Form 3885 L Depreciation and Amortization 2017

What is the Form 3885 L Depreciation And Amortization

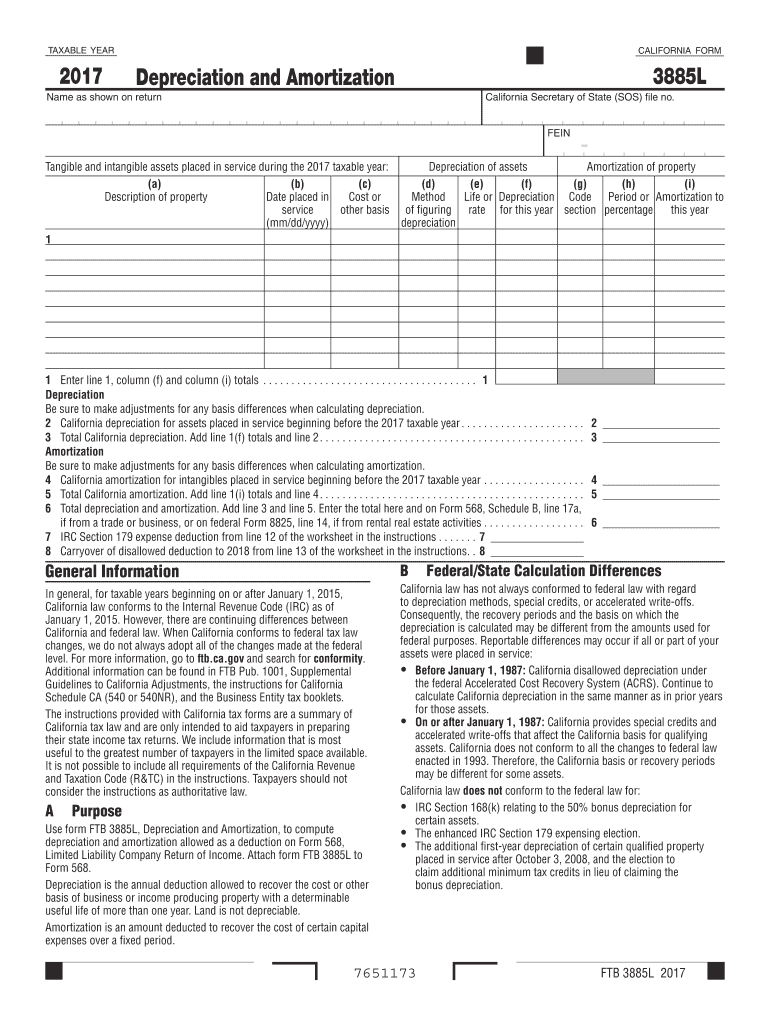

The Form 3885 L Depreciation and Amortization is a tax form used by businesses in the United States to report depreciation and amortization deductions. These deductions are essential for businesses as they allow for the recovery of the costs associated with tangible and intangible assets over time. The form is specifically designed to help taxpayers calculate the amount of depreciation or amortization they can claim on their federal tax returns, thereby reducing their taxable income.

How to use the Form 3885 L Depreciation And Amortization

Using the Form 3885 L involves several steps. First, gather all necessary documentation related to your assets, including purchase dates and costs. Next, fill out the form by providing detailed information about each asset, including its classification and the method of depreciation or amortization being used. After completing the form, review it for accuracy before submitting it with your federal tax return. It is important to keep a copy for your records, as it may be needed for future reference or audits.

Steps to complete the Form 3885 L Depreciation And Amortization

Completing the Form 3885 L requires careful attention to detail. Follow these steps:

- Identify the assets you wish to depreciate or amortize.

- Determine the appropriate method of depreciation or amortization for each asset, such as straight-line or declining balance.

- Fill in the asset details on the form, including acquisition dates and costs.

- Calculate the depreciation or amortization expense for the tax year.

- Review the completed form for accuracy before submission.

Legal use of the Form 3885 L Depreciation And Amortization

The legal use of the Form 3885 L is governed by IRS regulations. It is crucial to ensure that all information provided on the form is accurate and complies with federal tax laws. Misreporting or failing to file the form can result in penalties or audits. Therefore, businesses should maintain proper documentation and consult with tax professionals if necessary to ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3885 L typically align with the general tax filing deadlines for businesses. Generally, businesses must file their federal tax returns by April 15 of each year, unless an extension is requested. It is crucial to be aware of these deadlines to avoid late filing penalties. Additionally, if you are filing as a corporation, the deadlines may differ, so it is important to check the specific requirements applicable to your business entity.

Form Submission Methods (Online / Mail / In-Person)

The Form 3885 L can be submitted in several ways. Taxpayers have the option to file electronically through approved e-filing software, which is often the fastest method. Alternatively, the form can be printed and mailed to the IRS. In some cases, businesses may also choose to submit the form in person at designated IRS offices. Each method has its own benefits, and choosing the right one depends on your specific circumstances and preferences.

Quick guide on how to complete 2017 form 3885 l depreciation and amortization

Your assistance manual on how to prepare your Form 3885 L Depreciation And Amortization

If you seek to understand how to generate and dispatch your Form 3885 L Depreciation And Amortization, here are a few brief guidelines on how to simplify tax submission.

First and foremost, you only need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to alter information as needed. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Adhere to the steps outlined below to finalize your Form 3885 L Depreciation And Amortization in moments:

- Create your account and begin working on PDFs within moments.

- Utilize our catalog to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Form 3885 L Depreciation And Amortization in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized eSignature (if necessary).

- Review your document and amend any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Bear in mind that submitting on paper may increase return mistakes and postpone refunds. It goes without saying, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 3885 l depreciation and amortization

FAQs

-

What is the last date to fill out the management form in BVM and GCET for B.tech admission 2017?

BVM, GCET and ADIT- all these three colleges have common form for management admissions. You can refer website of BVM or GCET or ADIT to get the form and details precisely!Even if you will make a call they will furnish information. (Get college’s contact number from website. )If nothing works out, drop me a message- I have personal contacts.:)

-

Which form other than NEET and AIIMS are going to be out for 2017 and I should fill?

There are many other options open for you if you have had MATHS as a subject along with the other three main subjects.PCMB - You can apply for B.Tech. in BIOTech., BIOMEDICAL, BIOCHEMISTRY.JEE MAINSJEE ADVANCEDTUPCB -JIPMER (MBBS / NMT / CVT)Indian Institute of Science Bangalore (B.S. in BIOLOGY)NEST (B.S. + M.S. in BIOLOGY)Manipal School of Allied Health Sciences (B.S. and M.S. in NMT and CVT)I will try to add more when I find them out.Hope that helped.Thanks for A2A.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 3885 l depreciation and amortization

How to make an eSignature for the 2017 Form 3885 L Depreciation And Amortization in the online mode

How to generate an electronic signature for the 2017 Form 3885 L Depreciation And Amortization in Chrome

How to create an electronic signature for signing the 2017 Form 3885 L Depreciation And Amortization in Gmail

How to create an eSignature for the 2017 Form 3885 L Depreciation And Amortization straight from your smartphone

How to generate an electronic signature for the 2017 Form 3885 L Depreciation And Amortization on iOS devices

How to generate an eSignature for the 2017 Form 3885 L Depreciation And Amortization on Android OS

People also ask

-

What is Form 3885 L Depreciation And Amortization?

Form 3885 L Depreciation And Amortization is a tax form used to calculate depreciation and amortization for specific assets. It helps businesses allocate the cost of tangible and intangible property over time. Understanding this form is crucial for accurate tax reporting and financial planning.

-

How does airSlate SignNow streamline the process of handling Form 3885 L Depreciation And Amortization?

airSlate SignNow offers a user-friendly platform that simplifies the signing and sharing of documents, including Form 3885 L Depreciation And Amortization. Our platform allows you to easily prepare, send, and eSign the form, ensuring a smooth and efficient process that saves both time and resources.

-

Is there a cost associated with using airSlate SignNow for Form 3885 L Depreciation And Amortization?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different business needs. These plans are cost-effective and provide full access to features that will help you manage documents like Form 3885 L Depreciation And Amortization. You can choose a plan that fits your budget while enjoying the benefits of efficient document handling.

-

What features does airSlate SignNow offer for managing Form 3885 L Depreciation And Amortization?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for Form 3885 L Depreciation And Amortization. These tools allow you to create, modify, and track the status of your documents seamlessly, ensuring compliance and ease of use.

-

Can I integrate airSlate SignNow with other software when working on Form 3885 L Depreciation And Amortization?

Absolutely! airSlate SignNow offers robust integrations with various business applications, enhancing your workflow when managing Form 3885 L Depreciation And Amortization. This seamless integration means you can connect your favorite tools to streamline your document processes further.

-

What security measures does airSlate SignNow implement for documents like Form 3885 L Depreciation And Amortization?

Security is a top priority at airSlate SignNow. We implement industry-leading security measures to protect your documents, including Form 3885 L Depreciation And Amortization. Our platform features encryption, secure access controls, and compliance with data protection regulations to ensure your information remains safe.

-

How quickly can I send and receive Form 3885 L Depreciation And Amortization through airSlate SignNow?

With airSlate SignNow, you can send and receive Form 3885 L Depreciation And Amortization almost instantly. Our platform is designed for speed and efficiency, allowing all parties to eSign documents quickly, which accelerates the overall workflow and reduces delays in your business processes.

Get more for Form 3885 L Depreciation And Amortization

- Mathswatch worksheets foundation form

- General order g03 02 use of force chicago police department form

- Childcare enrolment form 30484916

- Massachusetts schedule ojc instructions form

- Aok pluspunkt mehr leistungen antrag form

- General services administration grafik graphic visions form

- Almb 6v2 521united states bankruptcy court form

- Equipment service agreement template form

Find out other Form 3885 L Depreciation And Amortization

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form