Instructions for Schedule D Form 2016

What is the Instructions For Schedule D Form

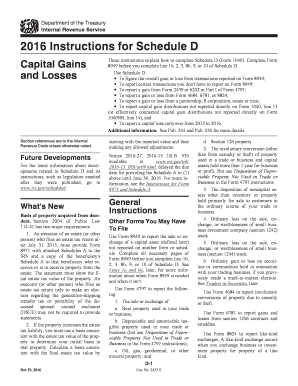

The Instructions For Schedule D Form is a document provided by the Internal Revenue Service (IRS) that guides taxpayers on how to report capital gains and losses from the sale of assets. This form is essential for individuals who have sold investments, such as stocks or real estate, during the tax year. Understanding the instructions is crucial for accurate reporting and compliance with tax regulations.

Steps to complete the Instructions For Schedule D Form

Completing the Instructions For Schedule D Form involves several key steps. First, gather all relevant financial documents, including records of asset purchases and sales. Next, follow the instructions to calculate your total capital gains or losses. This includes determining short-term versus long-term gains, as the tax rates differ. After calculations, accurately fill out the form, ensuring all required information is included. Finally, review the completed form for accuracy before submission.

Legal use of the Instructions For Schedule D Form

The legal use of the Instructions For Schedule D Form is vital for ensuring compliance with IRS regulations. The form must be filled out accurately to avoid potential penalties or audits. It is legally binding when submitted with the correct information and signatures. Additionally, using a reliable eSignature solution can enhance the legal validity of your submission, ensuring that all electronic signatures meet the necessary legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Schedule D Form typically align with the overall tax return deadlines. For most taxpayers, the deadline is April fifteenth of each year. However, if you file for an extension, you may have until October fifteenth to submit your form. It is essential to be aware of these dates to avoid late filing penalties and interest charges.

Examples of using the Instructions For Schedule D Form

Examples of using the Instructions For Schedule D Form include scenarios where individuals sell stocks, bonds, or real estate. For instance, if a taxpayer sells shares of a corporation at a profit, they need to report this gain on Schedule D. Similarly, if an asset is sold at a loss, this can offset gains and reduce taxable income. Each example illustrates the importance of accurately reporting these transactions to comply with tax laws.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Instructions For Schedule D Form. Taxpayers can file electronically through IRS-approved software, which often simplifies the process. Alternatively, forms can be printed and mailed to the appropriate IRS address. In-person submissions are less common but may be available at certain IRS offices. Each method has its own advantages, such as faster processing times for electronic submissions.

IRS Guidelines

The IRS provides specific guidelines for completing the Instructions For Schedule D Form. These guidelines include detailed explanations of how to report various types of capital gains and losses, as well as the necessary calculations. Taxpayers should refer to these guidelines to ensure they are following the most current tax laws and regulations, which can change annually.

Quick guide on how to complete 2015 instructions for schedule d 2016 form

Complete Instructions For Schedule D Form effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without obstacles. Manage Instructions For Schedule D Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Instructions For Schedule D Form without hassle

- Locate Instructions For Schedule D Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Schedule D Form and ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 instructions for schedule d 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 instructions for schedule d 2016 form

How to make an eSignature for your 2015 Instructions For Schedule D 2016 Form online

How to generate an electronic signature for the 2015 Instructions For Schedule D 2016 Form in Chrome

How to create an eSignature for signing the 2015 Instructions For Schedule D 2016 Form in Gmail

How to make an eSignature for the 2015 Instructions For Schedule D 2016 Form right from your smart phone

How to generate an eSignature for the 2015 Instructions For Schedule D 2016 Form on iOS devices

How to create an eSignature for the 2015 Instructions For Schedule D 2016 Form on Android OS

People also ask

-

What are the Instructions For Schedule D Form in airSlate SignNow?

The Instructions For Schedule D Form within airSlate SignNow provide detailed guidance on how to complete this important tax document. By using our platform, you can easily fill out the Schedule D Form, ensuring compliance with IRS regulations while streamlining your document management process.

-

How can airSlate SignNow help with the Instructions For Schedule D Form?

airSlate SignNow simplifies the process of completing the Instructions For Schedule D Form by offering user-friendly templates and eSignature capabilities. This allows you to quickly fill out and sign your tax documents from anywhere, helping you save time and reduce stress during tax season.

-

Is airSlate SignNow a cost-effective solution for managing the Instructions For Schedule D Form?

Yes, airSlate SignNow is a cost-effective solution for managing the Instructions For Schedule D Form. With affordable pricing plans, you can access powerful features that enhance your document workflow and ensure timely submissions, making it a smart choice for individuals and businesses alike.

-

What features does airSlate SignNow offer for the Instructions For Schedule D Form?

AirSlate SignNow offers a range of features for the Instructions For Schedule D Form, including customizable templates, automated workflows, and secure eSigning. These tools not only make it easy to complete your tax forms but also ensure that your documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other software for the Instructions For Schedule D Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to enhance your workflow when dealing with the Instructions For Schedule D Form. Whether it’s accounting software or CRM systems, our integrations help you streamline processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Instructions For Schedule D Form?

Using airSlate SignNow for the Instructions For Schedule D Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign your tax documents quickly, ensuring accuracy and compliance while freeing up valuable time.

-

How secure is the airSlate SignNow platform for handling the Instructions For Schedule D Form?

The airSlate SignNow platform prioritizes security, utilizing advanced encryption and authentication measures for handling the Instructions For Schedule D Form. Your sensitive tax information is protected, giving you peace of mind as you manage and sign your documents online.

Get more for Instructions For Schedule D Form

Find out other Instructions For Schedule D Form

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA