State W 4 FormDetailed Withholding Forms by State ChartState of Rhode Island Division of Human Resources What's NewState W 4 for 2022

Understanding the Rhode Island W-4 Form

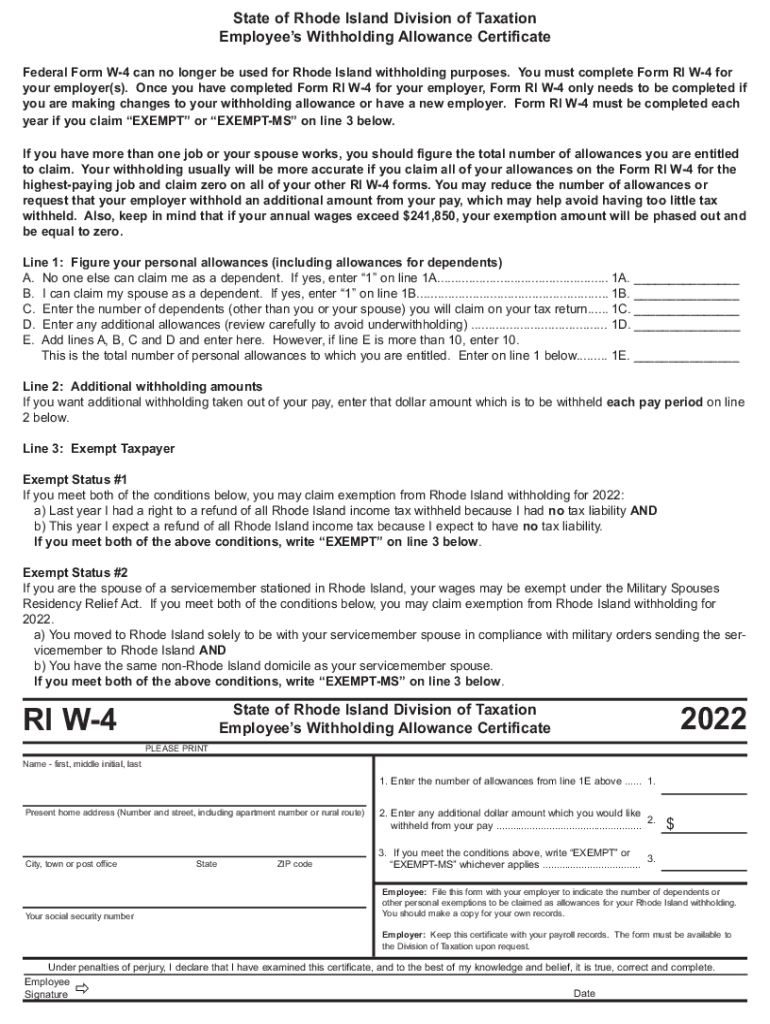

The Rhode Island W-4 form is a state-specific document that employees use to determine the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of tax is withheld based on an individual's financial situation, including filing status and number of allowances. Completing this form accurately helps prevent underpayment or overpayment of taxes throughout the year.

Steps to Complete the Rhode Island W-4 Form

Filling out the Rhode Island W-4 form involves several key steps:

- Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Allowances: Calculate the number of allowances you are claiming based on your personal circumstances. This can include dependents and other factors.

- Additional Withholding: If you wish to have an additional amount withheld from your paycheck, specify that amount in the designated section.

- Signature: Sign and date the form to validate it.

Legal Use of the Rhode Island W-4 Form

The Rhode Island W-4 form is legally binding once completed and submitted to your employer. It is crucial to ensure that the information provided is accurate, as it affects your tax withholding. Employers are required to keep this form on file and use it to calculate the appropriate state income tax deductions from your wages. Failure to submit a W-4 form may result in your employer withholding taxes at the highest rate.

Key Elements of the Rhode Island W-4 Form

Several key elements are essential to understand when filling out the Rhode Island W-4 form:

- Personal Information: Accurate personal details are necessary for proper identification.

- Filing Status: This determines the tax rate applied to your income.

- Allowances: The number of allowances directly impacts your withholding amount.

- Additional Withholding: This option allows for flexibility in your tax planning.

State-Specific Rules for the Rhode Island W-4 Form

Rhode Island has specific rules regarding the W-4 form that differ from other states. It is important to be aware of these rules to ensure compliance:

- Withholding Rates: The state may adjust withholding rates based on changes in tax law.

- Updates: Employees should review and update their W-4 forms regularly, especially after significant life events such as marriage or the birth of a child.

- Employer Requirements: Employers must adhere to state regulations regarding the processing and storage of W-4 forms.

Examples of Using the Rhode Island W-4 Form

The Rhode Island W-4 form can be used in various scenarios, such as:

- New Employment: Completing the W-4 is often one of the first steps when starting a new job.

- Life Changes: If you get married or have a child, you may need to adjust your allowances.

- Tax Planning: Individuals may choose to modify their withholding to align with their financial goals or tax strategy.

Quick guide on how to complete state w 4 formdetailed withholding forms by state chartstate of rhode island division of human resources whats newstate w 4

Manage State W 4 FormDetailed Withholding Forms By State ChartState Of Rhode Island Division Of Human Resources What's NewState W 4 For effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Handle State W 4 FormDetailed Withholding Forms By State ChartState Of Rhode Island Division Of Human Resources What's NewState W 4 For on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign State W 4 FormDetailed Withholding Forms By State ChartState Of Rhode Island Division Of Human Resources What's NewState W 4 For with ease

- Obtain State W 4 FormDetailed Withholding Forms By State ChartState Of Rhode Island Division Of Human Resources What's NewState W 4 For and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign State W 4 FormDetailed Withholding Forms By State ChartState Of Rhode Island Division Of Human Resources What's NewState W 4 For and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state w 4 formdetailed withholding forms by state chartstate of rhode island division of human resources whats newstate w 4

Create this form in 5 minutes!

How to create an eSignature for the state w 4 formdetailed withholding forms by state chartstate of rhode island division of human resources whats newstate w 4

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 2017 ri4 withholding form used for?

The 2017 ri4 withholding form is used to report and determine the correct withholding amount on payments made to Rhode Island residents. Businesses utilizing airSlate SignNow can easily gather necessary information from employees and clients, simplifying the overall process of compliance.

-

How can airSlate SignNow help with the management of 2017 ri4 withholding?

airSlate SignNow streamlines the collection and electronic signing of documents required for the 2017 ri4 withholding process. By automating these tasks, businesses can ensure accurate compliance while saving time and reducing errors in withholding amounts.

-

What features of airSlate SignNow assist in handling tax forms like 2017 ri4 withholding?

AirSlate SignNow offers features such as template creation, document tracking, and automated reminders, which are crucial when managing tax forms like the 2017 ri4 withholding. These features enhance operational efficiency and help ensure that deadlines are met without hassle.

-

Is airSlate SignNow a cost-effective solution for managing 2017 ri4 withholding?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes managing documents, including 2017 ri4 withholding. With competitive pricing plans, businesses can leverage powerful features without stretching their budgets.

-

Can airSlate SignNow integrate with accounting software for handling 2017 ri4 withholding?

Absolutely! airSlate SignNow can integrate with various accounting software solutions, which is essential for businesses looking to streamline their 2017 ri4 withholding processes. These integrations facilitate automatic updates and data sharing, ensuring greater accuracy.

-

What benefits does airSlate SignNow provide for 2017 ri4 withholding documentation?

Using airSlate SignNow for 2017 ri4 withholding documentation allows for quicker turnaround times on forms and improved accessibility. The electronic signing process ensures that all documents are compliant and securely stored, which is beneficial for audits and record-keeping.

-

Are there any collaboration features in airSlate SignNow for 2017 ri4 withholding?

Yes, airSlate SignNow includes collaboration features that enable multiple stakeholders to review and sign off on the 2017 ri4 withholding forms. This ensures everyone involved can provide input, leading to more thorough and compliant documentation.

Get more for State W 4 FormDetailed Withholding Forms By State ChartState Of Rhode Island Division Of Human Resources What's NewState W 4 For

- Mississippi stipulated agreement form

- Ms paternity 497314644 form

- Mississippi paternity 497314645 form

- Power of attorney for healthcare mississippi form

- Motion to examine judgment debtor mississippi form

- Affidavit for nonresident status mississippi form

- Ms summons 497314649 form

- Mississippi summons form

Find out other State W 4 FormDetailed Withholding Forms By State ChartState Of Rhode Island Division Of Human Resources What's NewState W 4 For

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe