Vermont 2018

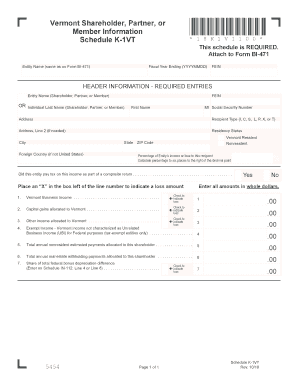

What is the Vermont Form K-1VT?

The Vermont Form K-1VT is a tax document used to report income, deductions, and credits from partnerships, S corporations, and limited liability companies (LLCs) that are treated as partnerships for tax purposes. This form is essential for individuals who receive income from these entities, allowing them to report their share of the entity's income on their personal tax returns. Understanding the purpose and requirements of the K-1VT can help taxpayers ensure accurate reporting and compliance with state tax laws.

Steps to Complete the Vermont Form K-1VT

Completing the Vermont Form K-1VT involves several key steps:

- Gather necessary information from the partnership or S corporation, including your share of income, deductions, and credits.

- Fill out the form accurately, ensuring that all amounts are reported correctly and match the entity's records.

- Review the completed form for any errors or omissions before submission.

- Submit the form along with your personal tax return to the Vermont Department of Taxes by the designated deadline.

Legal Use of the Vermont Form K-1VT

The legal use of the Vermont Form K-1VT is governed by state tax regulations. It is crucial for taxpayers to understand that this form must be filled out accurately to avoid penalties or issues with the Vermont Department of Taxes. The form serves as a legal document that supports the income reported on individual tax returns, and any discrepancies may lead to audits or additional tax liabilities.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Vermont Form K-1VT. Typically, the form should be submitted by the same deadline as the personal income tax return, which is usually April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Vermont Department of Taxes website for the most current deadlines and any changes that may occur.

Required Documents for the Vermont Form K-1VT

When preparing to file the Vermont Form K-1VT, taxpayers should have the following documents ready:

- Schedule K-1 from the partnership or S corporation detailing income, deductions, and credits.

- Personal identification information, including Social Security number.

- Previous year’s tax return for reference.

- Any supporting documentation for deductions or credits claimed.

Examples of Using the Vermont Form K-1VT

There are various scenarios where the Vermont Form K-1VT is applicable:

- A partner in a multi-member LLC receiving a share of the profits must report this on their K-1VT.

- An S corporation shareholder receiving dividends or distributions needs to include this information in their tax filings using the K-1VT.

- Taxpayers who have invested in partnerships that generate income must report their share through the K-1VT to comply with state tax laws.

Quick guide on how to complete tax help line 1 k 1vt 2018 2019 form

Complete Vermont effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Vermont on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Vermont with ease

- Locate Vermont and then click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Vermont and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax help line 1 k 1vt 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the tax help line 1 k 1vt 2018 2019 form

How to create an eSignature for the Tax Help Line 1 K 1vt 2018 2019 Form in the online mode

How to make an eSignature for your Tax Help Line 1 K 1vt 2018 2019 Form in Chrome

How to create an eSignature for signing the Tax Help Line 1 K 1vt 2018 2019 Form in Gmail

How to make an eSignature for the Tax Help Line 1 K 1vt 2018 2019 Form straight from your smartphone

How to generate an electronic signature for the Tax Help Line 1 K 1vt 2018 2019 Form on iOS devices

How to generate an eSignature for the Tax Help Line 1 K 1vt 2018 2019 Form on Android devices

People also ask

-

What are the pricing plans for airSlate SignNow in Vermont?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in Vermont. Our plans are designed to be cost-effective, ensuring that you can choose the one that best fits your budget and requirements. Whether you are a small business or a large enterprise, we have options that provide excellent value for electronic signatures.

-

How can airSlate SignNow benefit businesses in Vermont?

Businesses in Vermont can signNowly benefit from airSlate SignNow by streamlining their document signing processes. Our platform allows for quick and secure electronic signatures, reducing turnaround times and improving efficiency. With easy access to signed documents, Vermont businesses can enhance their workflow and focus on growth.

-

What features does airSlate SignNow offer for Vermont users?

airSlate SignNow provides a suite of features specifically designed to cater to users in Vermont. These include customizable templates, real-time tracking of document status, and advanced security measures to protect your sensitive information. Our user-friendly interface ensures that anyone in Vermont can quickly learn how to use the platform.

-

Is airSlate SignNow compliant with Vermont laws regarding electronic signatures?

Yes, airSlate SignNow is fully compliant with Vermont laws related to electronic signatures. We adhere to the UETA and ESIGN Acts, ensuring that all eSignatures obtained through our platform are legally binding. This compliance makes it easier for Vermont businesses to adopt digital solutions confidently.

-

Can I integrate airSlate SignNow with other tools used in Vermont?

Absolutely! airSlate SignNow offers seamless integrations with various applications commonly used by businesses in Vermont. Whether you need to connect with CRM systems, cloud storage solutions, or productivity tools, our platform can enhance your existing workflows and improve overall efficiency.

-

How does airSlate SignNow ensure document security for Vermont users?

Document security is a top priority for airSlate SignNow, especially for our Vermont users. We utilize advanced encryption methods and secure data storage to protect your documents from unauthorized access. Additionally, our platform includes features like audit trails and password protection to further enhance security.

-

What kind of customer support does airSlate SignNow provide for Vermont clients?

airSlate SignNow offers dedicated customer support for our clients in Vermont to ensure a smooth experience. Our support team is available via multiple channels, including phone, email, and live chat, to assist with any questions or issues. We are committed to providing timely and effective assistance to help you succeed.

Get more for Vermont

- Interstate movement small animals form

- Wsib form 6 hbpa on

- Permission form waterloo region district school board teachers wrdsb

- Northern tool commercial credit accounts apply today form

- Transcript request lenape valley regional high school lvhs form

- Allergy action plan form

- Request to employ form 2012 2019

- Form name change minor center for arkansas legal services arlegalservices

Find out other Vermont

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT