Tax Help Line 1 K 1vt Form 2014

What is the Tax Help Line 1 K 1vt Form

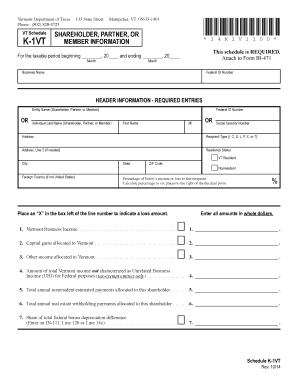

The Tax Help Line 1 K 1vt Form is a specific tax document used primarily for reporting income and expenses related to certain types of businesses and investments. This form is essential for taxpayers who need to provide detailed information about their financial activities to the Internal Revenue Service (IRS). It assists in ensuring accurate tax reporting and compliance with federal tax laws.

How to use the Tax Help Line 1 K 1vt Form

Using the Tax Help Line 1 K 1vt Form involves several steps. First, gather all necessary financial documents that pertain to the income and expenses you need to report. This may include invoices, receipts, and bank statements. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submission. It is also advisable to keep a copy for your records.

Steps to complete the Tax Help Line 1 K 1vt Form

To complete the Tax Help Line 1 K 1vt Form, follow these steps:

- Gather all relevant financial documentation.

- Begin filling out the form with your personal information, including your name, address, and Social Security number.

- Report your income by entering the amounts in the designated sections of the form.

- Detail any applicable deductions or expenses to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Tax Help Line 1 K 1vt Form

The legal use of the Tax Help Line 1 K 1vt Form is crucial for compliance with U.S. tax laws. This form must be filled out accurately to avoid legal repercussions, such as penalties or audits. It is recognized by the IRS as a valid document for reporting income and expenses. Ensuring that the form is completed according to IRS guidelines helps maintain the integrity of your tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Help Line 1 K 1vt Form are critical for compliance. Generally, the form must be submitted by April 15 of the tax year following the income reporting period. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, which can provide additional time for filing.

Form Submission Methods (Online / Mail / In-Person)

The Tax Help Line 1 K 1vt Form can be submitted through various methods, ensuring flexibility for taxpayers. Common submission methods include:

- Online filing through the IRS e-file system, which is often the quickest and most efficient option.

- Mailing a paper copy of the form to the appropriate IRS address, ensuring proper postage and tracking.

- In-person submission at designated IRS offices, where assistance may be available if needed.

Quick guide on how to complete tax help line 1 k 1vt 2014 2019 form

Effortlessly Prepare Tax Help Line 1 K 1vt Form on Any Gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, amend, and eSign your documents promptly without delays. Handle Tax Help Line 1 K 1vt Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Tax Help Line 1 K 1vt Form without hassle

- Obtain Tax Help Line 1 K 1vt Form and then click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all information and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Help Line 1 K 1vt Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax help line 1 k 1vt 2014 2019 form

Create this form in 5 minutes!

How to create an eSignature for the tax help line 1 k 1vt 2014 2019 form

How to create an eSignature for your Tax Help Line 1 K 1vt 2014 2019 Form in the online mode

How to generate an electronic signature for the Tax Help Line 1 K 1vt 2014 2019 Form in Google Chrome

How to generate an eSignature for putting it on the Tax Help Line 1 K 1vt 2014 2019 Form in Gmail

How to create an eSignature for the Tax Help Line 1 K 1vt 2014 2019 Form straight from your mobile device

How to make an eSignature for the Tax Help Line 1 K 1vt 2014 2019 Form on iOS

How to create an electronic signature for the Tax Help Line 1 K 1vt 2014 2019 Form on Android

People also ask

-

What is the Tax Help Line 1 K 1vt Form?

The Tax Help Line 1 K 1vt Form is a specific tax document used to report income from partnerships, S corporations, estates, and trusts. This form helps to ensure compliance with tax regulations and allows taxpayers to accurately report their share of the entity's income. Utilizing airSlate SignNow simplifies the eSigning of this form, making tax season stress-free.

-

How does airSlate SignNow assist with the Tax Help Line 1 K 1vt Form?

airSlate SignNow provides an easy-to-use platform to send, sign, and store the Tax Help Line 1 K 1vt Form digitally. This streamlines the process of managing tax documents, ensuring they are securely signed and returned promptly. Our platform's robust features help you stay organized during tax season.

-

Is there a cost associated with using airSlate SignNow for the Tax Help Line 1 K 1vt Form?

Yes, airSlate SignNow offers various pricing plans depending on the features you need for handling the Tax Help Line 1 K 1vt Form. We provide cost-effective solutions suitable for businesses of all sizes, ensuring you only pay for the services you need. Choose a plan that fits your budget while maximizing efficiency.

-

Can I integrate airSlate SignNow with my existing tools for the Tax Help Line 1 K 1vt Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications to simplify the management of the Tax Help Line 1 K 1vt Form. Whether you're using accounting software or project management tools, these integrations enhance your workflow, making document handling more efficient.

-

What are the benefits of using airSlate SignNow for tax documents like the Tax Help Line 1 K 1vt Form?

Using airSlate SignNow for tax documents such as the Tax Help Line 1 K 1vt Form offers multiple benefits, including faster processing times, enhanced security, and better compliance. Our platform allows for quick eSigning, reduces paper usage, and ensures your documents are protected with bank-level encryption.

-

How can I ensure compliance when using the Tax Help Line 1 K 1vt Form with airSlate SignNow?

To ensure compliance while using the Tax Help Line 1 K 1vt Form with airSlate SignNow, simply follow the compliance features offered by our platform. Our tools help to validate signatories and provide audit trails for each signed document. This ensures that you meet all required regulations for your tax filings.

-

Is it easy to collaborate with my team on the Tax Help Line 1 K 1vt Form using airSlate SignNow?

Yes, airSlate SignNow makes it incredibly easy to collaborate with your team on the Tax Help Line 1 K 1vt Form. Our platform allows multiple users to comment, review, and sign documents simultaneously. This collaborative approach streamlines communication and accelerates the document signing process.

Get more for Tax Help Line 1 K 1vt Form

- Blank i 20 form

- How to complete dependent verification worksheet for valencia 2012 form

- Omb no 1513 0007 instructions form

- 7001 health certificate form

- Form 17 140

- Usda veterinary certificate to eu form

- Salted hides and skins export to israel aphis aphis usda form

- How to fill out veterinary certificate to eu form

Find out other Tax Help Line 1 K 1vt Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation