Arizona Form 140es 2025-2026

What is the Arizona Form 140ES

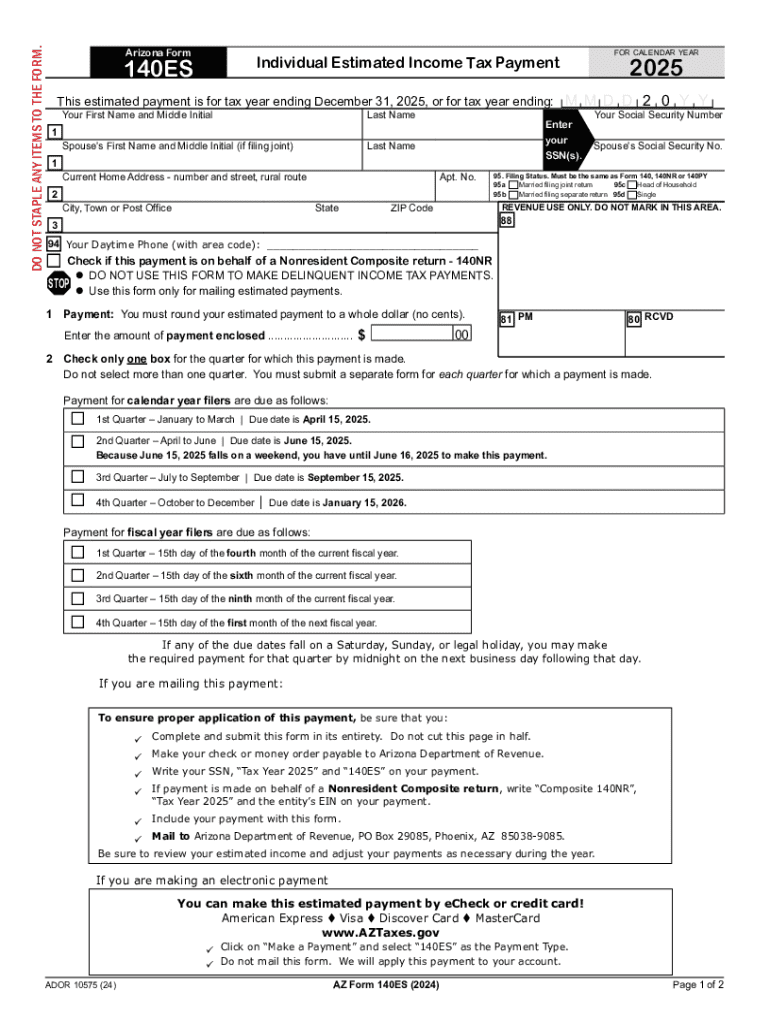

The Arizona Form 140ES is the official document used for making estimated tax payments for individuals in Arizona. This form is essential for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. It allows individuals to pay their estimated taxes in four installments throughout the year, ensuring they meet their tax obligations and avoid penalties.

How to use the Arizona Form 140ES

To effectively use the Arizona Form 140ES, taxpayers must first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated tax is calculated, individuals can fill out the form to indicate the amount they plan to pay for each installment. It is important to submit the form along with the payment by the due dates to avoid interest and penalties.

Steps to complete the Arizona Form 140ES

Completing the Arizona Form 140ES involves several key steps:

- Calculate your estimated tax liability for the year based on your expected income.

- Determine the amount to be paid for each of the four payment periods.

- Fill out the form with your personal information and payment details.

- Submit the form along with your payment by the specified deadlines.

Filing Deadlines / Important Dates

Timely filing of the Arizona Form 140ES is crucial to avoid penalties. The estimated tax payments are typically due on the following dates:

- First payment: April 15

- Second payment: June 15

- Third payment: September 15

- Fourth payment: January 15 of the following year

Required Documents

When preparing to complete the Arizona Form 140ES, it is helpful to have the following documents on hand:

- Last year's tax return for reference

- Income statements (W-2s, 1099s)

- Records of deductions and credits

- Any relevant financial documents that may affect your estimated tax

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 140ES can be submitted through various methods to accommodate taxpayer preferences:

- Online: Taxpayers can submit their payments electronically through the Arizona Department of Revenue's website.

- Mail: The completed form can be mailed to the appropriate address provided on the form.

- In-Person: Taxpayers may also choose to deliver their payments in person at designated tax offices.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 140es 771772654

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140es 771772654

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2025 Arizona estimated tax form?

The 2025 Arizona estimated tax form is a document used by individuals and businesses to report and pay estimated taxes to the state of Arizona. It helps taxpayers calculate their expected tax liability for the year and make timely payments to avoid penalties. Understanding this form is crucial for effective tax planning.

-

How can airSlate SignNow help with the 2025 Arizona estimated tax form?

airSlate SignNow provides a seamless platform for electronically signing and sending the 2025 Arizona estimated tax form. Our user-friendly interface ensures that you can complete and submit your tax documents quickly and securely. This saves you time and reduces the hassle of traditional paper forms.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to suit different business needs, including options for individuals and larger organizations. Each plan provides access to features that streamline the process of managing documents like the 2025 Arizona estimated tax form. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the 2025 Arizona estimated tax form and automated reminders for deadlines. These features help ensure that you stay organized and compliant with tax regulations. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your financial documents, including the 2025 Arizona estimated tax form. This integration allows for efficient data transfer and helps maintain accurate records, enhancing your overall tax preparation process.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your tax forms, including the 2025 Arizona estimated tax form, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime, anywhere. This convenience allows you to focus more on your business and less on administrative tasks.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes the security of your sensitive tax information. We utilize advanced encryption and security protocols to protect your documents, including the 2025 Arizona estimated tax form. You can trust that your data is safe while using our platform for electronic signatures and document management.

Get more for Arizona Form 140es

- Childrens product certificate form

- Ky form disclosure

- Form 447 nc sc dmv

- 1466 2 application for permit to export softwood lumber to the united states demande de license pour lexportation de boid duvre form

- Sample weekly activity schedule form

- Housing application avcp regional housing authority housingapplications form

- Adomyinfo form

- Lake travis ffa amp agriculture science program laketravisffa ffanow form

Find out other Arizona Form 140es

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors