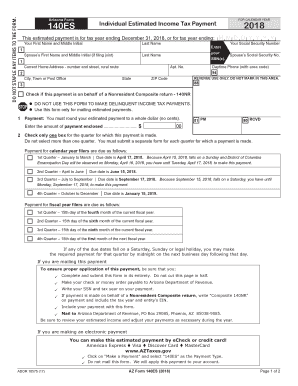

Arizona Form 140es 2018

What is the Arizona Form 140es

The Arizona Form 140es is an estimated tax form used by individuals and businesses in Arizona to report and pay estimated income taxes. This form is particularly important for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. By submitting the 140es, taxpayers can make quarterly payments to avoid penalties and interest on underpayment. It is essential for those who have income not subject to withholding, such as self-employment income, rental income, or dividends.

How to use the Arizona Form 140es

Using the Arizona Form 140es involves a few straightforward steps. First, taxpayers need to determine their expected taxable income for the year. This includes all sources of income, such as wages, business income, and investment income. Next, they should calculate the estimated tax liability using the current tax rates. Once the estimated amount is determined, taxpayers can fill out the 140es form, indicating the payment amounts due for each quarter. It is crucial to keep track of deadlines to ensure timely payments and avoid penalties.

Steps to complete the Arizona Form 140es

Completing the Arizona Form 140es requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including income sources and deductions.

- Calculate your estimated tax liability based on your expected income.

- Fill out the form, providing personal information and the calculated tax amounts.

- Review the form for accuracy before submission.

- Submit the form either online or by mail, depending on your preference.

Filing Deadlines / Important Dates

Timely filing of the Arizona Form 140es is crucial to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should mark these dates on their calendars to ensure they meet their obligations.

Required Documents

To complete the Arizona Form 140es, taxpayers should have the following documents ready:

- Previous year’s tax return for reference

- Income statements, such as W-2s or 1099s

- Records of any deductions or credits

- Any other relevant financial documents that may affect taxable income

Having these documents on hand will streamline the process and help ensure accuracy.

Legal use of the Arizona Form 140es

The Arizona Form 140es is legally binding when filled out and submitted correctly. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Arizona Department of Revenue. This includes accurate reporting of income, timely payments, and maintaining proper documentation. Failure to comply with these regulations can result in penalties or interest charges on unpaid taxes.

Quick guide on how to complete this estimated payment is for tax year ending december 31 2018 or for tax year ending

Effortlessly Prepare Arizona Form 140es on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without hindrances. Manage Arizona Form 140es on any platform with the airSlate SignNow applications for Android or iOS, streamlining any document-oriented process today.

The easiest way to edit and electronically sign Arizona Form 140es effortlessly

- Obtain Arizona Form 140es and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Arizona Form 140es to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct this estimated payment is for tax year ending december 31 2018 or for tax year ending

Create this form in 5 minutes!

How to create an eSignature for the this estimated payment is for tax year ending december 31 2018 or for tax year ending

How to create an electronic signature for your This Estimated Payment Is For Tax Year Ending December 31 2018 Or For Tax Year Ending online

How to create an eSignature for your This Estimated Payment Is For Tax Year Ending December 31 2018 Or For Tax Year Ending in Google Chrome

How to generate an electronic signature for signing the This Estimated Payment Is For Tax Year Ending December 31 2018 Or For Tax Year Ending in Gmail

How to make an electronic signature for the This Estimated Payment Is For Tax Year Ending December 31 2018 Or For Tax Year Ending right from your smartphone

How to create an eSignature for the This Estimated Payment Is For Tax Year Ending December 31 2018 Or For Tax Year Ending on iOS devices

How to make an eSignature for the This Estimated Payment Is For Tax Year Ending December 31 2018 Or For Tax Year Ending on Android devices

People also ask

-

What is the Arizona form 140ES?

The Arizona form 140ES is an Arizona estimated tax payment form that individuals and entities use to report and pay estimated taxes. It is important for taxpayers to file this form if they expect to owe more than a certain amount in taxes for the year.

-

How can airSlate SignNow help with the Arizona form 140ES?

airSlate SignNow simplifies the process of preparing and signing the Arizona form 140ES by providing an easy-to-use platform for electronic signatures and document management. With our solution, you can complete the form quickly, ensuring you meet important tax deadlines.

-

Is there a cost associated with using airSlate SignNow for the Arizona form 140ES?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. We provide a cost-effective solution, allowing you to eSign and manage the Arizona form 140ES without hidden fees, making it accessible for all users.

-

What features does airSlate SignNow offer for the Arizona form 140ES?

airSlate SignNow offers features like customizable templates, secure cloud storage, and real-time tracking for the Arizona form 140ES. These features ensure that your documents are accurate and easily retrievable for future reference.

-

Can I integrate airSlate SignNow with other software for my Arizona form 140ES?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to streamline your workflow when handling the Arizona form 140ES. This integration makes it easier to automate document processes and enhance collaboration.

-

What are the benefits of using airSlate SignNow for the Arizona form 140ES?

The benefits of using airSlate SignNow for the Arizona form 140ES include increased efficiency, reduced paper clutter, and enhanced document security. You can finalize your tax documents quickly and keep everything organized in one centralized location.

-

Is airSlate SignNow compliant with Arizona tax regulations for form 140ES?

Yes, airSlate SignNow is designed to comply with Arizona's tax regulations, ensuring that your Arizona form 140ES complies with legal standards. Our platform is regularly updated to align with any changes in tax laws, giving you peace of mind.

Get more for Arizona Form 140es

- Executor letter postal location change pdf my private audio form

- The invisible prince charitable foundation inc form

- Verified claim form

- Seatingmobility evaluation form

- Change of beneficiary form 40dcu cuna mutual group

- Ps form 2567 a should i sign

- Realtors association of new mexico property disclosure statement form

- Residential location of protected person form

Find out other Arizona Form 140es

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself