it 201 Instructions 2018

What is the IT-201 Instructions?

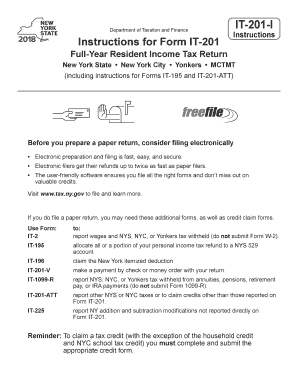

The IT-201 Instructions provide detailed guidance for individuals filing their New York State personal income tax returns using the IT-201 form. This document outlines the necessary steps, eligibility criteria, and important details required to accurately complete the form. It serves as a comprehensive resource for taxpayers to understand their obligations and ensure compliance with state tax laws.

Steps to Complete the IT-201 Instructions

Completing the IT-201 form involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any relevant financial records.

- Review the IT-201 Instructions to understand the specific requirements for your filing situation.

- Fill out the form accurately, ensuring that all income, deductions, and credits are reported correctly.

- Double-check your calculations and ensure all required fields are completed.

- Sign and date the form before submission.

How to Obtain the IT-201 Instructions

The IT-201 Instructions can be obtained easily through various channels:

- Visit the New York State Department of Taxation and Finance website to download the instructions in PDF format.

- Request a physical copy by contacting the department directly via phone or mail.

- Access local tax offices or libraries that may have printed copies available for public use.

Legal Use of the IT-201 Instructions

The IT-201 Instructions are legally binding as they provide the framework for completing the IT-201 form accurately. Adhering to the guidelines ensures compliance with New York State tax laws. Failure to follow these instructions may result in incorrect filings, which could lead to penalties or audits by the tax authorities.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines when filing the IT-201 form:

- The standard filing deadline for the IT-201 is typically April fifteenth of each year.

- If you need additional time, you can file for an extension, but it is crucial to pay any estimated taxes owed by the original deadline.

- Keep an eye on any changes to deadlines as announced by the New York State Department of Taxation and Finance.

Form Submission Methods

There are several methods available for submitting the IT-201 form:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the designated address provided in the instructions.

- In-person submission at local tax offices, where assistance may also be available.

Quick guide on how to complete it 201 d new york 2018 2019 form

Complete It 201 Instructions effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without hold-ups. Manage It 201 Instructions across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign It 201 Instructions effortlessly

- Obtain It 201 Instructions and click Get Form to initiate.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether it be via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device of your selection. Modify and eSign It 201 Instructions and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 201 d new york 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the it 201 d new york 2018 2019 form

How to make an eSignature for your It 201 D New York 2018 2019 Form online

How to generate an electronic signature for your It 201 D New York 2018 2019 Form in Google Chrome

How to make an eSignature for putting it on the It 201 D New York 2018 2019 Form in Gmail

How to generate an electronic signature for the It 201 D New York 2018 2019 Form right from your smart phone

How to generate an eSignature for the It 201 D New York 2018 2019 Form on iOS

How to generate an electronic signature for the It 201 D New York 2018 2019 Form on Android OS

People also ask

-

What are printable New York State tax forms and how can I access them?

Printable New York State tax forms are official documents used for filing your state taxes. You can easily access these forms on the New York State Department of Taxation and Finance website or through reliable software tools that provide printable options.

-

How does airSlate SignNow simplify the process of filling out printable New York State tax forms?

airSlate SignNow offers an intuitive platform that allows you to fill out printable New York State tax forms digitally. With features like cloud storage and easy document sharing, you can ensure accurate and timely submissions.

-

Are there any costs associated with using airSlate SignNow for printable New York State tax forms?

airSlate SignNow offers a cost-effective solution with various pricing plans to suit different business needs. You can choose a plan that fits your budget while leveraging the benefits of our platform for printable New York State tax forms.

-

Can I integrate airSlate SignNow with other software for handling printable New York State tax forms?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your experience with printable New York State tax forms. This allows you to sync your data and streamline your workflow across multiple platforms.

-

What benefits do I gain by using airSlate SignNow for my printable New York State tax forms?

Using airSlate SignNow for your printable New York State tax forms provides you with added convenience, efficiency, and security. You can eSign documents, track their status, and maintain compliance without the hassle of paper forms.

-

Is it easy to track the status of my submitted printable New York State tax forms with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your submitted printable New York State tax forms. Our platform provides notifications and progress tracking to keep you informed throughout the process.

-

What types of printable New York State tax forms can I use with airSlate SignNow?

airSlate SignNow supports a wide range of printable New York State tax forms, including individual income tax returns and business filings. This flexibility ensures that you can manage all your tax documentation in one place.

Get more for It 201 Instructions

Find out other It 201 Instructions

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will