1vt 2019

What is the 1vt

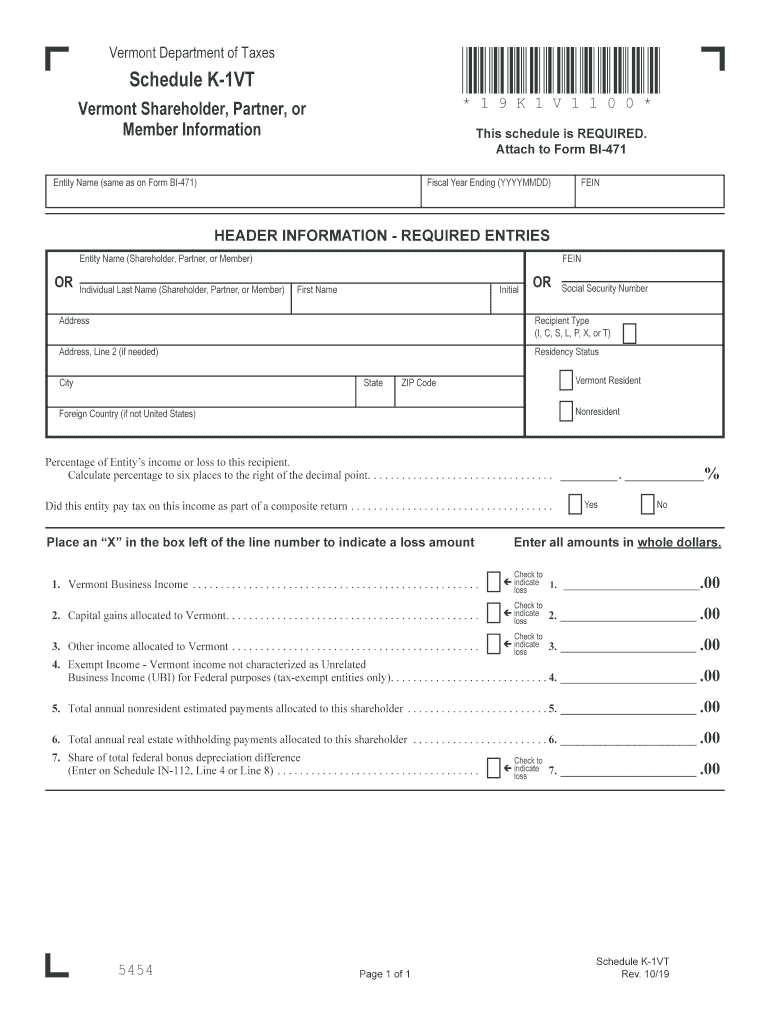

The 1vt form, also known as the Vermont Department of Taxes Form K-1VT, is a tax document used to report income, deductions, and credits for partners in a partnership or shareholders in an S corporation. This form is essential for individuals who receive income from these entities, as it provides detailed information necessary for filing personal income tax returns. The 1vt form captures the share of income, losses, and other tax attributes that each partner or shareholder must report on their individual tax returns.

How to use the 1vt

Using the 1vt form involves several steps to ensure accurate reporting of income from partnerships or S corporations. First, partners or shareholders should receive the completed K-1VT from the entity in which they have an interest. This document will outline their specific share of income, deductions, and credits. Next, individuals will need to input this information into their personal tax returns. It is important to ensure that all amounts are accurately reported to avoid discrepancies with the Vermont Department of Taxes.

Steps to complete the 1vt

Completing the 1vt form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your identification details and the entity's information.

- Fill out the form by entering your share of income, losses, and deductions as reported by the partnership or S corporation.

- Review the completed form for accuracy, ensuring all amounts align with the provided K-1VT.

- Sign and date the form to validate it before submission.

Legal use of the 1vt

The 1vt form is legally recognized as a valid document for reporting income and tax attributes in Vermont. To ensure its legal standing, it must be completed accurately and submitted according to the state's tax regulations. Compliance with the Vermont Department of Taxes' requirements is essential to avoid penalties and ensure that the reported information is accepted during tax audits. It is advisable to retain a copy of the form for personal records and future reference.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1vt form is crucial for compliance. Generally, the form must be filed by the same deadline as the personal income tax return, which is typically April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check for any specific updates or changes to the filing schedule each tax year to ensure timely submission.

Required Documents

To complete the 1vt form, certain documents are necessary. These include:

- The K-1VT received from the partnership or S corporation, detailing your share of income and deductions.

- Your personal identification information, including Social Security number.

- Any additional tax documents that may affect your overall tax situation, such as W-2s or 1099s.

Form Submission Methods (Online / Mail / In-Person)

The 1vt form can be submitted through various methods to accommodate different preferences. Individuals may choose to file online through the Vermont Department of Taxes' e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so it is advisable to consider the most suitable option based on individual circumstances.

Quick guide on how to complete k 1vt vermont department of taxes

Complete 1vt effortlessly on any device

Online document administration has become increasingly popular with businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 1vt on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign 1vt without any hassle

- Find 1vt and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign 1vt and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 1vt vermont department of taxes

Create this form in 5 minutes!

How to create an eSignature for the k 1vt vermont department of taxes

How to generate an electronic signature for the K 1vt Vermont Department Of Taxes in the online mode

How to make an electronic signature for your K 1vt Vermont Department Of Taxes in Chrome

How to create an eSignature for signing the K 1vt Vermont Department Of Taxes in Gmail

How to make an eSignature for the K 1vt Vermont Department Of Taxes from your smart phone

How to generate an eSignature for the K 1vt Vermont Department Of Taxes on iOS

How to make an eSignature for the K 1vt Vermont Department Of Taxes on Android OS

People also ask

-

What is 1vt and how does it benefit my business?

1vt stands for a streamlined electronic signing process that enhances document management efficiency. By using 1vt with airSlate SignNow, your business can easily send, eSign, and manage documents, reducing turnaround time and improving workflow.

-

How much does airSlate SignNow cost for using 1vt?

Pricing for airSlate SignNow implementing 1vt is competitive and tailored to fit various business needs. You can choose from several subscription tiers, each designed to offer scalable solutions while providing access to essential features.

-

What features does 1vt offer for document signing?

1vt includes a range of features such as customized templates, real-time tracking, and in-built security protocols. These features ensure that your documents are signed efficiently and securely, meeting compliance requirements.

-

Can I integrate airSlate SignNow with other software while using 1vt?

Yes, 1vt is designed to seamlessly integrate with various applications, including CRM, content management systems, and more. This allows you to enhance your existing workflows and improve efficiency when managing documents.

-

Is 1vt suitable for small businesses?

Absolutely! 1vt is particularly beneficial for small businesses looking to optimize their document signing process. With its cost-effective pricing and user-friendly interface, any small business can leverage airSlate SignNow for better productivity.

-

What type of support is available for 1vt users?

airSlate SignNow provides robust support for users leveraging 1vt, with various resources such as tutorials, live chat, and a dedicated support team. This ensures that you can efficiently address any issues and maximize your usage of the platform.

-

How secure is the 1vt signing process?

The security of the 1vt signing process is a priority for airSlate SignNow, featuring bank-level encryption and compliance with industry standards. This guarantees that your documents are kept safe while ensuring a reliable signing experience for all parties involved.

Get more for 1vt

- Fsco family law 7 form

- On form 52 application to withdraw or transfer up to 50 of the fsco gov on

- Pre trial statement form

- Steps for reporting fraudid theft at the city of lacey form

- County verification of business location 10 27 10 state of indiana form

- Cert 108 partial exemption of materials tools ad fuels ctgov form

- Cert 135 reduced sales and use tax rete for motor ctgov form

- Emt assessment sheet form

Find out other 1vt

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple