W 4 Form RI State 2021

What is the W-4 Form for Rhode Island?

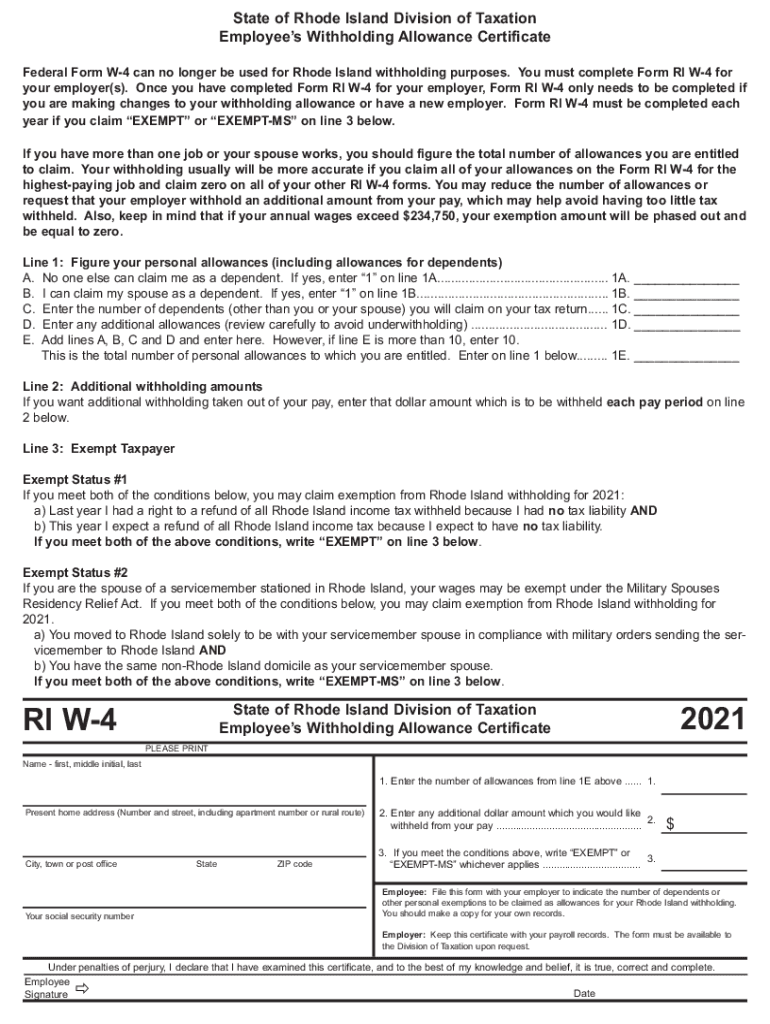

The W-4 form for Rhode Island, also known as the Rhode Island withholding form, is a critical document used by employees to indicate their tax withholding preferences to their employers. This form helps determine the amount of state income tax that should be withheld from an employee's paycheck. By accurately completing the W-4 form, individuals can ensure they are not over- or under-withheld, which can impact their tax returns at the end of the year.

Steps to Complete the W-4 Form for Rhode Island

Completing the Rhode Island W-4 form involves several straightforward steps:

- Personal Information: Fill in your name, address, Social Security number, and filing status.

- Withholding Allowances: Calculate the number of allowances you are claiming based on your personal situation, such as dependents and other deductions.

- Additional Withholding: If you wish to withhold an extra amount from your paycheck, specify that amount in the designated section.

- Signature and Date: Sign and date the form to validate it. This signature confirms that the information provided is accurate.

How to Obtain the W-4 Form for Rhode Island

The Rhode Island W-4 form can be obtained through several convenient methods. It is available for download from the official Rhode Island Division of Taxation website. Additionally, employers often provide this form to new employees during the onboarding process. If you prefer a physical copy, you can request one from your employer or visit a local tax office.

Key Elements of the W-4 Form for Rhode Island

Understanding the key elements of the Rhode Island W-4 form is essential for accurate completion:

- Filing Status: Options typically include single, married filing jointly, or head of household.

- Allowances: The number of allowances affects how much tax is withheld; more allowances mean less tax withheld.

- Additional Withholding: This section allows you to specify any extra amount you want withheld from each paycheck.

- Signature: Your signature is required to validate the form and affirm that the information is correct.

Legal Use of the W-4 Form for Rhode Island

The Rhode Island W-4 form is legally binding when it is completed and signed by the employee. It serves as an official declaration of the employee's tax withholding preferences. Employers are required to keep this form on file for their records and must use the information provided to calculate the appropriate amount of state income tax to withhold from employee wages. Compliance with the information on the W-4 form is essential to avoid penalties for non-compliance.

Form Submission Methods for the W-4 Form in Rhode Island

Submitting the Rhode Island W-4 form can be done through various methods:

- Online: Many employers allow employees to submit their W-4 forms electronically through payroll systems.

- Mail: If submitting a paper form, it can be mailed directly to your employer's payroll department.

- In-Person: Employees may also choose to deliver the completed form directly to their employer.

Quick guide on how to complete 2021 w 4 form ri state

Complete W 4 Form RI State effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing access to the necessary form and secure online storage. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage W 4 Form RI State from any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to amend and electronically sign W 4 Form RI State without hassle

- Locate W 4 Form RI State and click Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign W 4 Form RI State and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 w 4 form ri state

Create this form in 5 minutes!

How to create an eSignature for the 2021 w 4 form ri state

The way to generate an e-signature for a PDF in the online mode

The way to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

The way to generate an e-signature for a PDF on Android OS

People also ask

-

What is RI withholding and how does it relate to airSlate SignNow?

RI withholding refers to the income tax that is deducted from wages in Rhode Island. Using airSlate SignNow, businesses can easily manage and eSign documents related to RI withholding, ensuring compliance and accuracy in their payroll processes.

-

How can airSlate SignNow help streamline my RI withholding documentation?

airSlate SignNow offers a user-friendly platform to create, send, and eSign documents related to RI withholding. By simplifying the documentation process, businesses save time and minimize errors, helping to ensure all withholding forms are completed correctly.

-

Is airSlate SignNow cost-effective for handling RI withholding forms?

Yes, airSlate SignNow provides a cost-effective solution for managing all types of documents, including those related to RI withholding. With flexible pricing plans, businesses can choose an option that fits their budget while benefiting from powerful features.

-

What features does airSlate SignNow offer for managing RI withholding documents?

airSlate SignNow includes various features ideal for handling RI withholding documents, such as customizable templates, secure eSigning, and automated workflows. These features ensure that your documents are processed efficiently and securely.

-

Can I integrate airSlate SignNow with my current payroll software for RI withholding?

Absolutely! airSlate SignNow offers seamless integrations with many popular payroll software systems. This integration allows you to efficiently handle RI withholding processes without disrupting your existing systems or workflows.

-

What are the benefits of using airSlate SignNow for RI withholding management?

Using airSlate SignNow for RI withholding management provides numerous benefits, including improved efficiency, reduced errors, and enhanced compliance with tax regulations. The platform facilitates faster transactions and document handling, giving businesses more time to focus on their core activities.

-

Is airSlate SignNow secure for managing sensitive RI withholding information?

Yes, airSlate SignNow prioritizes security and implements robust measures to protect sensitive RI withholding information. With features such as encryption, secure access, and compliance with data protection regulations, your documents are safe with airSlate SignNow.

Get more for W 4 Form RI State

- Interrogatories to plaintiff for motor vehicle occurrence arkansas form

- Interrogatories to defendant for motor vehicle accident arkansas form

- Llc notices resolutions and other operations forms package arkansas

- Residential real estate sales disclosure statement arkansas form

- Notice of dishonored check criminal keywords bad check bounced check arkansas form

- Mutual wills containing last will and testaments for unmarried persons living together with no children arkansas form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children arkansas form

- Mutual wills or last will and testaments for unmarried persons living together with minor children arkansas form

Find out other W 4 Form RI State

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online