Get the Arizona Form 140ES Individual Estimated Tax 2022

What is the Arizona Form 140ES Individual Estimated Tax?

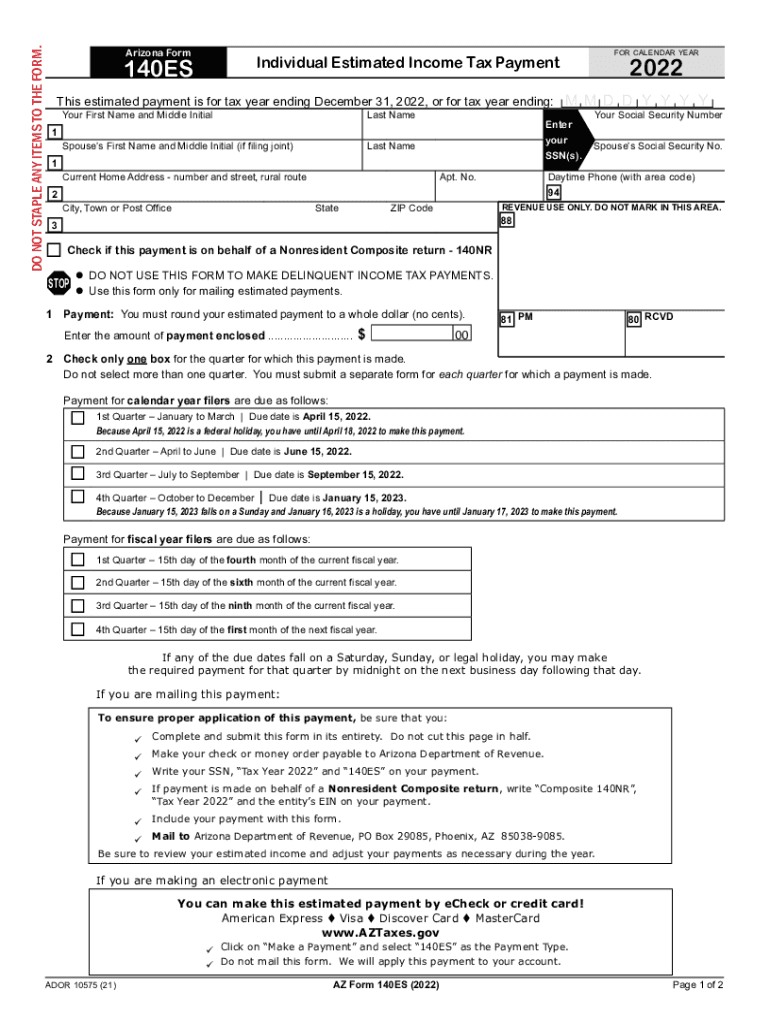

The Arizona Form 140ES is used for making estimated tax payments for individuals who expect to owe tax of $1,000 or more when filing their annual tax return. This form is essential for those who receive income that is not subject to withholding, such as self-employment income, rental income, or investment income. By submitting the Arizona Form 140ES, taxpayers can ensure they meet their tax obligations and avoid penalties for underpayment.

Steps to Complete the Arizona Form 140ES Individual Estimated Tax

Completing the Arizona Form 140ES involves several key steps:

- Gather necessary information: Collect your income details, deductions, and any applicable credits to estimate your tax liability accurately.

- Calculate your estimated tax: Use the information gathered to determine your expected tax for the year. This includes considering any prior year tax returns for reference.

- Fill out the form: Enter your personal information, estimated tax amounts, and any other required details on the Arizona Form 140ES.

- Review your calculations: Double-check all entries to ensure accuracy before submission.

- Submit the form: Choose your preferred method of submission, whether online, by mail, or in person, and ensure timely payment of any estimated taxes owed.

Legal Use of the Arizona Form 140ES Individual Estimated Tax

The Arizona Form 140ES is legally recognized as a valid method for individuals to report and pay their estimated taxes. To ensure compliance, it is crucial to follow the guidelines set forth by the Arizona Department of Revenue. This includes adhering to submission deadlines and accurately reporting estimated tax amounts. Failure to comply with these regulations may result in penalties or interest charges.

Filing Deadlines / Important Dates

Timely filing of the Arizona Form 140ES is essential to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15: First payment due for the current tax year.

- June 15: Second payment due.

- September 15: Third payment due.

- January 15 of the following year: Final payment due.

Taxpayers should mark these dates on their calendars to ensure they meet their obligations without incurring late fees.

Form Submission Methods

Taxpayers can submit the Arizona Form 140ES through various methods:

- Online: Many taxpayers prefer to file electronically through the Arizona Department of Revenue's website, which offers a secure and efficient process.

- By Mail: Paper forms can be mailed to the appropriate address provided by the Arizona Department of Revenue. Ensure that the form is postmarked by the due date.

- In Person: Taxpayers may also choose to deliver their forms in person at designated locations, ensuring they receive confirmation of submission.

Key Elements of the Arizona Form 140ES Individual Estimated Tax

Understanding the key elements of the Arizona Form 140ES is vital for accurate completion:

- Personal Information: This includes your name, address, and Social Security number.

- Estimated Tax Amount: Clearly indicate the amount you expect to pay for each quarter.

- Payment Options: Specify how you intend to make your payment, whether through electronic means or by check.

Being thorough with these elements helps ensure that your submission is complete and accurate, reducing the risk of issues later on.

Eligibility Criteria for Using the Arizona Form 140ES

To use the Arizona Form 140ES, individuals must meet specific eligibility criteria. Primarily, taxpayers must expect to owe at least $1,000 in tax for the current year after subtracting withholding and refundable credits. Additionally, those who had no tax liability in the previous year and were residents for the full year may not need to make estimated payments. It is essential to evaluate your tax situation carefully to determine eligibility.

Quick guide on how to complete get the free arizona form 140es individual estimated tax

Prepare Get The Arizona Form 140ES Individual Estimated Tax seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and store it securely online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Get The Arizona Form 140ES Individual Estimated Tax on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Get The Arizona Form 140ES Individual Estimated Tax effortlessly

- Locate Get The Arizona Form 140ES Individual Estimated Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal value as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Edit and eSign Get The Arizona Form 140ES Individual Estimated Tax and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free arizona form 140es individual estimated tax

Create this form in 5 minutes!

How to create an eSignature for the get the free arizona form 140es individual estimated tax

How to generate an e-signature for your PDF online

How to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an e-signature for a PDF document on Android

People also ask

-

What is the Arizona Form 140ES 2024 used for?

The Arizona Form 140ES 2024 is used by individuals who need to make estimated tax payments throughout the year. By utilizing this form, taxpayers can stay compliant with their tax obligations and avoid penalties. Understanding its use can help ensure you manage your finances effectively in Arizona.

-

How does airSlate SignNow simplify the signing of Arizona Form 140ES 2024?

airSlate SignNow provides an intuitive platform that allows you to eSign the Arizona Form 140ES 2024 quickly and securely. With features like in-document signing and template management, you can streamline the process of completing tax forms. This reduces turnaround time and enhances productivity.

-

Are there any costs associated with using airSlate SignNow for Arizona Form 140ES 2024?

Yes, airSlate SignNow offers various pricing plans that are designed to cater to different business sizes and needs. The cost-effective solutions ensure that you can eSign the Arizona Form 140ES 2024 without breaking your budget. Additionally, there are free trials available to explore the features before committing.

-

Can I integrate airSlate SignNow with other tools for the Arizona Form 140ES 2024?

Absolutely! airSlate SignNow seamlessly integrates with various platforms like CRM systems, cloud storage, and productivity tools. This means you can easily manage your documents, including the Arizona Form 140ES 2024, alongside your existing workflows, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for tax documents like Arizona Form 140ES 2024?

Using airSlate SignNow for tax documents, such as the Arizona Form 140ES 2024, offers numerous benefits including increased security, ease of use, and faster processing times. The platform's electronic signature capabilities ensure documents are signed quickly, saving you time and reducing paper clutter.

-

Is airSlate SignNow compliant with Arizona tax regulations for the Form 140ES 2024?

Yes, airSlate SignNow is designed to comply with all relevant regulations, including those pertaining to the Arizona Form 140ES 2024. This compliance ensures that your eSigned documents hold up in legal contexts and adhere to state requirements, providing peace of mind during tax season.

-

What features make airSlate SignNow suitable for handling Arizona Form 140ES 2024?

Key features of airSlate SignNow that are beneficial for handling the Arizona Form 140ES 2024 include user-friendly document editing, secure eSignature capabilities, and document tracking. These features facilitate efficient completion and submission of tax forms, making the entire process straightforward.

Get more for Get The Arizona Form 140ES Individual Estimated Tax

- Bylaws a corporation form

- Sample corporate records for a missouri professional corporation missouri form

- Missouri a corporation form

- Sample transmittal letter for articles of incorporation missouri form

- New resident guide missouri form

- Satisfaction release or cancellation of deed of trust by corporation missouri form

- Satisfaction release or cancellation of deed of trust by individual missouri form

- Partial release deed form

Find out other Get The Arizona Form 140ES Individual Estimated Tax

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile