Instructions for Schedule D Form 2015

What is the Instructions For Schedule D Form

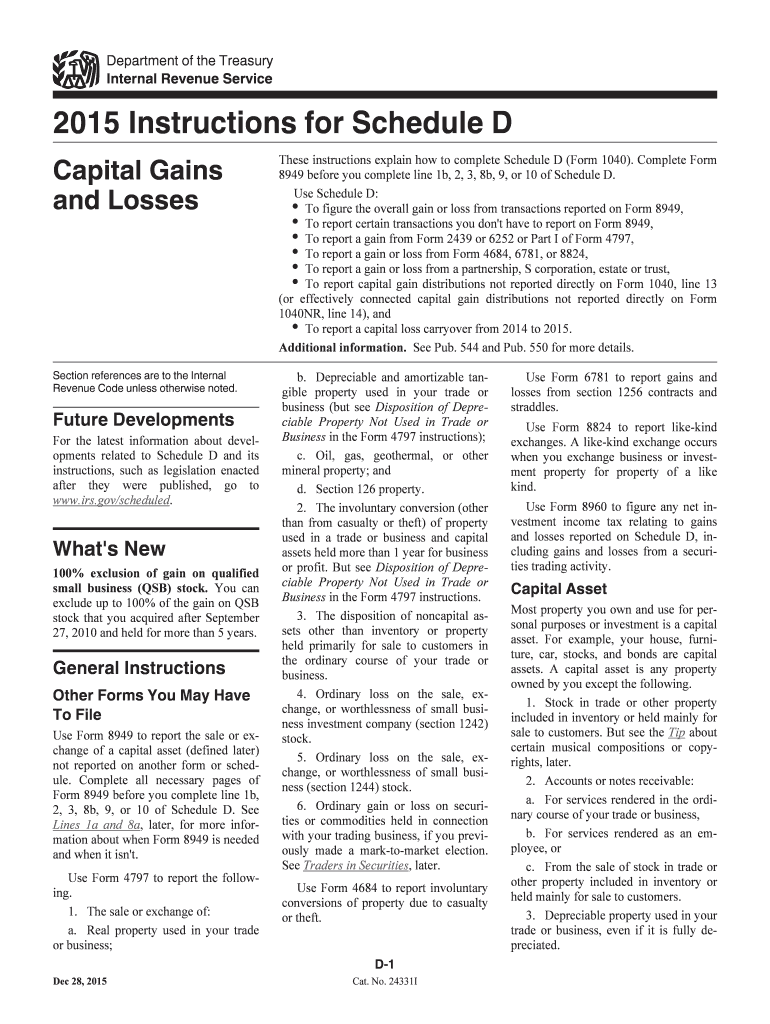

The Instructions For Schedule D Form provide essential guidance for taxpayers in the United States who need to report capital gains and losses from the sale of assets. This form is a critical component of the federal income tax return, helping individuals and businesses accurately calculate their tax obligations related to investments. The instructions detail how to complete the form, including definitions of key terms, reporting requirements, and examples to clarify complex concepts. Understanding these instructions is vital for ensuring compliance with IRS regulations and for maximizing potential tax benefits.

Steps to complete the Instructions For Schedule D Form

Completing the Instructions For Schedule D Form involves several key steps that ensure accurate reporting of capital gains and losses. Begin by gathering all relevant financial documents, including records of asset purchases, sales, and any associated expenses. Follow these steps:

- Review the instructions carefully to understand the specific requirements for your situation.

- Calculate your total capital gains and losses, categorizing them as short-term or long-term based on the holding period of each asset.

- Fill out the form accurately, ensuring that all calculations are correct and that you have included all necessary information.

- Double-check your entries against the instructions to avoid errors that could lead to penalties.

- Submit the completed form along with your tax return by the appropriate deadline.

How to obtain the Instructions For Schedule D Form

Taxpayers can obtain the Instructions For Schedule D Form through several convenient methods. The most straightforward way is to visit the official IRS website, where the form and its instructions are available for download in PDF format. Additionally, taxpayers can request a physical copy by calling the IRS or visiting a local IRS office. Many tax preparation software programs also include the necessary instructions, making it easier to complete the form electronically.

Legal use of the Instructions For Schedule D Form

The legal use of the Instructions For Schedule D Form is governed by IRS regulations, which outline the requirements for reporting capital gains and losses. Adhering to these instructions ensures that taxpayers fulfill their legal obligations and avoid potential penalties. It is important to note that accurate reporting is not only a legal requirement but also a way to ensure that taxpayers receive any applicable deductions or credits. Compliance with these guidelines helps maintain the integrity of the tax system.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Schedule D Form align with the annual tax return deadlines set by the IRS. Typically, individual taxpayers must file their returns by April 15 of each year, unless this date falls on a weekend or holiday, in which case the deadline may be extended. It is crucial to be aware of any changes in deadlines, as well as the implications of late filing, which can include penalties and interest on unpaid taxes. Taxpayers should also consider any extensions that may apply to their specific circumstances.

Examples of using the Instructions For Schedule D Form

Examples of using the Instructions For Schedule D Form can help clarify how to apply the guidelines to real-life scenarios. For instance, if a taxpayer sells stock purchased for $1,000 for $1,500, the instructions guide them on how to report the $500 gain. Similarly, if an individual sells a property for a loss, the instructions provide information on how to report that loss and its potential impact on overall tax liability. These examples illustrate the practical application of the instructions and underscore their importance in accurate tax reporting.

Quick guide on how to complete 2015 instructions for schedule d form

Prepare Instructions For Schedule D Form effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Instructions For Schedule D Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Instructions For Schedule D Form with ease

- Obtain Instructions For Schedule D Form and click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to confirm your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Instructions For Schedule D Form and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 instructions for schedule d form

Create this form in 5 minutes!

How to create an eSignature for the 2015 instructions for schedule d form

How to create an eSignature for your 2015 Instructions For Schedule D Form in the online mode

How to create an electronic signature for your 2015 Instructions For Schedule D Form in Google Chrome

How to make an electronic signature for putting it on the 2015 Instructions For Schedule D Form in Gmail

How to create an eSignature for the 2015 Instructions For Schedule D Form straight from your mobile device

How to generate an eSignature for the 2015 Instructions For Schedule D Form on iOS

How to create an eSignature for the 2015 Instructions For Schedule D Form on Android OS

People also ask

-

What are the Instructions For Schedule D Form when using airSlate SignNow?

The Instructions For Schedule D Form involve outlining the capital gains and losses from your investments. With airSlate SignNow, you can easily fill out and eSign your Schedule D Form online, ensuring accurate reporting of your financial information.

-

How can airSlate SignNow help with filling out the Instructions For Schedule D Form?

airSlate SignNow streamlines the process of completing the Instructions For Schedule D Form by providing customizable templates and easy document editing tools. This allows users to input their financial data quickly and efficiently, reducing the risk of errors.

-

What features does airSlate SignNow offer for managing the Instructions For Schedule D Form?

AirSlate SignNow offers features such as document templates, eSigning capabilities, and secure cloud storage to effectively manage the Instructions For Schedule D Form. These features simplify the process, making it more convenient for users to handle their tax documentation.

-

Is airSlate SignNow cost-effective for handling the Instructions For Schedule D Form?

Yes, airSlate SignNow provides a cost-effective solution for individuals and businesses needing to handle the Instructions For Schedule D Form. With competitive pricing plans, users can access essential tools without breaking the bank, ensuring value for money.

-

Can I integrate airSlate SignNow with other software for the Instructions For Schedule D Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, making it easier to manage the Instructions For Schedule D Form alongside your other financial documents. This integration enhances workflow efficiency and reduces data entry duplication.

-

What are the benefits of using airSlate SignNow for the Instructions For Schedule D Form?

Using airSlate SignNow for the Instructions For Schedule D Form offers numerous benefits, including increased accuracy, reduced processing time, and enhanced security. With its user-friendly interface, you can complete and eSign your forms anytime, anywhere.

-

How does airSlate SignNow ensure the security of my Instructions For Schedule D Form?

AirSlate SignNow prioritizes the security of your documents, including the Instructions For Schedule D Form, by employing advanced encryption and secure cloud storage. This ensures that your sensitive financial information remains protected throughout the signing process.

Get more for Instructions For Schedule D Form

- Form childhood disability

- United states citizen liberia visa application form

- Burkina faso tourist visa application burkina faso visa visahq form

- Mold remediation completion form

- Voluntary remediation program application 3 20 03 azdeq form

- School nurse health assessment form

- In the districtsuperior court for the state of al form

- Imm 5484 e document checklist form

Find out other Instructions For Schedule D Form

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA