California Form 592 F Foreign Partner or Member Annual Withholding Return 2025-2026

Understanding the California Form 592 F

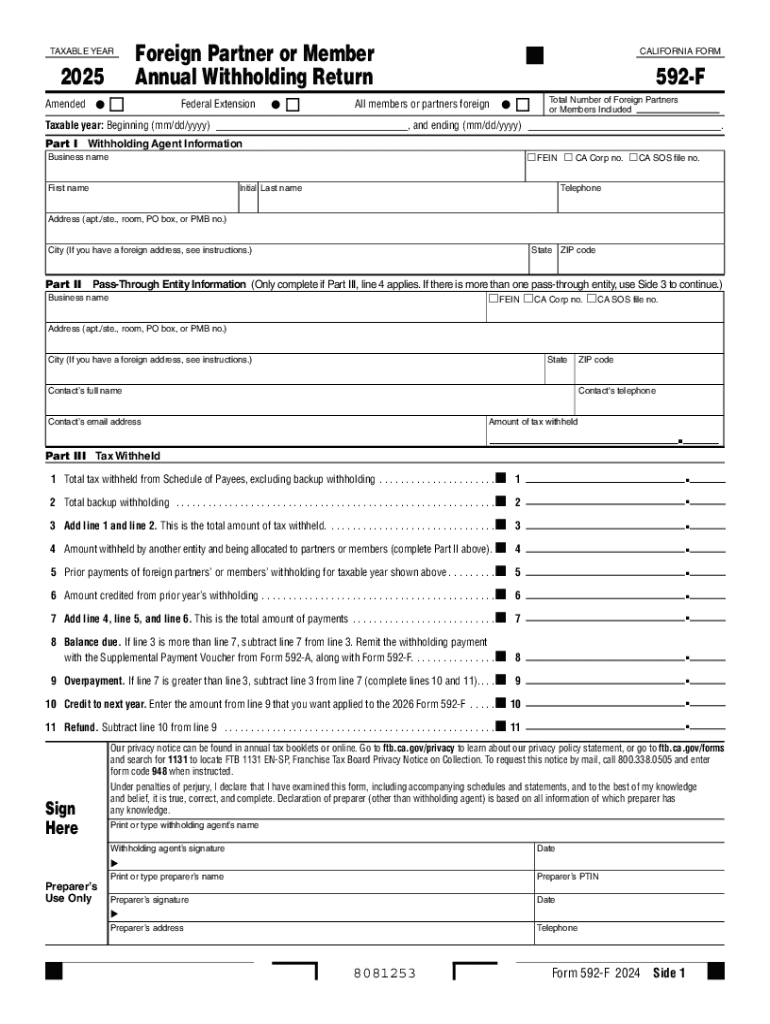

The California Form 592 F, officially known as the Foreign Partner or Member Annual Withholding Return, is essential for foreign partners or members of partnerships, LLCs, or corporations that earn income in California. This form is designed to report and withhold taxes on income derived from California sources. It ensures compliance with California tax regulations, particularly for non-resident entities.

Steps to Complete the California Form 592 F

Filling out the California Form 592 F involves several key steps:

- Gather necessary information: Collect details about the foreign partner or member, including their name, address, and taxpayer identification number.

- Report income: Document the total amount of income earned by the foreign partner or member from California sources.

- Calculate withholding: Determine the amount of tax to be withheld based on the income reported. The standard withholding rate is generally applicable.

- Complete the form: Accurately fill out each section of the form, ensuring all information is correct and complete.

- Submit the form: File the completed Form 592 F with the California Franchise Tax Board by the designated deadline.

Legal Use of the California Form 592 F

The California Form 592 F serves a crucial legal purpose. It helps ensure that foreign partners or members comply with California tax laws regarding income earned in the state. By accurately completing and submitting this form, entities can avoid penalties and legal issues related to tax compliance. It also facilitates proper tax withholding, ensuring that the correct amount is remitted to the state.

Filing Deadlines and Important Dates

Timely filing of the California Form 592 F is essential to avoid penalties. The deadline for submitting this form typically aligns with the tax return due date for the partnership or entity. It is important to check for specific due dates each tax year, as they may vary. Keeping track of these deadlines helps ensure compliance and avoids unnecessary fees.

Obtaining the California Form 592 F

The California Form 592 F can be easily obtained from the California Franchise Tax Board's official website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, many tax preparation software solutions include the form, making it accessible for electronic completion and submission.

Key Elements of the California Form 592 F

Several key elements must be included when completing the California Form 592 F:

- Entity Information: Include the name, address, and taxpayer identification number of the foreign partner or member.

- Income Details: Clearly state the total income earned from California sources.

- Withholding Amount: Specify the total amount withheld for tax purposes.

- Signature: Ensure that the form is signed by an authorized representative of the entity.

Create this form in 5 minutes or less

Find and fill out the correct california form 592 f foreign partner or member annual withholding return

Create this form in 5 minutes!

How to create an eSignature for the california form 592 f foreign partner or member annual withholding return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 592 f ca and why is it important?

Form 592 f ca is a California tax form used by non-residents to report income earned in California. It is essential for ensuring compliance with state tax regulations and avoiding penalties. Understanding how to properly fill out and submit form 592 f ca can save you time and money.

-

How can airSlate SignNow help with form 592 f ca?

airSlate SignNow provides a seamless platform for electronically signing and sending form 592 f ca. With its user-friendly interface, you can easily manage your documents and ensure they are signed and submitted on time. This simplifies the process and enhances your productivity.

-

What are the pricing options for using airSlate SignNow for form 592 f ca?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes features that facilitate the signing and management of documents like form 592 f ca. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for form 592 f ca with airSlate SignNow?

Yes, airSlate SignNow integrates with numerous applications, allowing you to streamline your workflow when handling form 592 f ca. You can connect it with popular tools like Google Drive, Dropbox, and CRM systems to enhance document management. This integration helps you save time and reduce errors.

-

What features does airSlate SignNow offer for managing form 592 f ca?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage for managing form 592 f ca. These tools help ensure that your documents are organized and easily accessible. Additionally, you can track the status of your forms in real-time.

-

Is airSlate SignNow secure for handling sensitive information on form 592 f ca?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect sensitive information on form 592 f ca. You can trust that your data is safe while using our platform for electronic signatures and document management.

-

Can I use airSlate SignNow on mobile devices for form 592 f ca?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage form 592 f ca on the go. Whether you are using a smartphone or tablet, you can easily sign and send documents from anywhere. This flexibility enhances your ability to stay productive.

Get more for California Form 592 F Foreign Partner Or Member Annual Withholding Return

Find out other California Form 592 F Foreign Partner Or Member Annual Withholding Return

- How Do I Add Sign in CMS

- How Do I Install Sign in WorkDay

- How Can I Install Sign in WorkDay

- Help Me With Install Sign in WorkDay

- Can I Install Sign in WorkDay

- How Can I Add Sign in CMS

- How To Install Sign in NetSuite

- Help Me With Install Sign in NetSuite

- How Can I Install Sign in NetSuite

- Help Me With Install Sign in ServiceNow

- How Can I Install Sign in ServiceNow

- Help Me With Add Sign in CRM

- How To Add Sign in SalesForce

- How Do I Add Sign in SalesForce

- Help Me With Add Sign in SalesForce

- How Can I Add Sign in SalesForce

- Help Me With Install Sign in G Suite

- Can I Add Sign in SalesForce

- How Can I Install Sign in G Suite

- Can I Install Sign in Egnyte