Shareholder's Instructions for Schedule K 1 Form 1120 S IRS 2021-2026

What is the Shareholder's Instructions For Schedule K-1 Form 1120-S?

The Shareholder's Instructions for Schedule K-1 Form 1120-S provide essential guidance for shareholders of S corporations. This form details each shareholder's share of the corporation's income, deductions, and credits. It is crucial for tax reporting and ensures that shareholders accurately report their income on their individual tax returns. Understanding this form is vital for compliance with IRS regulations and for avoiding potential penalties.

Steps to Complete the Shareholder's Instructions For Schedule K-1 Form 1120-S

Completing the Shareholder's Instructions for Schedule K-1 Form 1120-S involves several key steps:

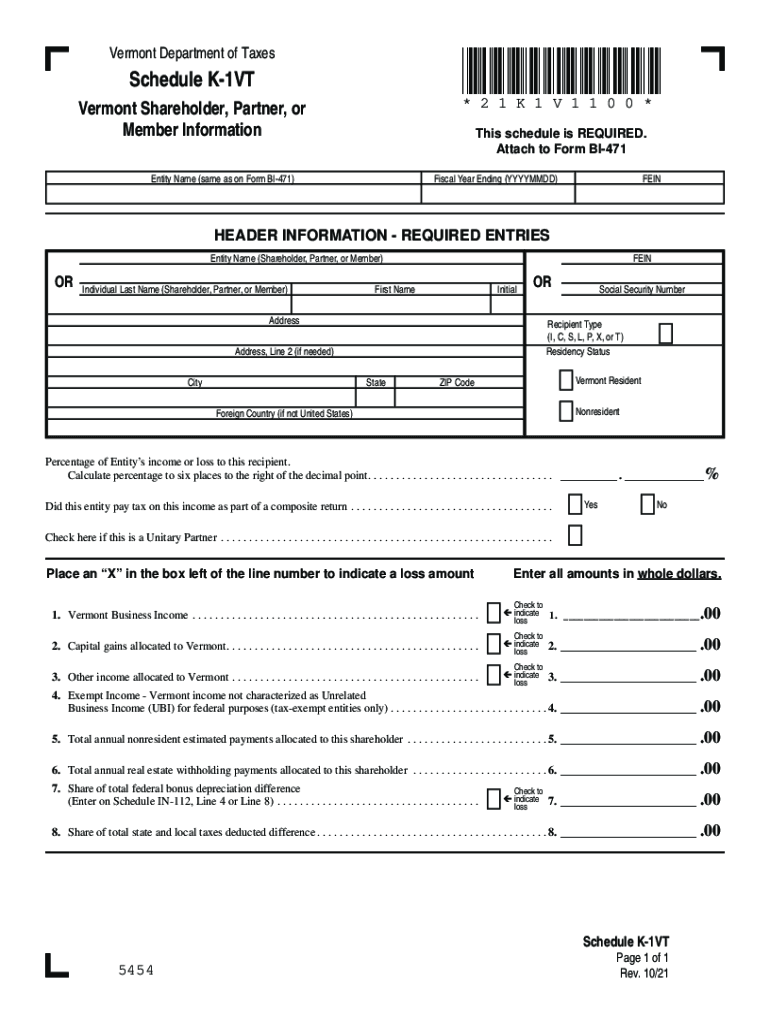

- Gather necessary information, including the corporation's name, address, and Employer Identification Number (EIN).

- Fill in the shareholder's details, such as name, address, and Social Security Number (SSN).

- Report the shareholder's share of income, deductions, and credits as provided by the corporation.

- Review the completed form for accuracy before submission.

Following these steps carefully can help ensure that the form is filled out correctly and filed on time.

Legal Use of the Shareholder's Instructions For Schedule K-1 Form 1120-S

The legal use of the Shareholder's Instructions for Schedule K-1 Form 1120-S is critical for both the corporation and its shareholders. This form must be issued by the S corporation to each shareholder, providing them with the necessary information to report their income accurately. Failure to provide accurate information can lead to legal repercussions, including fines or audits by the IRS. It is essential for shareholders to retain this form for their records and to ensure compliance with tax laws.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Shareholder's Instructions for Schedule K-1 Form 1120-S is vital for timely compliance. Generally, the S corporation must file Form 1120-S by the fifteenth day of the third month after the end of its tax year. Shareholders should receive their Schedule K-1 by this deadline, allowing them to include the information on their individual tax returns. Missing these deadlines can result in penalties and interest on any unpaid taxes.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Shareholder's Instructions for Schedule K-1 Form 1120-S. These guidelines include detailed instructions on how to report various types of income, deductions, and credits. It is important for both the corporation and shareholders to familiarize themselves with these guidelines to ensure compliance. Adhering to IRS instructions can prevent errors and reduce the risk of audits.

Examples of Using the Shareholder's Instructions For Schedule K-1 Form 1120-S

Examples of using the Shareholder's Instructions for Schedule K-1 Form 1120-S can help clarify its application. For instance, a shareholder receiving a K-1 may report dividend income, capital gains, or losses from the corporation on their personal tax return. Each type of income has specific reporting requirements, and understanding these examples can aid shareholders in accurately completing their tax filings. Additionally, these examples illustrate how different scenarios may affect the overall tax liability of the shareholder.

Quick guide on how to complete shareholders instructions for schedule k 1 form 1120 s irs

Complete Shareholder's Instructions For Schedule K 1 Form 1120 S IRS effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Shareholder's Instructions For Schedule K 1 Form 1120 S IRS on any device with airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and eSign Shareholder's Instructions For Schedule K 1 Form 1120 S IRS without hassle

- Locate Shareholder's Instructions For Schedule K 1 Form 1120 S IRS and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious document searches, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Edit and eSign Shareholder's Instructions For Schedule K 1 Form 1120 S IRS and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct shareholders instructions for schedule k 1 form 1120 s irs

Create this form in 5 minutes!

How to create an eSignature for the shareholders instructions for schedule k 1 form 1120 s irs

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is a 1vt number in airSlate SignNow?

A 1vt number in airSlate SignNow refers to a unique identifier assigned to each document that is sent for signing. This number helps track the document's status and ensures that all parties involved can reliably access it. Understanding your 1vt number is crucial for managing your document transactions efficiently.

-

How does airSlate SignNow utilize the 1vt number for document tracking?

The 1vt number acts as a reference that allows users to easily track the progress of their documents in airSlate SignNow. When you send a document for eSigning, the 1vt number enables you to check who has signed and who is still pending, ensuring your workflows remain smooth and organized.

-

Is the 1vt number essential for document retrieval?

Yes, the 1vt number is essential for retrieving documents in airSlate SignNow. By entering the specific 1vt number, users can quickly locate and access their documents, regardless of how many files are in their account. This feature enhances user efficiency and helps maintain a well-documented trail.

-

Can I customize my 1vt number for better identification?

Currently, the 1vt number in airSlate SignNow is automatically generated and cannot be customized. However, the unique coded format ensures that every document is distinct, preventing mix-ups. For better organization, consider using custom tags for additional context.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing plans that cater to businesses of various sizes. Each plan provides full access to eSigning features, including document management and tracking by 1vt number. Review our pricing page to find a plan that meets your business needs at a cost-effective rate.

-

What features can I expect with airSlate SignNow's eSigning solution?

With airSlate SignNow, you can expect features such as customizable document templates, secure eSigning, and robust tracking using the 1vt number. The platform also allows for team collaboration, integrations with popular software, and compliance with industry standards to ensure a seamless signing experience.

-

Are there integrations available with other software tools?

Yes, airSlate SignNow includes integrations with a variety of software tools that enhance your document workflow. From CRM systems to cloud storage solutions, these integrations help streamline processes while leveraging the tracking capabilities of the 1vt number. Check out our integration page for a complete list.

Get more for Shareholder's Instructions For Schedule K 1 Form 1120 S IRS

- Commercial property sales package louisiana form

- General partnership package louisiana form

- Statutory living will louisiana form

- Louisiana military advance medical directive louisiana form

- Revocation of statutory living will louisiana form

- Power of attorney forms package louisiana

- Anatomical gift form 497309344

- Employment hiring process package louisiana form

Find out other Shareholder's Instructions For Schedule K 1 Form 1120 S IRS

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast