Ct 1096 Form 2016

What is the Ct 1096 Form

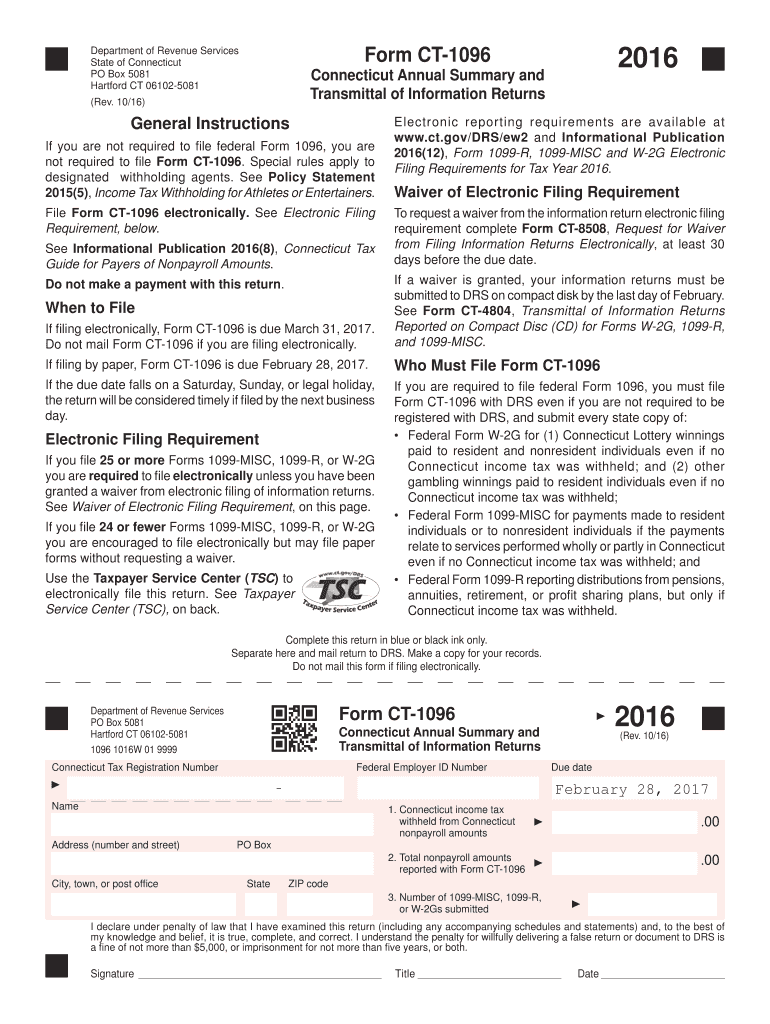

The Ct 1096 Form is a state-specific document used in Connecticut for reporting and summarizing information related to certain tax obligations. This form is primarily utilized by businesses and individuals to report payments made to non-residents or other entities that are subject to Connecticut withholding tax. Understanding the purpose and requirements of the Ct 1096 Form is essential for compliance with state tax regulations.

How to use the Ct 1096 Form

To effectively use the Ct 1096 Form, individuals and businesses must first gather the necessary information regarding payments made during the tax year. This includes details such as the total amount paid, the type of payment, and the recipient's information. Once the required data is collected, users can fill out the form accurately, ensuring that all sections are completed to avoid delays or penalties. After completing the form, it must be submitted to the appropriate state tax authority by the designated deadline.

Steps to complete the Ct 1096 Form

Completing the Ct 1096 Form involves several key steps:

- Gather all relevant payment records for the tax year.

- Obtain the Ct 1096 Form from the Connecticut Department of Revenue Services website or other authorized sources.

- Fill in the required fields, including your name, address, and taxpayer identification number.

- Report the total payments made, specifying the type of payments and the recipients.

- Review the completed form for accuracy and completeness.

- Submit the form by mail or electronically, as per the state guidelines.

Legal use of the Ct 1096 Form

The legal use of the Ct 1096 Form is crucial for compliance with Connecticut tax laws. This form serves as an official record of payments made to non-residents and ensures that the appropriate taxes are withheld and reported. Failure to use this form correctly can result in penalties or legal repercussions. Therefore, it is important to understand the legal implications and requirements associated with the Ct 1096 Form to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 1096 Form are typically set by the Connecticut Department of Revenue Services. It is essential to be aware of these dates to avoid late penalties. Generally, the form must be filed by the end of January following the tax year in which the payments were made. Keeping track of these deadlines ensures timely submission and compliance with state regulations.

Form Submission Methods

The Ct 1096 Form can be submitted through various methods, including:

- Online submission via the Connecticut Department of Revenue Services portal.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the appropriate submission method can help streamline the filing process and ensure that the form is received on time.

Quick guide on how to complete ct 1096 2016 form

Complete Ct 1096 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents swiftly without delays. Handle Ct 1096 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ct 1096 Form with ease

- Locate Ct 1096 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your modifications.

- Choose how you would like to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct 1096 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1096 2016 form

Create this form in 5 minutes!

How to create an eSignature for the ct 1096 2016 form

How to make an electronic signature for the Ct 1096 2016 Form online

How to create an eSignature for the Ct 1096 2016 Form in Google Chrome

How to create an electronic signature for signing the Ct 1096 2016 Form in Gmail

How to make an electronic signature for the Ct 1096 2016 Form right from your smart phone

How to make an eSignature for the Ct 1096 2016 Form on iOS devices

How to generate an electronic signature for the Ct 1096 2016 Form on Android

People also ask

-

What is the Ct 1096 Form and why is it important?

The Ct 1096 Form is a crucial document used by businesses in Connecticut to report annual sales tax information. This form helps ensure compliance with state tax regulations and provides the necessary details for tax reporting. Using airSlate SignNow can streamline the process of signing and submitting your Ct 1096 Form.

-

How can airSlate SignNow help me with the Ct 1096 Form?

airSlate SignNow offers easy-to-use eSignature features that allow you to electronically sign your Ct 1096 Form quickly and securely. You can also store templates and automate workflows to simplify the filing process, making it easier to manage your tax obligations effectively.

-

Is there a cost associated with using airSlate SignNow for the Ct 1096 Form?

Yes, airSlate SignNow offers a variety of pricing plans depending on the features you need. Whether you are a small business or a large corporation, you can find a plan that fits your budget and includes the tools necessary to handle the Ct 1096 Form efficiently.

-

What features does airSlate SignNow offer for electronic signatures?

airSlate SignNow provides a robust set of features for electronic signatures, including customizable templates, secure cloud storage, and real-time tracking. These features ensure that signing the Ct 1096 Form is not only easy but also compliant with legal standards.

-

Can I integrate airSlate SignNow with other software for my Ct 1096 Form?

Absolutely! airSlate SignNow integrates seamlessly with various business applications like Google Drive, Salesforce, and Dropbox. This means you can easily access and manage your Ct 1096 Form alongside your other important documents.

-

How does airSlate SignNow ensure the security of my Ct 1096 Form?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and secure data storage to protect your Ct 1096 Form and other sensitive documents, ensuring that your information remains confidential and safe.

-

Can I access my Ct 1096 Form on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and sign your Ct 1096 Form from any device. This flexibility enables you to manage your documents on the go, making the signing process more convenient.

Get more for Ct 1096 Form

Find out other Ct 1096 Form

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form