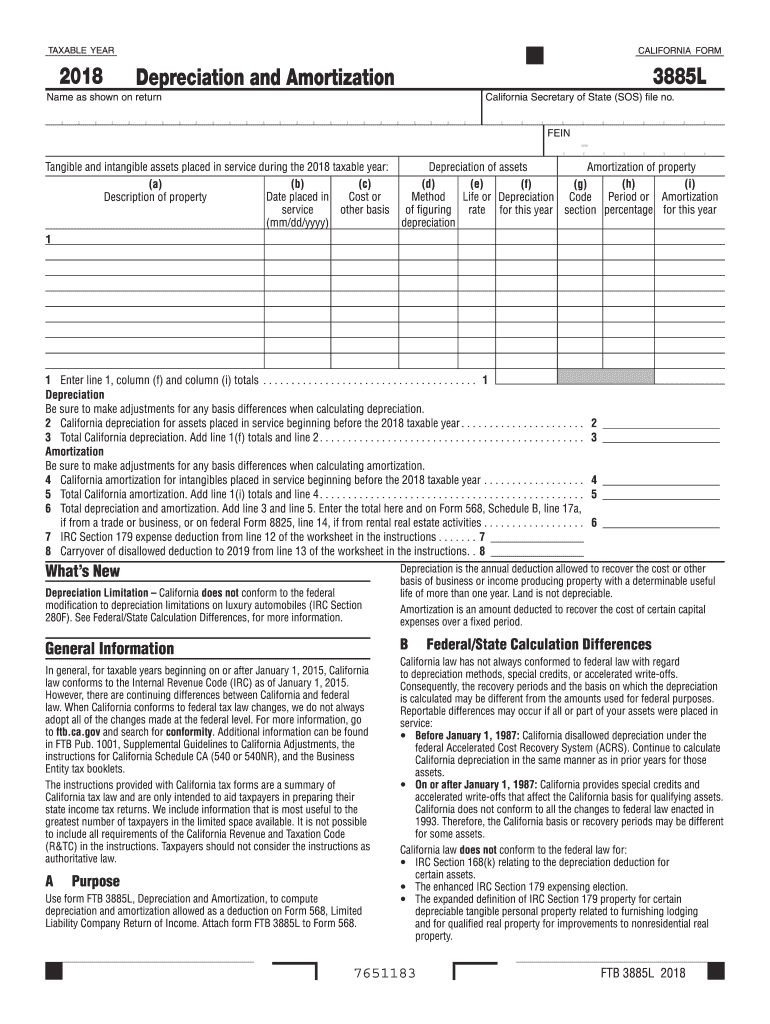

Form 3885l 2018

What is the Form 3885L

The Form 3885L is a California tax form used primarily for reporting the California Child and Dependent Care Expenses Credit. This form allows taxpayers to claim a credit for expenses incurred while caring for qualifying children or dependents. It is essential for individuals who wish to reduce their tax liability by taking advantage of available credits. The form is designed to be filled out online, providing a convenient option for users to complete their tax filings efficiently.

Steps to Complete the Form 3885L

Completing the Form 3885L involves several key steps:

- Gather necessary information, including your Social Security number, details of your dependents, and the expenses incurred for their care.

- Access the fillable version of the form through a secure platform like signNow.

- Enter your personal information in the designated fields, ensuring accuracy to avoid delays.

- Detail your child and dependent care expenses, including the provider's information and the amount paid.

- Review the form for completeness and accuracy before submitting it electronically.

Legal Use of the Form 3885L

The Form 3885L is legally recognized by the California Franchise Tax Board (FTB) for claiming tax credits. To ensure compliance, taxpayers must adhere to the guidelines set forth by the FTB. This includes providing accurate information regarding qualifying expenses and ensuring that all claims are substantiated with appropriate documentation. Utilizing the form correctly can lead to significant tax savings, making it a valuable tool for eligible taxpayers.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 3885L. Generally, the deadline for submitting this form coincides with the annual tax return deadline, which is typically April fifteenth. However, if you file for an extension, you may have until October fifteenth to submit your tax return along with the Form 3885L. It is crucial to stay informed about any changes to these dates to ensure timely filing and avoid penalties.

Form Submission Methods

The Form 3885L can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online: Users can complete and submit the form electronically through secure platforms like signNow, ensuring a streamlined process.

- Mail: Taxpayers may also print the completed form and send it via postal mail to the appropriate FTB address.

- In-Person: For those who prefer face-to-face interactions, submitting the form in person at designated FTB offices is an option.

Key Elements of the Form 3885L

Understanding the key elements of the Form 3885L is essential for accurate completion. Important components include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Dependent Information: Details about each qualifying child or dependent must be provided.

- Expense Reporting: Taxpayers must list all eligible child and dependent care expenses, including the name and address of the care provider.

- Signature: An electronic signature is required to validate the submission.

Quick guide on how to complete 2018 form 3885 l depreciation and amortization 2018 california form 3885 l depreciation and amortization

Your assistance manual on how to prepare your Form 3885l

If you’re curious about how to generate and submit your Form 3885l, here are some brief instructions on how to simplify tax processing signNowly.

To begin, you merely need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and return to modify information when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to finalize your Form 3885l in no time:

- Establish your account and start working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Form 3885l in our editor.

- Complete the necessary fillable fields with your information (text, numerical data, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that paper submissions can lead to return errors and delay refunds. It goes without saying, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 3885 l depreciation and amortization 2018 california form 3885 l depreciation and amortization

FAQs

-

When and how are the assignments for IGNOU CHR to be submitted for the December 2018 TEE? How and when to fill out the examination form? Where do I look for the datasheet?

First download the assignments from IGNOU - The People's University website and write them with A4 size paper then submitted it in your study center.check the above website you will find a link that TEE from fill up for dec 2018 after got the link you will fill your tee from online.Remember while filling your TEE you should put tick mark on the box like this;Are you submitted assignments: yes[ ] No[ ]

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

-

If I buy a new 2018 Honda CR-V EX-L, and immediately sell it back to the dealership, after driving 1000 miles, exactly how much loss or depreciation will the car get?

Approximately $5,365, or $5.36 per mile.And that does not even factor in the fact that dealers pay much less than retail for cars they buy from customers.

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 3885 l depreciation and amortization 2018 california form 3885 l depreciation and amortization

How to create an electronic signature for the 2018 Form 3885 L Depreciation And Amortization 2018 California Form 3885 L Depreciation And Amortization in the online mode

How to generate an electronic signature for your 2018 Form 3885 L Depreciation And Amortization 2018 California Form 3885 L Depreciation And Amortization in Chrome

How to make an eSignature for signing the 2018 Form 3885 L Depreciation And Amortization 2018 California Form 3885 L Depreciation And Amortization in Gmail

How to create an electronic signature for the 2018 Form 3885 L Depreciation And Amortization 2018 California Form 3885 L Depreciation And Amortization right from your smart phone

How to create an electronic signature for the 2018 Form 3885 L Depreciation And Amortization 2018 California Form 3885 L Depreciation And Amortization on iOS

How to make an eSignature for the 2018 Form 3885 L Depreciation And Amortization 2018 California Form 3885 L Depreciation And Amortization on Android

People also ask

-

What is the 2017 CA 3885L fillable form?

The 2017 CA 3885L fillable form is an important document used for California tax calculations and reports. This form allows users to input their financial information electronically, ensuring accuracy and efficiency. Being fillable makes it easy to complete and submit, enhancing the overall filing experience.

-

How can I obtain the 2017 CA 3885L fillable form?

You can easily obtain the 2017 CA 3885L fillable form directly from tax preparation software or online tax resource sites. Additionally, airSlate SignNow offers tools that enable users to create and fill out this form digitally. This convenience helps streamline the tax filing process.

-

Can airSlate SignNow help me fill out the 2017 CA 3885L form securely?

Yes, airSlate SignNow provides a secure and user-friendly platform for filling out the 2017 CA 3885L fillable form. With advanced security features, you can confidently enter your information knowing it is protected. This solution not only enhances security but also simplifies document management.

-

What features does airSlate SignNow offer for signing the 2017 CA 3885L fillable form?

airSlate SignNow offers various features such as eSignatures, document sharing, and real-time collaboration for the 2017 CA 3885L fillable form. These features facilitate a seamless signing experience, allowing multiple signers to add their signatures easily. The platform is designed to make the entire process efficient and transparent.

-

Is there a cost associated with using the 2017 CA 3885L fillable form on airSlate SignNow?

Yes, there may be costs associated with using airSlate SignNow for the 2017 CA 3885L fillable form, but the pricing is competitive and tailored for various business needs. Subscription plans typically include a range of features to enhance your document workflow. Ensure you review the pricing options to find the best fit for your requirements.

-

Does airSlate SignNow integrate with other software for the 2017 CA 3885L fillable form?

Indeed, airSlate SignNow supports integrations with various software solutions to enhance the workflow associated with the 2017 CA 3885L fillable form. Users can seamlessly connect with tools like CRM systems and accounting software. This integration helps streamline processes and save time during tax season.

-

What benefits does electronic signing of the 2017 CA 3885L fillable form provide?

Using airSlate SignNow for electronically signing the 2017 CA 3885L fillable form offers numerous benefits, including faster processing times and reduced paperwork. Electronic signatures are legally binding, ensuring compliance. This method also allows for easy tracking and storage of documents.

Get more for Form 3885l

- 4p rounding form

- Fax 1300722404 form

- United kingdom value added tax form

- N 400 questions pdf form

- Form ab 100 alcohol beverage individual questionnaire and instructions fill in form

- Submit via emailprint formclear formattorney ethic

- Equipment responsibility agreement template form

- Equipment sale agreement template form

Find out other Form 3885l

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation