State of Rhode Island and Providence Plantations Employees 2020

Understanding the Rhode Island W-4 Form

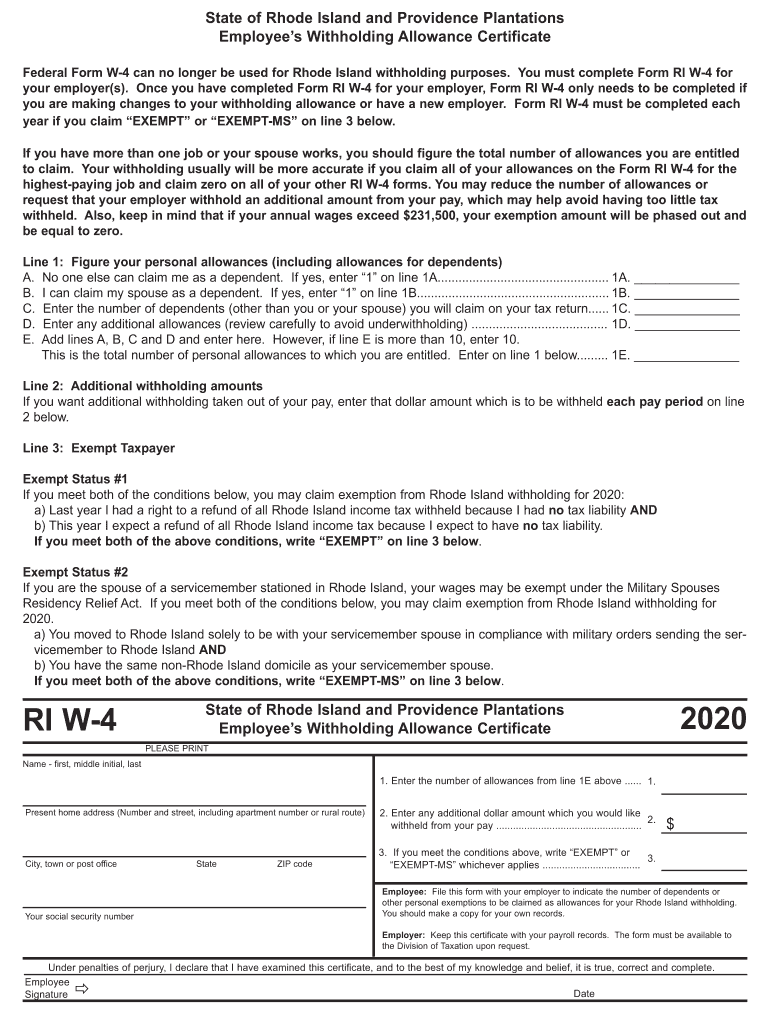

The Rhode Island W-4 form, officially known as the RI W-4 2019, is essential for employees in the state to accurately report their tax withholding preferences. This form is utilized by employers to determine the appropriate amount of state income tax to withhold from employees' paychecks. Completing this form correctly ensures that employees do not overpay or underpay their state taxes throughout the year.

Steps to Complete the Rhode Island W-4 Form

Filling out the Rhode Island W-4 form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can affect your withholding amount. Options typically include single, married, or head of household.

- Specify any additional withholding amounts if you wish to have more tax withheld from your paycheck.

- Sign and date the form to validate your submission.

Once completed, submit the form to your employer's payroll department for processing.

Legal Use of the Rhode Island W-4 Form

The Rhode Island W-4 form is legally binding when filled out and submitted according to state regulations. It is crucial for employees to ensure that the information provided is accurate and up to date, as discrepancies can lead to issues with tax filings and potential penalties. Employers must also retain these forms for their records to comply with state tax regulations.

Filing Deadlines for the Rhode Island W-4 Form

While there is no specific deadline for submitting the Rhode Island W-4 form, it is advisable for employees to complete it as soon as they begin a new job or experience a change in their tax situation. This ensures that the correct amount of state tax is withheld from the first paycheck. Additionally, employees should review and potentially update their W-4 form annually or when significant life changes occur, such as marriage or the birth of a child.

Required Documents for Completing the Rhode Island W-4 Form

To accurately complete the Rhode Island W-4 form, employees should have the following documents on hand:

- Social Security number for identification purposes.

- Details regarding filing status, such as marital status and number of dependents.

- Any previous W-4 forms if applicable, to ensure consistency in withholding preferences.

Having these documents readily available can streamline the completion process and help avoid errors.

Examples of Using the Rhode Island W-4 Form

Employees may need to use the Rhode Island W-4 form in various scenarios, including:

- Starting a new job and needing to establish withholding preferences with their employer.

- Adjusting their withholding due to changes in personal circumstances, such as marriage or having children.

- Revising their tax situation after experiencing significant changes in income or deductions.

These examples highlight the form's importance in ensuring accurate tax withholding throughout the year.

Quick guide on how to complete state of rhode island and providence plantations employees

Effortlessly Prepare State Of Rhode Island And Providence Plantations Employees on Any Device

Online document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage State Of Rhode Island And Providence Plantations Employees on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

Effortlessly Edit and eSign State Of Rhode Island And Providence Plantations Employees

- Find State Of Rhode Island And Providence Plantations Employees and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign State Of Rhode Island And Providence Plantations Employees to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of rhode island and providence plantations employees

Create this form in 5 minutes!

How to create an eSignature for the state of rhode island and providence plantations employees

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the RI W4 2019 form used for?

The RI W4 2019 form is utilized by employees in Rhode Island to determine the amount of state income tax to be withheld from their paychecks. It allows employees to provide their personal information and any additional withholding amounts they wish to apply. Completing the RI W4 2019 accurately ensures proper tax deduction and compliance.

-

How can airSlate SignNow help with the RI W4 2019 form?

AirSlate SignNow provides an efficient way to complete and eSign the RI W4 2019 form electronically. Our platform ensures that your form is securely stored, easily accessible, and can be shared with your employer or payroll department. Utilizing airSlate SignNow simplifies the process of managing tax forms like the RI W4 2019 while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for the RI W4 2019 form?

AirSlate SignNow offers a cost-effective solution for eSigning the RI W4 2019 form without hidden fees. We provide flexible pricing plans that include various features suitable for businesses of all sizes. This value allows employees to quickly manage their tax forms at an affordable rate.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow comes equipped with features such as electronic signatures, document templates, and real-time tracking, which enhance the efficiency of handling forms like the RI W4 2019. Users can easily create, send, and sign documents online, while maintaining security and compliance. These features provide convenience and streamline the workflow for businesses.

-

Is airSlate SignNow suitable for businesses of all sizes?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, making it suitable for anyone who needs to manage documents like the RI W4 2019 form. Whether you are a small business or a large enterprise, our platform adapts to meet your needs efficiently. This flexibility allows for seamless integration into your existing processes.

-

Can I integrate airSlate SignNow with other software applications I use?

Absolutely! AirSlate SignNow offers numerous integration options with popular software applications, enabling users to manage the RI W4 2019 form alongside other tools they currently utilize. Integrating our platform helps improve workflow efficiency and keeps your processes interconnected and streamlined.

-

How secure is my information when using airSlate SignNow for the RI W4 2019 form?

Security is a top priority at airSlate SignNow. When you complete the RI W4 2019 form using our platform, your data is encrypted and securely stored to protect your sensitive information. We adhere to industry-standard security protocols to ensure compliance and safeguard your documents.

Get more for State Of Rhode Island And Providence Plantations Employees

- Single member limited liability company llc operating agreement utah form

- Utah formation

- Utah disclaimer form

- Nature of document notice of claim of lien form

- Quitclaim deed from individual to husband and wife utah form

- Warranty deed from individual to husband and wife utah form

- Quitclaim deed from corporation to husband and wife utah form

- Warranty deed from corporation to husband and wife utah form

Find out other State Of Rhode Island And Providence Plantations Employees

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors