About Form 8960, Net Investment Income Tax Individuals 2020

Understanding Form 8960: Net Investment Income Tax for Individuals

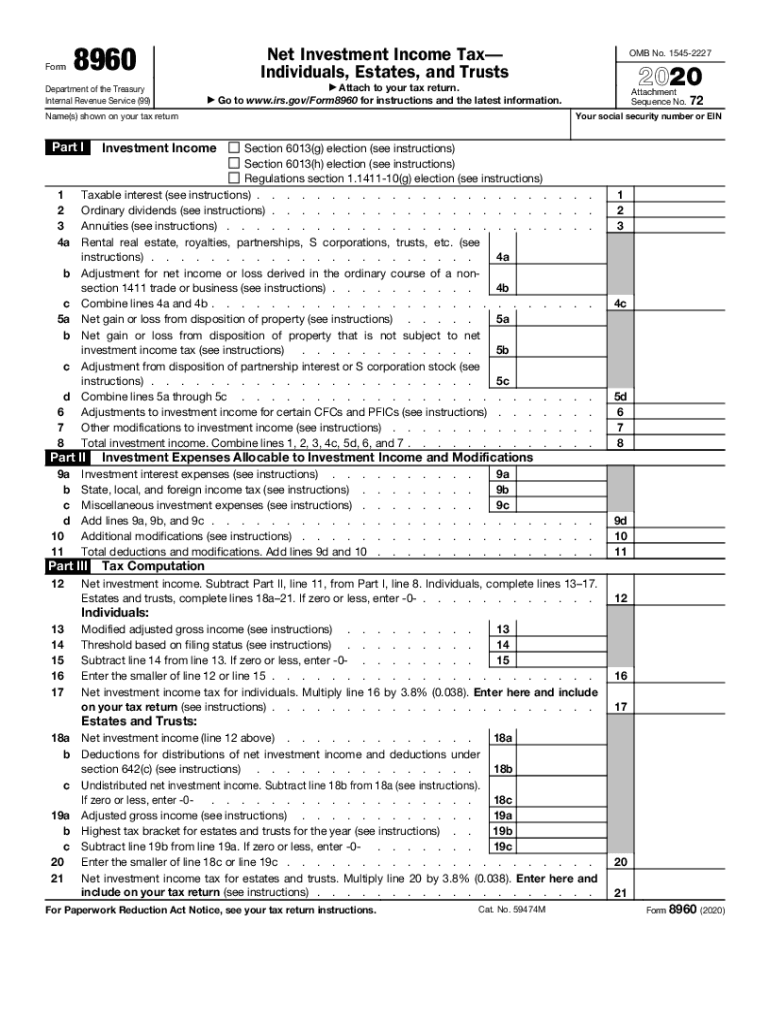

The 2019 Form 8960 is used by individuals to report and calculate the Net Investment Income Tax (NIIT). This tax applies to individuals, estates, and trusts that have income from investments exceeding certain thresholds. The NIIT is an additional tax of three point eight percent on the lesser of net investment income or the amount by which modified adjusted gross income exceeds the applicable threshold. For single filers, the threshold is two hundred fifty thousand dollars, while for married couples filing jointly, it is five hundred thousand dollars.

Steps to Complete the 2019 Form 8960

Completing the 2019 Form 8960 involves several key steps:

- Gather necessary financial documents, including income statements and records of investment income.

- Calculate your net investment income, which includes interest, dividends, capital gains, and rental income.

- Determine your modified adjusted gross income to see if it exceeds the threshold for your filing status.

- Fill out the form by reporting your net investment income and any deductions you may qualify for.

- Review your completed form for accuracy before submitting it with your tax return.

Legal Use of Form 8960

The 2019 Form 8960 is legally binding when completed accurately and submitted according to IRS guidelines. It is essential to ensure that all information is correct, as inaccuracies can lead to penalties or additional taxes owed. The form must be filed with your federal tax return, and it is crucial to keep copies of all submitted documents for your records. Compliance with the IRS regulations surrounding this form helps avoid legal complications and ensures that your tax obligations are met.

Filing Deadlines for Form 8960

For the 2019 tax year, the filing deadline for Form 8960 coincides with the standard tax return deadline, which is typically April fifteenth of the following year. If you file for an extension, you may have until October fifteenth to submit your return, including Form 8960. It is important to be aware of these deadlines to avoid late penalties and ensure timely processing of your tax return.

Required Documents for Completing Form 8960

To accurately complete the 2019 Form 8960, you will need several documents:

- Form 1040 or 1040-SR, which is your main tax return.

- Statements of any investment income, such as brokerage statements or K-1 forms.

- Documentation of any deductions related to investment income.

- Records of your modified adjusted gross income to determine if you exceed the threshold.

IRS Guidelines for Form 8960

The IRS provides specific guidelines for completing Form 8960, which include detailed instructions on how to calculate net investment income and modified adjusted gross income. It is essential to follow these guidelines closely to ensure compliance with tax laws. The IRS also offers resources and publications that can assist in understanding the requirements and implications of the NIIT.

Quick guide on how to complete about form 8960 net investment income tax individuals

Complete About Form 8960, Net Investment Income Tax Individuals effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers a great eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any hindrances. Manage About Form 8960, Net Investment Income Tax Individuals on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign About Form 8960, Net Investment Income Tax Individuals seamlessly

- Obtain About Form 8960, Net Investment Income Tax Individuals and click Get Form to initiate.

- Employ the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign About Form 8960, Net Investment Income Tax Individuals and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8960 net investment income tax individuals

Create this form in 5 minutes!

How to create an eSignature for the about form 8960 net investment income tax individuals

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2019 8960 and how does it relate to eSigning?

The 2019 8960 is a tax form used for reporting income from foreign corporations. Understanding how to integrate the 2019 8960 with eSigning solutions like airSlate SignNow is crucial for businesses dealing with international transactions, as it allows for seamless document management while ensuring compliance.

-

How can airSlate SignNow help with the completion of the 2019 8960?

AirSlate SignNow can streamline the process of completing the 2019 8960 by allowing users to fill out and sign the document electronically. This ensures a quicker turnaround, reduces errors, and keeps your documents secure, making tax season much easier for businesses.

-

What features does airSlate SignNow offer for managing the 2019 8960?

AirSlate SignNow provides features like customizable templates, automated workflows, and secure storage to efficiently manage the 2019 8960. These tools not only save time but also enhance accuracy and compliance during the filing process.

-

Is there a free trial available for airSlate SignNow to manage the 2019 8960?

Yes, airSlate SignNow offers a free trial that allows businesses to experience its features related to the 2019 8960 without any commitment. This is a great opportunity to explore how the platform simplifies document management before making a purchase.

-

What pricing plans does airSlate SignNow offer for eSigning documents like the 2019 8960?

AirSlate SignNow offers several pricing plans tailored to different business needs, which include options for managing documents like the 2019 8960. By choosing the right plan, businesses can benefit from the cost-effective solution that meets their eSigning requirements.

-

Can I integrate airSlate SignNow with other applications for processing the 2019 8960?

Absolutely! AirSlate SignNow easily integrates with various applications, enhancing your ability to process the 2019 8960. This includes accounting software and CRM systems that streamline the workflow and improve document collaboration.

-

What are the security features of airSlate SignNow when handling documents like the 2019 8960?

AirSlate SignNow employs top-notch security features, including encryption and secure cloud storage, when handling documents such as the 2019 8960. These measures ensure that sensitive data remains protected while facilitating easy access for authorized personnel.

Get more for About Form 8960, Net Investment Income Tax Individuals

- Joining letter after medical leave for govt employees form

- Business tax organizer form

- Ngo profile template word 71584548 form

- Florida surety bonds form

- Lessee information form oregon lottery oregonlottery

- National lifeguard service theory 100 question assignment lifelink ca form

- Rev 614form ab1 alcoholic beverages excise retur

- Hotelmotel excise tax form ampamp instructions

Find out other About Form 8960, Net Investment Income Tax Individuals

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure