Form 592 V, Payment Voucher for Resident and Nonresident Withholding Form 592 V, Payment Voucher for Resident and No 2018

What is the Form 592 V, Payment Voucher For Resident And Nonresident Withholding

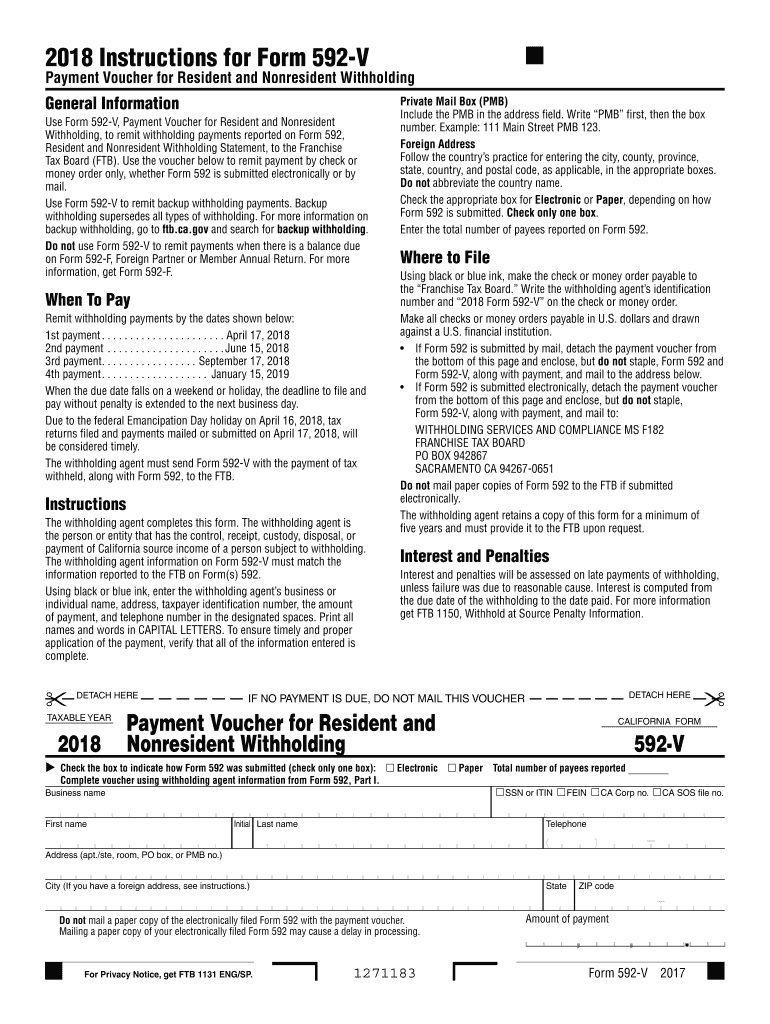

The Form 592 V, Payment Voucher for Resident and Nonresident Withholding, is an essential document used by individuals and businesses in the United States to remit withholding payments to the California Franchise Tax Board. This form is specifically designed for those who are required to withhold taxes from payments made to residents and nonresidents. It ensures that the correct amount of tax is paid on behalf of the payee, facilitating compliance with state tax laws.

How to use the Form 592 V, Payment Voucher For Resident And Nonresident Withholding

Using the Form 592 V involves a straightforward process. First, gather the necessary information, including the payee's details and the amount being withheld. Next, accurately fill out the form, ensuring all fields are completed. Once the form is filled out, it should be submitted along with the payment to the appropriate tax authority. It is crucial to keep a copy of the completed form for your records, as it serves as proof of payment.

Steps to complete the Form 592 V, Payment Voucher For Resident And Nonresident Withholding

Completing the Form 592 V involves several key steps:

- Obtain the latest version of the form from the California Franchise Tax Board's website.

- Enter the payer's name, address, and taxpayer identification number (TIN).

- Provide the payee's information, including their name, address, and TIN.

- Indicate the amount being withheld and any applicable payment period.

- Review the completed form for accuracy before submitting.

Legal use of the Form 592 V, Payment Voucher For Resident And Nonresident Withholding

The Form 592 V is legally required for any entity or individual who withholds taxes from payments made to residents and nonresidents in California. Proper use of this form ensures compliance with state tax regulations, helping to avoid potential penalties and interest for underpayment or late payment of taxes. It is important to understand the legal implications of withholding taxes and to use this form accurately to fulfill tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 592 V vary depending on the payment period. Generally, payments are due on or before the 15th day of the month following the end of the quarter in which the withholding occurred. It is essential to stay informed about these deadlines to ensure timely submission and avoid penalties. Marking your calendar with these dates can help maintain compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 592 V can be submitted through various methods, making it convenient for users. Individuals and businesses can file the form online through the California Franchise Tax Board's e-file system, which offers a quick and efficient way to handle tax payments. Alternatively, the form can be mailed to the appropriate address provided by the tax authority. In-person submissions may also be possible at designated tax offices, depending on local regulations.

Quick guide on how to complete 2018 form 592 v payment voucher for resident and nonresident withholding 2018 form 592 v payment voucher for resident and

Your assistance manual on how to prepare your Form 592 V, Payment Voucher For Resident And Nonresident Withholding Form 592 V, Payment Voucher For Resident And No

If you're curious about how to finalize and submit your Form 592 V, Payment Voucher For Resident And Nonresident Withholding Form 592 V, Payment Voucher For Resident And No, here are some straightforward instructions to simplify tax filing.

To get started, you simply need to create your airSlate SignNow profile to change the way you handle documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, generate, and finalize your tax forms effortlessly. With its editor, you can navigate among text, check boxes, and eSignatures and revisit to adjust information as necessary. Optimize your tax organization with enhanced PDF editing, eSigning, and easy sharing options.

Follow these steps to finalize your Form 592 V, Payment Voucher For Resident And Nonresident Withholding Form 592 V, Payment Voucher For Resident And No in just a few minutes:

- Create your account and begin handling PDFs in moments.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Hit Get form to load your Form 592 V, Payment Voucher For Resident And Nonresident Withholding Form 592 V, Payment Voucher For Resident And No in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Review your document and amend any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to more errors and slow down refunds. Of course, before e-filing your taxes, review the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 592 v payment voucher for resident and nonresident withholding 2018 form 592 v payment voucher for resident and

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 592 v payment voucher for resident and nonresident withholding 2018 form 592 v payment voucher for resident and

How to generate an eSignature for your 2018 Form 592 V Payment Voucher For Resident And Nonresident Withholding 2018 Form 592 V Payment Voucher For Resident And online

How to create an electronic signature for the 2018 Form 592 V Payment Voucher For Resident And Nonresident Withholding 2018 Form 592 V Payment Voucher For Resident And in Chrome

How to make an eSignature for signing the 2018 Form 592 V Payment Voucher For Resident And Nonresident Withholding 2018 Form 592 V Payment Voucher For Resident And in Gmail

How to generate an eSignature for the 2018 Form 592 V Payment Voucher For Resident And Nonresident Withholding 2018 Form 592 V Payment Voucher For Resident And from your smartphone

How to create an electronic signature for the 2018 Form 592 V Payment Voucher For Resident And Nonresident Withholding 2018 Form 592 V Payment Voucher For Resident And on iOS devices

How to create an eSignature for the 2018 Form 592 V Payment Voucher For Resident And Nonresident Withholding 2018 Form 592 V Payment Voucher For Resident And on Android OS

People also ask

-

What is the purpose of Form 592 V, Payment Voucher For Resident And Nonresident Withholding?

Form 592 V, Payment Voucher For Resident And Nonresident Withholding is used to report withholding payments for California residents and non-residents. This form helps ensure compliance with California tax laws by providing a structure for making timely payments.

-

How can airSlate SignNow help me with Form 592 V, Payment Voucher?

airSlate SignNow simplifies the process of filling out and submitting Form 592 V, Payment Voucher For Resident And Nonresident Withholding. Our platform allows you to easily eSign and send the document securely, making tax season less stressful.

-

Is airSlate SignNow suitable for individuals as well as businesses for handling Form 592 V?

Yes, airSlate SignNow is designed for a wide range of users, from individual taxpayers to large businesses. No matter your size, our platform helps manage Form 592 V, Payment Voucher For Resident And Nonresident Withholding efficiently.

-

What are the key features of airSlate SignNow for managing withholding forms?

Key features of airSlate SignNow include customizable templates for Form 592 V, Payment Voucher For Resident And Nonresident Withholding, real-time collaboration, and secure document storage. These features ensure that users can prepare and submit forms easily and securely.

-

Does airSlate SignNow offer integration with accounting software for managing Form 592 V?

Yes, airSlate SignNow integrates with a variety of accounting and financial software, providing a seamless experience when managing Form 592 V, Payment Voucher For Resident And Nonresident Withholding. This integration helps streamline your overall workflow.

-

What is the pricing structure for using airSlate SignNow?

AirSlate SignNow offers competitive pricing options tailored to different user needs, making it a cost-effective solution for managing Form 592 V, Payment Voucher For Resident And Nonresident Withholding. Pricing varies based on features and user scales, ensuring you pay for what you need.

-

How secure is airSlate SignNow for submitting sensitive tax forms like Form 592 V?

Security is a top priority at airSlate SignNow; we use state-of-the-art encryption to ensure that your Form 592 V, Payment Voucher For Resident And Nonresident Withholding is submitted safely. Our compliance with various regulations guarantees that your sensitive information is protected.

Get more for Form 592 V, Payment Voucher For Resident And Nonresident Withholding Form 592 V, Payment Voucher For Resident And No

Find out other Form 592 V, Payment Voucher For Resident And Nonresident Withholding Form 592 V, Payment Voucher For Resident And No

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe