8960 2018

What is the 8960?

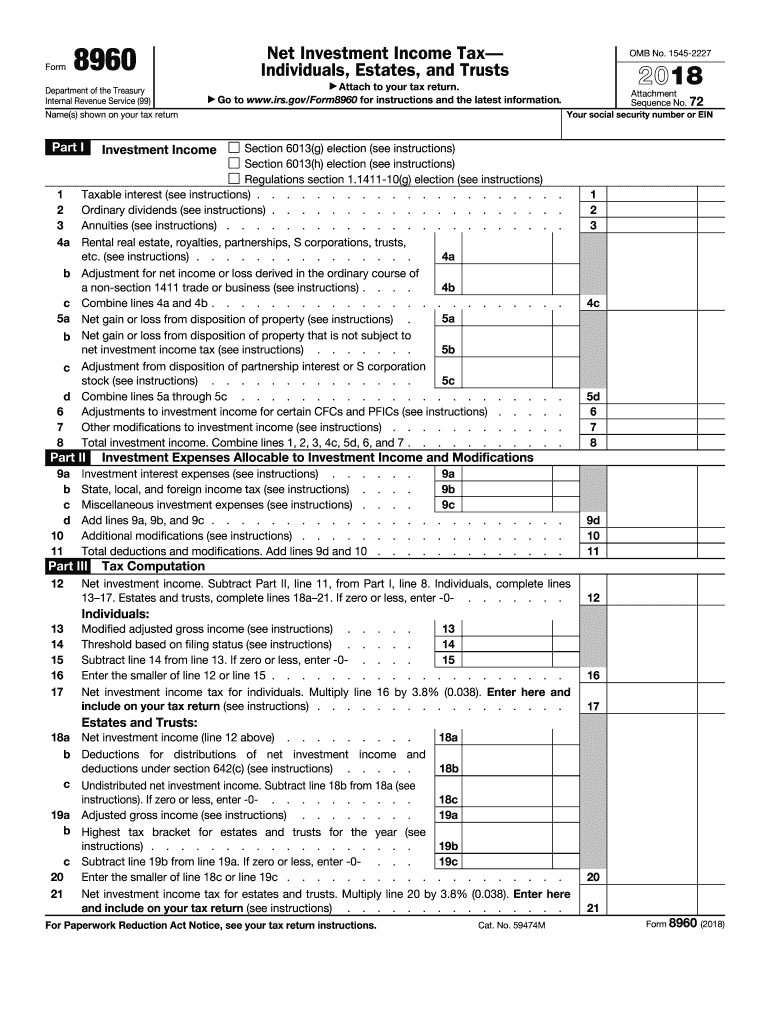

The form 8960, officially known as the Net Investment Income Tax (NIIT) form, is used by individuals, estates, and trusts to report and calculate the net investment income tax. This tax applies to certain high-income taxpayers, and it is important for determining additional tax liabilities. The form captures various types of income, including interest, dividends, capital gains, and rental income, which may be subject to this additional tax. Understanding the purpose of form 8960 is crucial for compliance with U.S. tax laws.

How to use the 8960

Using form 8960 involves several steps to ensure accurate reporting of net investment income. Taxpayers must first gather all relevant financial information, including income from investments and any applicable deductions. The form requires specific calculations to determine the amount of net investment income and the corresponding tax owed. It is essential to follow the instructions provided with the form carefully to avoid errors that could lead to penalties or increased tax liabilities.

Steps to complete the 8960

Completing form 8960 requires a systematic approach:

- Gather necessary financial documents, including income statements and investment records.

- Calculate total net investment income by summing applicable income sources.

- Determine modified adjusted gross income (MAGI) to see if it exceeds the threshold for NIIT.

- Complete the form by entering the calculated figures accurately.

- Review the form for accuracy before submission.

Following these steps will help ensure that the form is filled out correctly and submitted on time.

Legal use of the 8960

The legal use of form 8960 is governed by IRS regulations. It is essential to file this form if your income exceeds certain thresholds, as failure to do so can result in penalties. The form must be submitted along with your annual tax return, and it is vital to adhere to the guidelines set forth by the IRS to ensure compliance. Understanding the legal implications of the form can help taxpayers avoid issues with tax authorities.

Filing Deadlines / Important Dates

Form 8960 must be filed by the tax return deadline, which is typically April fifteenth for most individual taxpayers. If you are unable to meet this deadline, you may request an extension, but it is important to note that any taxes owed must still be paid by the original due date to avoid penalties and interest. Keeping track of important dates related to form 8960 will help ensure timely compliance with tax obligations.

Required Documents

To complete form 8960 accurately, several documents may be required, including:

- Income statements from investments (e.g., 1099 forms).

- Records of capital gains and losses.

- Documentation of any deductions related to investment income.

Having these documents readily available will streamline the process of filling out the form and help ensure that all necessary information is included.

Quick guide on how to complete 2018 form 8960 net investment income tax

Effortlessly Prepare 8960 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right template and securely store it on the web. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle 8960 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Alter and eSign 8960 with Ease

- Locate 8960 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text (SMS), invitation link, or download it to your computer.

You no longer need to worry about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Alter and eSign 8960 to ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 8960 net investment income tax

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 8960 net investment income tax

How to create an electronic signature for your 2018 Form 8960 Net Investment Income Tax in the online mode

How to generate an eSignature for your 2018 Form 8960 Net Investment Income Tax in Google Chrome

How to create an eSignature for putting it on the 2018 Form 8960 Net Investment Income Tax in Gmail

How to create an eSignature for the 2018 Form 8960 Net Investment Income Tax from your smart phone

How to create an electronic signature for the 2018 Form 8960 Net Investment Income Tax on iOS devices

How to generate an electronic signature for the 2018 Form 8960 Net Investment Income Tax on Android

People also ask

-

What is form 20178960 and how can airSlate SignNow assist with it?

Form 20178960 is a specific document required for various official processes. With airSlate SignNow, you can easily send, eSign, and manage this form electronically, streamlining your workflow and ensuring compliance.

-

How does airSlate SignNow ensure the security of form 20178960?

airSlate SignNow employs industry-standard encryption and security protocols to protect sensitive documents, including form 20178960. This ensures that your data remains safe throughout the signing and storage processes.

-

Are there any pricing plans available for using form 20178960 with airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan based on your usage of form 20178960, allowing you to find a cost-effective solution.

-

What features does airSlate SignNow provide for managing form 20178960?

airSlate SignNow provides features such as customizable templates, automated reminders, and audit trails for form 20178960. These tools help you manage the document efficiently, ensuring a smooth signing process.

-

Can I integrate airSlate SignNow with other applications for form 20178960?

Absolutely! airSlate SignNow integrates with various applications, allowing you to work on form 20178960 seamlessly across different platforms. This enhances productivity and enables better collaboration.

-

What are the benefits of using airSlate SignNow for form 20178960?

The primary benefits of using airSlate SignNow for form 20178960 include enhanced efficiency, reduced costs, and improved compliance. These advantages make it easier for businesses to handle their documentation needs.

-

Is airSlate SignNow user-friendly for completing form 20178960?

Yes, airSlate SignNow is designed with user experience in mind. Its intuitive interface makes it easy for anyone to complete and eSign form 20178960 without requiring extensive training.

Get more for 8960

- Elc005 journeyman electrician license applicationpub texas form

- Texas contractor form 36044428

- Travellers agreement form

- Schedule c 1 travelers canada form

- Application for credit platt electric supply form

- On campus student job availability form careers gmu

- Employment verification form

- Blank plant cell worksheet form

Find out other 8960

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online