Connecticut Annual Summary and Transmittal of CT Gov 2019

Understanding the Connecticut Annual Summary and Transmittal

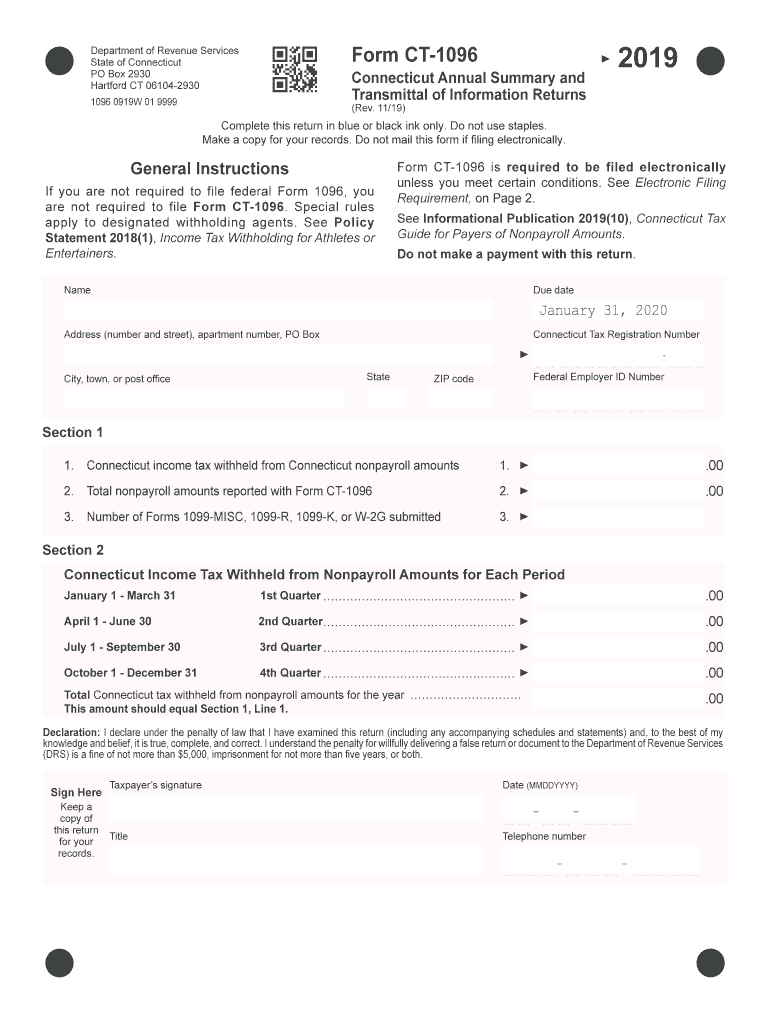

The Connecticut Annual Summary and Transmittal, often referred to as the Connecticut Misc, serves as a crucial document for businesses operating within the state. This form is primarily used to summarize and transmit various information regarding employee wages, withholding, and tax contributions to the Connecticut Department of Revenue Services. It is essential for ensuring compliance with state tax regulations and maintaining accurate records for both employers and employees.

Steps to Complete the Connecticut Annual Summary and Transmittal

Completing the Connecticut Annual Summary and Transmittal involves several key steps:

- Gather necessary information, including total wages paid, taxes withheld, and employee details.

- Access the official form, which can be obtained online or through state offices.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy to prevent errors that could lead to penalties.

- Submit the form by the designated deadline, either electronically or via mail.

Legal Use of the Connecticut Annual Summary and Transmittal

The Connecticut Annual Summary and Transmittal is legally binding when completed and submitted in accordance with state regulations. It must be filed by employers to report wages and tax withholdings for their employees. Compliance with this requirement helps avoid penalties and ensures that businesses remain in good standing with the state tax authority. Additionally, accurate reporting supports the integrity of the state's tax system.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is crucial for compliance. The Connecticut Annual Summary and Transmittal typically has a deadline of January 31 for the previous calendar year's information. Employers should mark their calendars and ensure that all necessary documentation is prepared well in advance to meet this deadline.

Form Submission Methods

Employers have several options for submitting the Connecticut Annual Summary and Transmittal. The form can be submitted electronically through the Connecticut Department of Revenue Services' online portal, which is often the preferred method for its efficiency. Alternatively, businesses may choose to mail the completed form to the appropriate state office. In-person submissions are also an option, though less common.

Required Documents for Submission

To complete the Connecticut Annual Summary and Transmittal, employers must have specific documents on hand. These typically include:

- Employee wage records for the reporting year.

- Records of tax withholdings for each employee.

- Any relevant state tax identification numbers.

Having these documents readily available will streamline the completion and submission process.

Penalties for Non-Compliance

Failure to file the Connecticut Annual Summary and Transmittal by the deadline can result in significant penalties. These may include fines and interest on unpaid taxes. Additionally, non-compliance can lead to increased scrutiny from the state tax authority, which could result in further legal implications. It is essential for businesses to prioritize timely and accurate submissions to avoid these consequences.

Quick guide on how to complete connecticut annual summary and transmittal of ctgov

Complete Connecticut Annual Summary And Transmittal Of CT gov effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-conscious substitute for traditional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without holdups. Handle Connecticut Annual Summary And Transmittal Of CT gov on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

Ways to modify and eSign Connecticut Annual Summary And Transmittal Of CT gov seamlessly

- Locate Connecticut Annual Summary And Transmittal Of CT gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form searches, or errors necessitating new document prints. airSlate SignNow meets your document management needs in several clicks from any device of your preference. Revise and eSign Connecticut Annual Summary And Transmittal Of CT gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticut annual summary and transmittal of ctgov

Create this form in 5 minutes!

How to create an eSignature for the connecticut annual summary and transmittal of ctgov

How to generate an eSignature for the Connecticut Annual Summary And Transmittal Of Ctgov online

How to make an electronic signature for your Connecticut Annual Summary And Transmittal Of Ctgov in Google Chrome

How to generate an electronic signature for signing the Connecticut Annual Summary And Transmittal Of Ctgov in Gmail

How to create an electronic signature for the Connecticut Annual Summary And Transmittal Of Ctgov right from your mobile device

How to generate an eSignature for the Connecticut Annual Summary And Transmittal Of Ctgov on iOS

How to generate an eSignature for the Connecticut Annual Summary And Transmittal Of Ctgov on Android

People also ask

-

What is the purpose of 'connecticut misc.' in airSlate SignNow?

'Connecticut misc.' refers to miscellaneous forms and documents that businesses in Connecticut may need to manage electronically. airSlate SignNow provides an easy-to-use platform to send and eSign these documents, ensuring compliance and efficiency for Connecticut-based companies.

-

How does airSlate SignNow help with Connecticut misc. document management?

airSlate SignNow streamlines the management of Connecticut misc. documents by offering tools for document creation, sending, and eSigning. This helps businesses save time and reduce errors, making the process more efficient and secure.

-

What pricing options are available for airSlate SignNow targeting Connecticut misc.?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options specifically tailored for professionals dealing with Connecticut misc. documents. You can choose from monthly or annual subscriptions to find the best fit for your budget and usage.

-

Does airSlate SignNow integrate with other applications for managing Connecticut misc.?

Yes, airSlate SignNow offers numerous integrations with popular applications that can help streamline workflows for handling Connecticut misc. documents. You can connect it with tools like Google Drive, Dropbox, and others to enhance your document management experience.

-

What features does airSlate SignNow offer for Connecticut misc. eSigning?

AirSlate SignNow provides advanced features for eSigning Connecticut misc. documents, including multi-party signing, automated reminders, and real-time tracking. These features help ensure that your documents are signed quickly and securely.

-

Can airSlate SignNow assist with compliance for Connecticut misc. documents?

Absolutely! airSlate SignNow is designed to assist businesses in Connecticut with compliance for their miscellaneous documents. The platform adheres to industry standards and regulations, ensuring that your electronic signatures are legally binding.

-

What are the benefits of using airSlate SignNow for Connecticut misc.?

Using airSlate SignNow for Connecticut misc. applications allows businesses to improve efficiency, reduce paper usage, and minimize errors. The easy-to-use platform also enhances collaboration and ensures that all documents are securely stored and easily accessible.

Get more for Connecticut Annual Summary And Transmittal Of CT gov

- Retail installment sale contract bradford publishing form

- Form g1

- Administrators deed form

- Online dl 17 form

- Stormwater pollution control plan form ventura countywide vcstormwater

- Advisor transition guide hd vest financial services form

- Novo form

- Transcript request office of admissions and records blinn college blinn form

Find out other Connecticut Annual Summary And Transmittal Of CT gov

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe