Check If This Payment is on Behalf of a Nonresident Composite Return 140NR 2021

Understanding the Arizona Estimated Payment Form

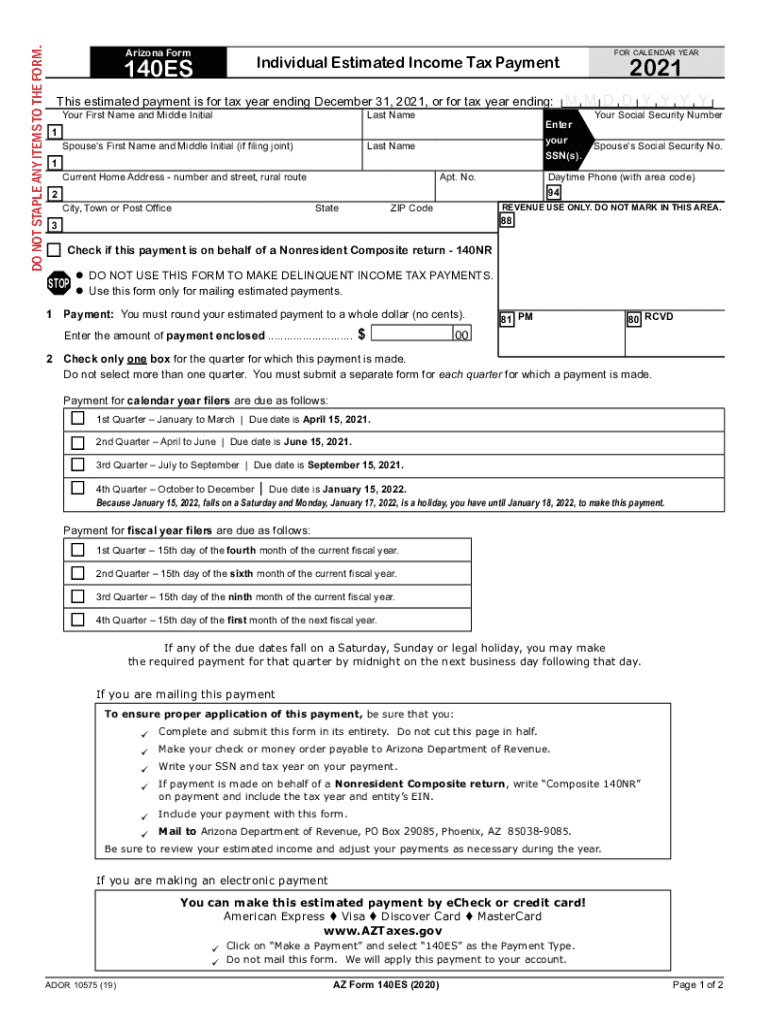

The Arizona estimated payment form, commonly referred to as the 140ES form, is essential for taxpayers who need to pay estimated income taxes throughout the year. This form is particularly relevant for individuals who expect to owe tax of at least one thousand dollars when they file their return. The 140ES form allows taxpayers to calculate and submit their estimated payments, ensuring compliance with state tax obligations.

Steps to Complete the Arizona Estimated Payment Form

Filling out the Arizona estimated payment form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your expected income for the year to determine the estimated tax owed.

- Complete the 140ES form, ensuring all required fields are filled accurately.

- Submit the form along with the payment by the designated deadlines to avoid penalties.

Filing Deadlines for Arizona Estimated Payments

It is crucial to be aware of the filing deadlines for the Arizona estimated payment form. Typically, estimated payments are due on the 15th of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on the unpaid amounts.

Key Elements of the Arizona Estimated Payment Form

The 140ES form includes several important elements that taxpayers need to understand:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Estimated Income: Expected income for the year, which helps determine the amount owed.

- Payment Amount: The total estimated tax payment calculated based on the expected income.

- Signature: Required to validate the form and confirm the accuracy of the information provided.

Legal Use of the Arizona Estimated Payment Form

The Arizona estimated payment form is legally recognized by the state of Arizona as an official method for taxpayers to report and pay their estimated taxes. Compliance with state tax laws is essential, and using this form correctly ensures that taxpayers meet their obligations and avoid potential legal issues.

Examples of Using the Arizona Estimated Payment Form

Taxpayers may find various scenarios where the 140ES form is applicable:

- Self-employed individuals who need to pay estimated taxes based on their projected income.

- Investors who expect significant capital gains and want to avoid underpayment penalties.

- Individuals with multiple income sources, such as rental properties, requiring estimated tax payments.

Quick guide on how to complete check if this payment is on behalf of a nonresident composite return 140nr

Complete Check If This Payment Is On Behalf Of A Nonresident Composite Return 140NR effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and safely archive it online. airSlate SignNow provides you with all the tools required to create, adjust, and eSign your documents quickly without delays. Manage Check If This Payment Is On Behalf Of A Nonresident Composite Return 140NR on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Check If This Payment Is On Behalf Of A Nonresident Composite Return 140NR with ease

- Obtain Check If This Payment Is On Behalf Of A Nonresident Composite Return 140NR and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then press the Done button to preserve your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require you to print new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Check If This Payment Is On Behalf Of A Nonresident Composite Return 140NR and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct check if this payment is on behalf of a nonresident composite return 140nr

Create this form in 5 minutes!

How to create an eSignature for the check if this payment is on behalf of a nonresident composite return 140nr

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the process for calculating Arizona estimated payment?

Calculating your Arizona estimated payment involves assessing your projected income and tax liability for the year. You can use the IRS Form 1040-ES, which provides guidelines for determining your estimates. Remember to consider deductions and credits that might affect your total tax due in Arizona.

-

How can airSlate SignNow help me with my Arizona estimated payment?

airSlate SignNow simplifies the process of handling documents related to your Arizona estimated payment. With our platform, you can easily eSign forms and send them securely, which saves you time and ensures compliance with state regulations. Our user-friendly interface allows for seamless document management.

-

What features does airSlate SignNow offer for document signing related to Arizona estimated payment?

airSlate SignNow offers a variety of features that cater specifically to your Arizona estimated payment needs. You can create templates for frequently used forms, set up automation for reminders, and track the status of your documents. This streamlines your workflow, making tax-related tasks more efficient.

-

Is there a mobile app for managing my Arizona estimated payment documents?

Yes, airSlate SignNow provides a mobile app that allows you to manage your Arizona estimated payment documents on the go. You can easily review, sign, and send documents directly from your smartphone or tablet. This flexibility ensures you can keep up with your financial obligations anytime, anywhere.

-

What are the costs associated with using airSlate SignNow for my Arizona estimated payment?

The pricing for airSlate SignNow varies depending on the features you choose and your business needs. Our plans are designed to be cost-effective while still providing essential tools for managing your Arizona estimated payment documents. Check our website for a detailed breakdown of pricing options.

-

Can I integrate airSlate SignNow with other software for managing Arizona estimated payments?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software to streamline your Arizona estimated payment processes. By connecting with popular tools, you can ensure that your document management is cohesive and efficient, saving time and reducing manual errors.

-

What benefits does airSlate SignNow provide for managing my Arizona estimated payment?

Using airSlate SignNow for your Arizona estimated payment documents offers numerous benefits. It enhances collaboration by allowing multiple parties to sign remotely and securely, reduces paperwork, and speeds up turnaround times. Additionally, our cloud storage ensures your important documents are always accessible.

Get more for Check If This Payment Is On Behalf Of A Nonresident Composite Return 140NR

- Shriners hospital printable donation form

- 10171009 dom wireless llc form

- Breakage report form

- Basketball roster form

- Microscope observation worksheet form

- Cisco college residency questionare form

- Area and circumference of a circle word problems worksheet pdf form

- Maybank2u biz application form 448402600

Find out other Check If This Payment Is On Behalf Of A Nonresident Composite Return 140NR

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe