Arizona Form Individual Estimated Income Tax 2024

What is the Arizona Form Individual Estimated Income Tax

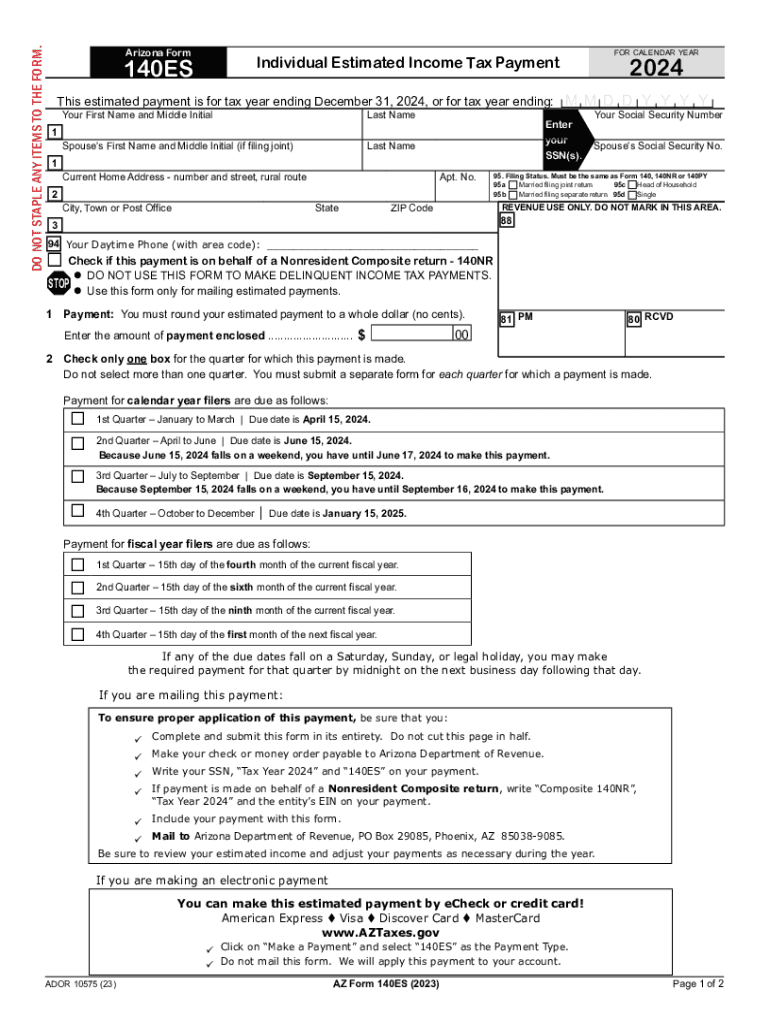

The Arizona Form 140 ES is the official document used for making estimated income tax payments for individuals in Arizona. This form is essential for taxpayers who expect to owe tax of one thousand dollars or more when filing their annual return. It allows individuals to pay their estimated taxes in four installments throughout the year, helping to avoid penalties for underpayment. The form is specifically designed for residents of Arizona and aligns with state tax regulations.

How to use the Arizona Form Individual Estimated Income Tax

To use the Arizona Form 140 ES, individuals must first determine their estimated tax liability for the year. This can be done by calculating expected income, deductions, and credits. Once the estimated amount is established, taxpayers can fill out the form, providing necessary details such as their name, address, and Social Security number. The form includes sections for reporting estimated income and calculating the payment amount due for each installment. After completing the form, individuals can submit it along with their payment to the Arizona Department of Revenue.

Steps to complete the Arizona Form Individual Estimated Income Tax

Completing the Arizona Form 140 ES involves several key steps:

- Gather financial information, including income sources and potential deductions.

- Calculate your estimated tax liability for the year.

- Complete the form by entering personal information and the estimated payment amounts.

- Review the form for accuracy to ensure all calculations are correct.

- Submit the form along with the payment by the due dates specified by the Arizona Department of Revenue.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Arizona Form 140 ES. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Missing these deadlines may result in penalties and interest on unpaid taxes. It is crucial to mark these dates on your calendar to ensure timely payments and compliance with state tax laws.

Required Documents

When filling out the Arizona Form 140 ES, individuals should have several documents on hand to ensure accurate reporting. Required documents include:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

- Any other relevant financial records that may impact your estimated tax calculations.

Penalties for Non-Compliance

Failure to file the Arizona Form 140 ES or to make the required estimated tax payments can lead to significant penalties. Arizona imposes penalties for underpayment of estimated taxes, which can accumulate over time. Taxpayers may also face interest charges on unpaid balances. Understanding these potential penalties emphasizes the importance of timely and accurate tax payment submissions.

Create this form in 5 minutes or less

Find and fill out the correct arizona form individual estimated income tax

Create this form in 5 minutes!

How to create an eSignature for the arizona form individual estimated income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 form 140 es estimated tax and who needs to file it?

The 2024 form 140 es estimated tax is a tax form used by individuals and businesses in Arizona to report and pay estimated income taxes. If you expect to owe at least $1,000 in tax for the year, you are required to file this form. It's essential for managing your tax obligations and avoiding penalties.

-

How can airSlate SignNow help with the 2024 form 140 es estimated tax?

airSlate SignNow provides a streamlined solution for electronically signing and sending the 2024 form 140 es estimated tax. Our platform ensures that your documents are securely signed and delivered, making tax filing easier and more efficient. This can save you time and reduce the stress associated with tax season.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Our plans are designed to be cost-effective, especially for those needing to manage multiple documents like the 2024 form 140 es estimated tax. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the 2024 form 140 es estimated tax and automated reminders for deadlines. These features help ensure that you stay organized and compliant with tax regulations. Our platform simplifies the entire process of document handling.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your tax documents, including the 2024 form 140 es estimated tax, alongside your financial records. This integration enhances workflow efficiency and ensures that all your documents are in one place.

-

What benefits does airSlate SignNow offer for businesses filing estimated taxes?

Using airSlate SignNow for filing estimated taxes like the 2024 form 140 es estimated tax offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick document turnaround and secure electronic signatures, which can signNowly streamline your tax filing process. This ultimately saves you time and resources.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax documents, including the 2024 form 140 es estimated tax, are protected. We use advanced encryption and security protocols to safeguard your information. You can trust our platform for secure document management.

Get more for Arizona Form Individual Estimated Income Tax

Find out other Arizona Form Individual Estimated Income Tax

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure