CT 6559, Submitter Report for Form W 2 CD Filing 2021-2026

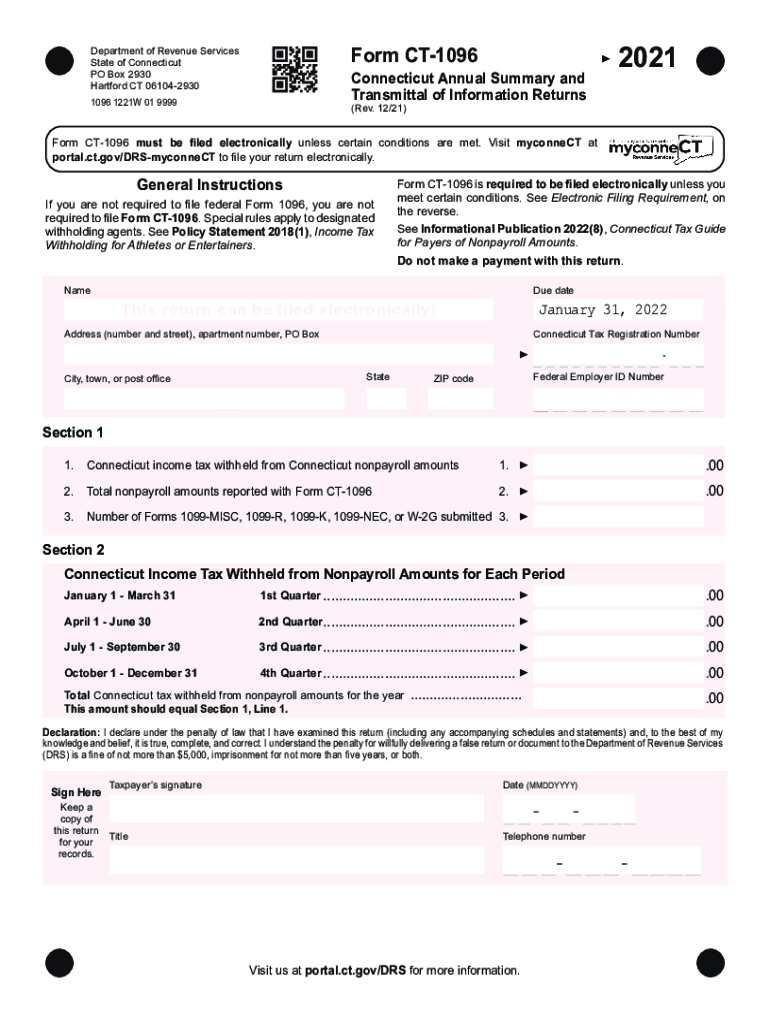

What is the CT 1096 Form?

The CT 1096 form is a crucial document used in Connecticut for reporting information related to various tax filings. This form serves as a summary of the information provided on other related forms, such as W-2s or 1099s, and is essential for ensuring compliance with state tax regulations. The 2011 CT 1096 specifically pertains to the tax year 2011, capturing data necessary for the Connecticut Department of Revenue Services (DRS) to process tax returns accurately.

Steps to Complete the CT 1096 Form

Completing the CT 1096 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information from your W-2 or 1099 forms, including total wages, taxes withheld, and other relevant data. Next, accurately fill out the CT 1096 form by entering the totals in the appropriate fields. Ensure that all entries match the information reported on the individual forms. Once completed, review the form for any errors before submission. This careful approach helps avoid delays or penalties associated with incorrect filings.

Filing Deadlines / Important Dates

Timely submission of the CT 1096 form is essential to avoid penalties. For the 2011 tax year, the deadline for filing the CT 1096 typically aligns with the due date for the associated W-2 or 1099 forms. Generally, this deadline falls on January thirty-first of the following year. However, if you are filing electronically, you may have an extended deadline. Always check the Connecticut DRS website for the most current deadlines to ensure compliance.

Form Submission Methods

The CT 1096 form can be submitted through various methods, providing flexibility for filers. You can file the form electronically through the Connecticut DRS e-filing system, which is often the preferred method due to its efficiency and speed. Alternatively, you may choose to mail the completed form to the appropriate address provided by the DRS. Ensure that you send it well before the deadline to allow for processing time. In-person submissions are generally not recommended and may not be accepted.

Penalties for Non-Compliance

Failing to file the CT 1096 form on time or submitting inaccurate information can result in significant penalties. The Connecticut DRS imposes fines for late filings, which can accumulate over time. Additionally, inaccuracies may lead to audits or further scrutiny, complicating your tax situation. It is crucial to ensure that all information is accurate and submitted on time to avoid these potential penalties.

Digital vs. Paper Version

When completing the CT 1096 form, you have the option to use either a digital or paper version. The digital version is often more efficient, allowing for easier data entry and submission. It also reduces the risk of errors associated with handwriting. Conversely, some may prefer the paper version for its tangible nature. Regardless of the format chosen, ensure that all information is filled out completely and accurately to maintain compliance with state regulations.

Quick guide on how to complete ct 6559 submitter report for form w 2 cd filing

Easily Prepare CT 6559, Submitter Report For Form W 2 CD Filing on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without interruptions. Manage CT 6559, Submitter Report For Form W 2 CD Filing on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to edit and eSign CT 6559, Submitter Report For Form W 2 CD Filing with ease

- Locate CT 6559, Submitter Report For Form W 2 CD Filing and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Inspect all information thoroughly and click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign CT 6559, Submitter Report For Form W 2 CD Filing to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 6559 submitter report for form w 2 cd filing

Create this form in 5 minutes!

How to create an eSignature for the ct 6559 submitter report for form w 2 cd filing

The way to create an e-signature for a PDF online

The way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the purpose of the Connecticut 1096 2011 form?

The Connecticut 1096 2011 form is used for summarizing information regarding various 1099 forms filed with the state. Businesses need to submit this form to ensure compliance with Connecticut tax regulations. Using airSlate SignNow simplifies the eSigning process for these documents, making it easy to submit Connecticut 1096 2011 forms securely.

-

How can airSlate SignNow help with filing the Connecticut 1096 2011?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign their Connecticut 1096 2011 form. With user-friendly features, you can streamline your document management and ensure timely and accurate submissions. This solution reduces paperwork and enhances your filing experience for Connecticut 1096 2011 forms.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for teams and enterprises. While the costs may vary based on the number of users and features chosen, investing in airSlate SignNow ensures you can manage your documents, including the Connecticut 1096 2011, effectively. Check our website for more details on pricing.

-

What features does airSlate SignNow provide for managing the Connecticut 1096 2011?

airSlate SignNow includes features such as customizable templates, document tracking, and secure eSigning options which are essential for managing the Connecticut 1096 2011. You can collaborate with your team in real-time and integrate with existing software systems. These features signNowly enhance your efficiency in handling tax documents.

-

Are there any integrations available with airSlate SignNow for handling tax documents?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software platforms, making it easier to manage forms like the Connecticut 1096 2011. Through these integrations, you can automate data entry and streamline your workflow. This connectivity enhances your overall document management process.

-

What are the benefits of eSigning the Connecticut 1096 2011 form?

ESigning the Connecticut 1096 2011 form through airSlate SignNow speeds up the submission process and ensures that your documents are legally binding. It eliminates the hassle of printing, scanning, or faxing, saving you valuable time and resources. Additionally, eSigning enhances security and tracking for your important tax documents.

-

Can I track the status of my Connecticut 1096 2011 submissions?

Absolutely! airSlate SignNow provides real-time tracking capabilities for your submitted documents, including the Connecticut 1096 2011. You can easily monitor whether recipients have viewed or signed the document, helping you stay organized and on top of your filing deadlines.

Get more for CT 6559, Submitter Report For Form W 2 CD Filing

Find out other CT 6559, Submitter Report For Form W 2 CD Filing

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors