Ri W 4 2018

What is the RI W-4?

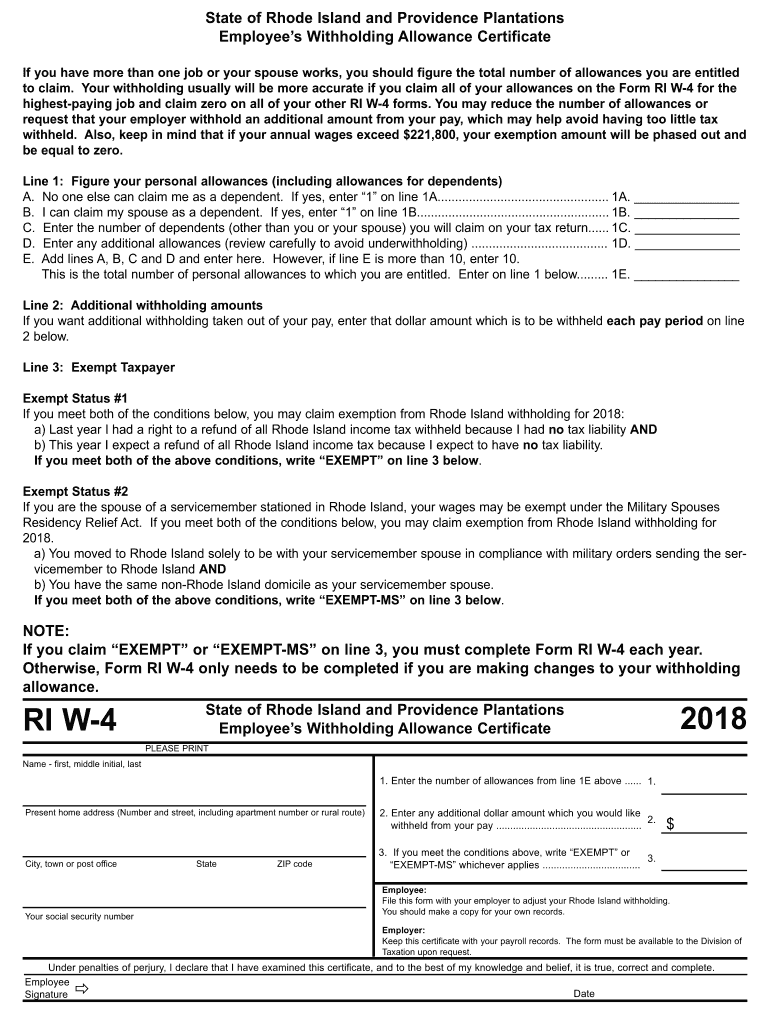

The RI W-4 is a state-specific withholding form used by employees in Rhode Island to determine the amount of state income tax that should be withheld from their paychecks. This form is essential for ensuring that the correct amount of tax is deducted, which helps prevent underpayment or overpayment of state taxes. The RI W-4 allows taxpayers to specify their filing status and any additional allowances they wish to claim, which can affect their overall tax liability.

How to obtain the RI W-4

To obtain the RI W-4 form, individuals can visit the official Rhode Island Division of Taxation website, where the form is available for download. Alternatively, employees can request a physical copy from their employer, who is required to provide it upon request. It is important to ensure that the most current version of the form is used, as tax regulations may change from year to year.

Steps to complete the RI W-4

Completing the RI W-4 involves several straightforward steps:

- Download or obtain a copy of the RI W-4 form.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status (single, married, etc.) and indicate the number of allowances you wish to claim.

- Review your entries for accuracy.

- Sign and date the form to validate it.

Once completed, the form should be submitted to your employer for processing.

Legal use of the RI W-4

The RI W-4 is legally binding when completed and submitted correctly. It is important to provide accurate information, as any discrepancies can lead to penalties or adjustments by the Rhode Island Division of Taxation. The form must be signed to affirm that the information provided is true and correct, ensuring compliance with state tax laws.

Key elements of the RI W-4

Key elements of the RI W-4 include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Selection of filing status, which impacts tax calculations.

- Allowances: Number of allowances claimed, which can reduce the amount withheld.

- Signature: Required to validate the form and confirm the accuracy of the information.

Form Submission Methods

The RI W-4 can be submitted to your employer through various methods:

- In-Person: Hand the completed form directly to your employer's payroll department.

- Mail: Send the completed form via postal mail if your employer allows this method.

- Email: Some employers may accept scanned copies of the completed form sent via email.

It is advisable to confirm with your employer regarding their preferred submission method.

Quick guide on how to complete ri w 4 form fillable form 2018 2019

Prepare Ri W 4 with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to draft, modify, and eSign your documents quickly without delays. Manage Ri W 4 across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Ri W 4 effortlessly

- Find Ri W 4 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to finalize your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ri W 4 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ri w 4 form fillable form 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the ri w 4 form fillable form 2018 2019

How to make an electronic signature for the Ri W 4 Form Fillable Form 2018 2019 in the online mode

How to generate an electronic signature for the Ri W 4 Form Fillable Form 2018 2019 in Chrome

How to create an eSignature for signing the Ri W 4 Form Fillable Form 2018 2019 in Gmail

How to generate an electronic signature for the Ri W 4 Form Fillable Form 2018 2019 from your mobile device

How to generate an eSignature for the Ri W 4 Form Fillable Form 2018 2019 on iOS

How to create an electronic signature for the Ri W 4 Form Fillable Form 2018 2019 on Android

People also ask

-

What is the ri w4 2019 form and why is it necessary?

The ri w4 2019 form is the Rhode Island Employee's Withholding Allowance Certificate, essential for determining the correct amount of state income tax to withhold from your paycheck. Completing this form accurately ensures compliance with state tax regulations and can signNowly impact your tax return.

-

How can airSlate SignNow help with completing the ri w4 2019?

airSlate SignNow provides a user-friendly platform for electronically signing and managing documents like the ri w4 2019. With our eSignature technology, you can easily fill out, sign, and send the form securely, streamlining your tax paperwork process.

-

What are the pricing options for airSlate SignNow when managing tax forms like ri w4 2019?

airSlate SignNow offers various pricing options to suit different business needs, making it highly cost-effective for managing forms like the ri w4 2019. Our plans include a free trial, allowing you to explore features before making a financial commitment.

-

Can I integrate airSlate SignNow with other software for managing ri w4 2019 forms?

Yes, airSlate SignNow seamlessly integrates with popular software applications like Google Workspace, Microsoft Office, and many more. This feature enables you to manage the ri w4 2019 form and other documents in one centralized system, enhancing efficiency.

-

What features does airSlate SignNow offer for the secure transmission of ri w4 2019 forms?

airSlate SignNow provides robust security features, including encryption and secure cloud storage, to protect your ri w4 2019 form and other sensitive documents. Our platform ensures that only authorized users can access and sign documents, providing peace of mind.

-

How does airSlate SignNow streamline the process of submitting the ri w4 2019?

With airSlate SignNow, the process of submitting your ri w4 2019 is simplified. You can complete the form electronically, obtain required signatures instantly, and send it to your employer, reducing the time and effort usually involved in traditional paper submissions.

-

Is there support available if I have questions about using airSlate SignNow for ri w4 2019?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any inquiries related to completing or submitting your ri w4 2019 form. Our team is ready to provide guidance and ensure you make the most of our platform.

Get more for Ri W 4

Find out other Ri W 4

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate