Form 8960 Net Investment Income TaxIndividuals, Estates, and Trusts 2024

Understanding Form 8960: Net Investment Income Tax for Individuals, Estates, and Trusts

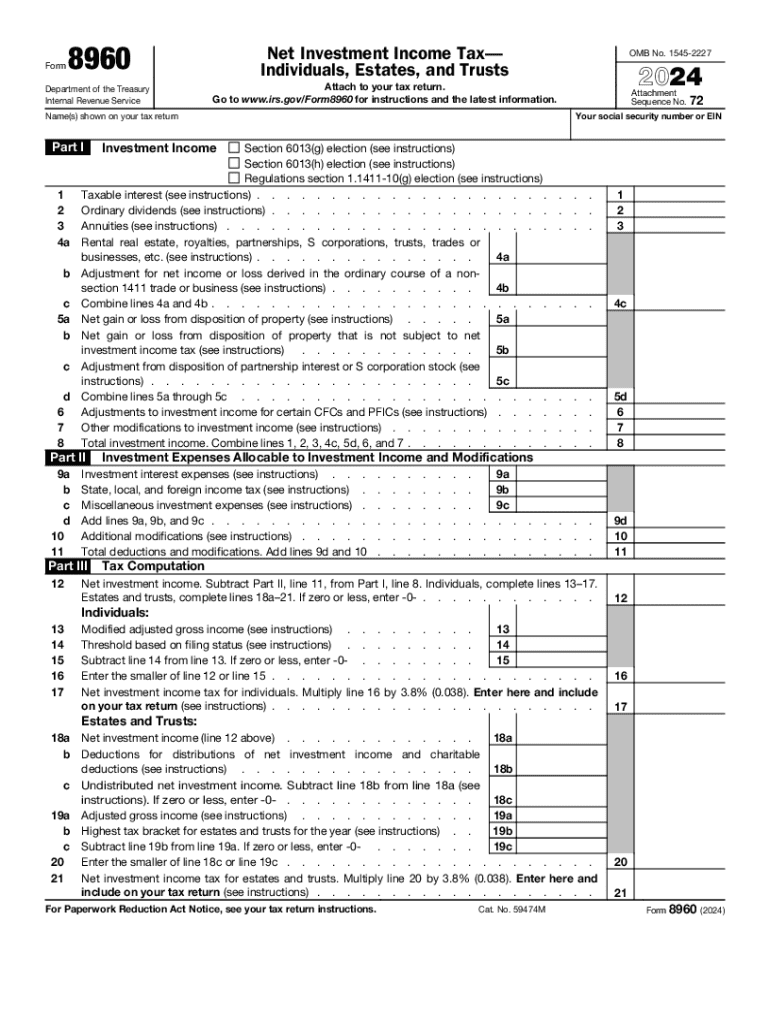

Form 8960 is used to calculate the Net Investment Income Tax (NIIT) imposed on individuals, estates, and trusts. This tax applies to individuals with a modified adjusted gross income above certain thresholds. The NIIT is an additional tax of three point eight percent on net investment income, which includes income from interest, dividends, capital gains, rental income, and other investment-related sources. Understanding this form is crucial for compliance with IRS regulations and ensuring accurate tax reporting.

How to Complete Form 8960: A Step-by-Step Guide

Completing Form 8960 involves several steps to ensure accuracy and compliance. First, gather all relevant financial documents that detail your investment income and any applicable deductions. Next, follow these steps:

- Determine your modified adjusted gross income (MAGI) to see if it exceeds the threshold for NIIT.

- Calculate your total net investment income by summing all applicable income sources.

- Use the form to report your investment income, deductions, and calculate the NIIT owed.

- Review the completed form for accuracy before submission.

Each section of the form must be filled out accurately to avoid delays or penalties.

Obtaining Form 8960: Where to Find It

Form 8960 can be easily obtained from the IRS website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, tax software often includes the form, allowing for electronic completion and submission. Always ensure you are using the correct version of the form for the tax year you are filing.

Key Components of Form 8960

Form 8960 consists of several key components that taxpayers must understand:

- Modified Adjusted Gross Income (MAGI): This is the income threshold that determines liability for the NIIT.

- Net Investment Income: This section requires a detailed accounting of all investment income sources.

- Tax Calculation: The form includes a section for calculating the total NIIT owed based on reported income.

Familiarity with these components helps ensure accurate reporting and compliance with tax obligations.

IRS Guidelines for Filing Form 8960

The IRS provides specific guidelines for filing Form 8960, which include instructions on eligibility, reporting requirements, and deadlines. Taxpayers should refer to the IRS instructions accompanying the form for detailed information on how to properly complete and submit the form. Adhering to these guidelines is essential to avoid penalties and ensure timely processing of tax returns.

Filing Deadlines for Form 8960

Form 8960 must be filed along with your federal income tax return. The standard deadline for filing individual tax returns is April fifteenth, unless an extension is filed. If you are filing for an estate or trust, the deadlines may vary. It is important to stay informed about any changes in deadlines to ensure compliance and avoid late fees.

Legal Implications of Non-Compliance with Form 8960

Failure to file Form 8960 when required can result in significant penalties. The IRS may impose fines for late filing or underpayment of taxes. Additionally, interest may accrue on any unpaid tax amounts. It is essential to understand the legal obligations associated with this form to mitigate risks and ensure compliance with tax laws.

Create this form in 5 minutes or less

Find and fill out the correct form 8960 net investment income taxindividuals estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the form 8960 net investment income taxindividuals estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 8960 form and how does airSlate SignNow help with it?

The 2018 8960 form is used to report the net investment income tax for individuals. airSlate SignNow simplifies the process of completing and eSigning the 2018 8960 form, ensuring that you can efficiently manage your tax documents without hassle.

-

How much does it cost to use airSlate SignNow for the 2018 8960 form?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you have the tools necessary to manage the 2018 8960 form effectively.

-

What features does airSlate SignNow provide for handling the 2018 8960?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing the 2018 8960 form. These features streamline the process, making it easier to complete and submit your tax documents.

-

Can I integrate airSlate SignNow with other software for the 2018 8960?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your documents related to the 2018 8960 form. This integration capability enhances your workflow and ensures that all your data is synchronized.

-

What are the benefits of using airSlate SignNow for the 2018 8960 form?

Using airSlate SignNow for the 2018 8960 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. With its user-friendly interface, you can complete your tax documents quickly and securely.

-

Is airSlate SignNow secure for submitting the 2018 8960 form?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the 2018 8960 form. Your data is encrypted, ensuring that your sensitive information remains confidential and secure.

-

How can I get started with airSlate SignNow for the 2018 8960?

Getting started with airSlate SignNow for the 2018 8960 form is easy. Simply sign up for an account, choose a pricing plan, and start creating or uploading your documents to eSign and manage them efficiently.

Get more for Form 8960 Net Investment Income TaxIndividuals, Estates, And Trusts

Find out other Form 8960 Net Investment Income TaxIndividuals, Estates, And Trusts

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile