Ct 1096 Form 2017

What is the Ct 1096 Form

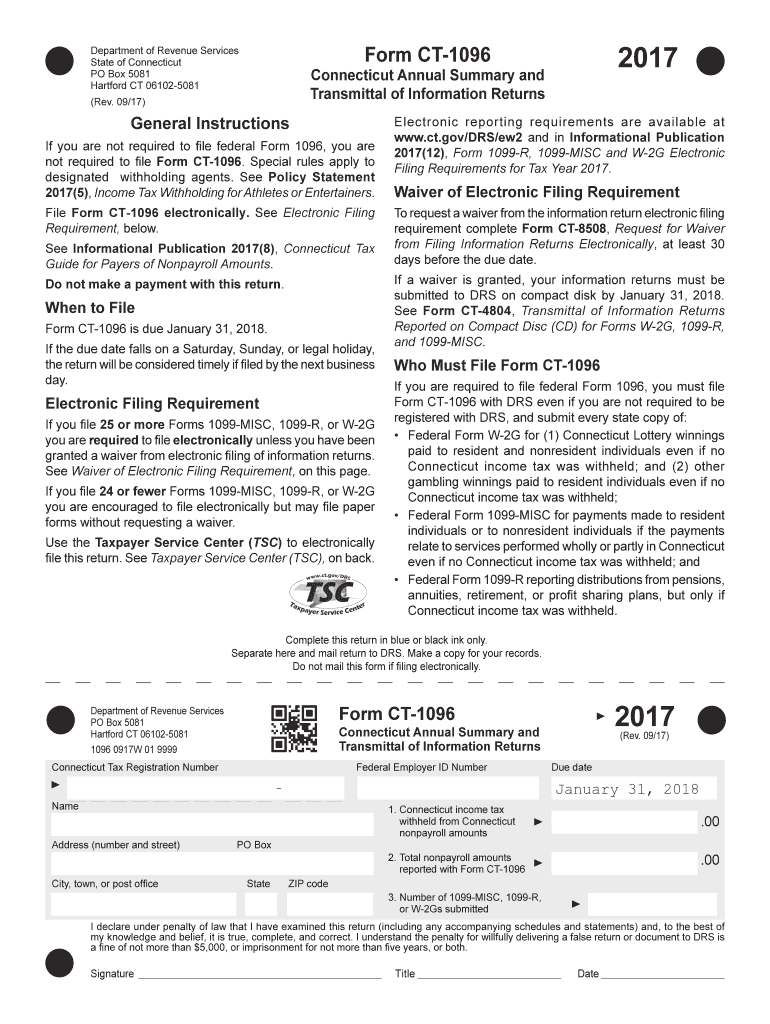

The Ct 1096 Form is a tax-related document used in Connecticut for reporting and summarizing information regarding various tax payments made by businesses within the state. This form is essential for ensuring compliance with state tax regulations and is typically submitted alongside other related tax forms. It serves as a summary of the payments made to the Connecticut Department of Revenue Services, allowing for accurate record-keeping and tax reporting.

How to use the Ct 1096 Form

Using the Ct 1096 Form involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the tax payments made during the reporting period. This includes details about the amounts paid, the types of taxes, and the corresponding periods. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Finally, submit the form to the appropriate state agency by the specified deadline, either electronically or via mail, depending on the submission options available.

Steps to complete the Ct 1096 Form

Completing the Ct 1096 Form requires careful attention to detail. Follow these steps:

- Collect all relevant tax payment records for the reporting period.

- Enter your business information, including name, address, and tax identification number.

- Summarize the total tax payments made, categorizing them by type of tax.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Ct 1096 Form

The Ct 1096 Form is legally binding when completed and submitted in accordance with Connecticut state tax laws. It is crucial for businesses to adhere to the guidelines set forth by the Connecticut Department of Revenue Services to avoid penalties. Proper use of this form ensures that businesses remain compliant with state tax regulations and helps maintain accurate financial records.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 1096 Form vary based on the specific tax year and the type of taxes being reported. Typically, businesses must submit this form by a predetermined date following the end of the tax reporting period. It is important to stay informed about these deadlines to avoid late fees or penalties. Always consult the Connecticut Department of Revenue Services for the most current information regarding filing dates.

Required Documents

To successfully complete the Ct 1096 Form, certain documents are required. These may include:

- Records of all tax payments made during the reporting period.

- Previous tax returns and forms for reference.

- Any correspondence from the Connecticut Department of Revenue Services related to tax obligations.

Having these documents on hand will facilitate a smoother completion process and ensure accuracy.

Form Submission Methods

The Ct 1096 Form can be submitted through various methods, depending on the preferences and capabilities of the business. Options typically include:

- Online submission through the Connecticut Department of Revenue Services’ website.

- Mailing a physical copy of the form to the designated address.

- In-person submission at local tax offices, if available.

Choosing the appropriate submission method can help streamline the process and ensure timely filing.

Quick guide on how to complete ct 1096 2017 form

Complete Ct 1096 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Ct 1096 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Ct 1096 Form effortlessly

- Obtain Ct 1096 Form and click on Get Form to begin.

- Use the tools at your disposal to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Disregard lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign Ct 1096 Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1096 2017 form

Create this form in 5 minutes!

How to create an eSignature for the ct 1096 2017 form

How to create an electronic signature for the Ct 1096 2017 Form in the online mode

How to create an eSignature for the Ct 1096 2017 Form in Chrome

How to make an eSignature for signing the Ct 1096 2017 Form in Gmail

How to make an electronic signature for the Ct 1096 2017 Form right from your mobile device

How to generate an eSignature for the Ct 1096 2017 Form on iOS devices

How to make an eSignature for the Ct 1096 2017 Form on Android OS

People also ask

-

What is the Ct 1096 Form?

The Ct 1096 Form is a crucial document used by businesses in Connecticut to report and summarize their income tax withholding. It is essential for employers to accurately complete this form to ensure proper tax compliance. By utilizing airSlate SignNow, you can easily eSign and send your Ct 1096 Form securely.

-

How can airSlate SignNow help me with the Ct 1096 Form?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing and submitting the Ct 1096 Form. With features like document templates and electronic signatures, you can streamline your tax reporting process, ensuring accuracy and efficiency. Our solution allows you to manage your forms from anywhere, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the Ct 1096 Form?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs. Our plans are cost-effective and designed to help you manage forms like the Ct 1096 Form efficiently. You can choose a plan that fits your budget and take advantage of our comprehensive features.

-

Can I integrate airSlate SignNow with other software for the Ct 1096 Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including popular accounting and HR software. This makes it easier to manage your Ct 1096 Form alongside your other business processes, ensuring a cohesive workflow without the hassle of switching platforms.

-

What features does airSlate SignNow offer for managing the Ct 1096 Form?

Our platform includes features such as document templates, reusable workflows, and secure electronic signatures, all of which enhance the management of the Ct 1096 Form. These tools help ensure that your forms are completed accurately and submitted on time, providing peace of mind during tax season.

-

How secure is my data when using airSlate SignNow for the Ct 1096 Form?

Security is a top priority at airSlate SignNow. When you use our platform to manage the Ct 1096 Form, your data is encrypted and stored securely to protect sensitive information. We implement industry-standard security measures to ensure your documents are safe from unauthorized access.

-

Can I track the status of my Ct 1096 Form with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents, including the Ct 1096 Form. You can easily monitor when your form has been sent, viewed, and signed, giving you full visibility and control over your document workflow.

Get more for Ct 1096 Form

Find out other Ct 1096 Form

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple