Form 8960 Net Investment Income Tax Individuals Estates an 2021

Understanding Form 8960: Net Investment Income Tax

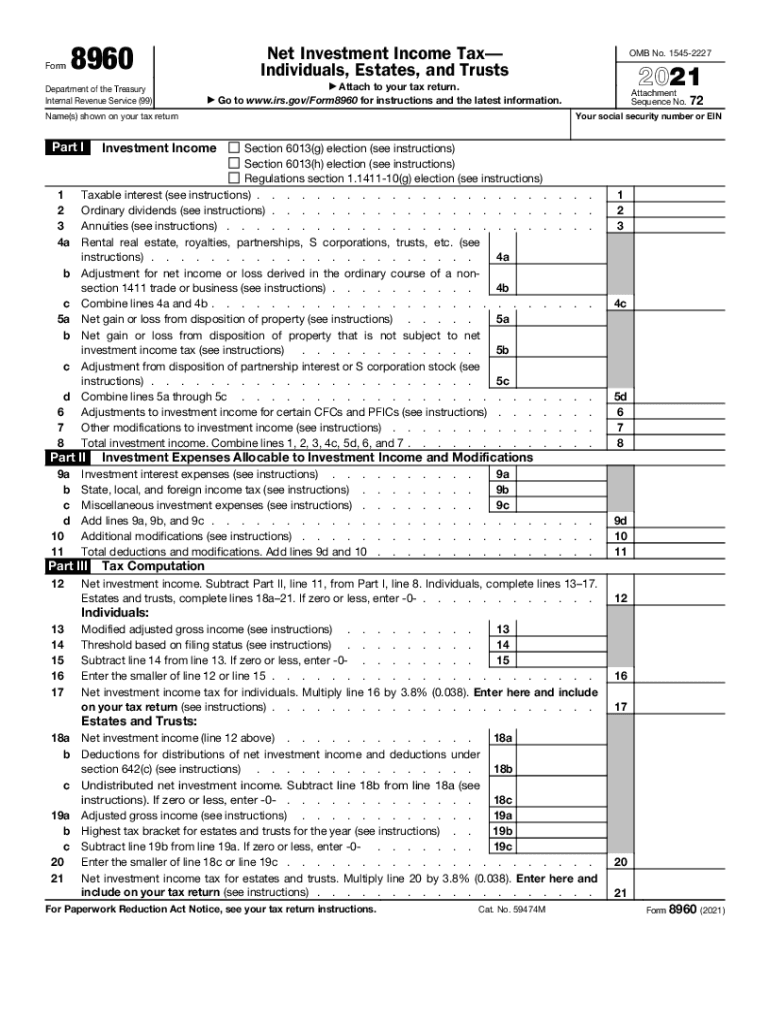

The Form 8960 is used to calculate the Net Investment Income Tax (NIIT) for individuals, estates, and trusts. This tax applies to individuals with modified adjusted gross income above certain thresholds. For 2021, the thresholds are $200,000 for single filers and $250,000 for married couples filing jointly. The form helps determine the amount of net investment income subject to this additional tax, which is set at three point eight percent. Understanding the purpose of this form is essential for accurate tax reporting and compliance.

Steps to Complete Form 8960

Completing Form 8960 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and investment records. Follow these steps:

- Identify your modified adjusted gross income (MAGI) and determine if it exceeds the applicable threshold.

- Calculate your net investment income, which includes interest, dividends, capital gains, and rental income.

- Use the form to report your MAGI and net investment income, ensuring all calculations are accurate.

- Transfer the calculated tax amount to your main tax return.

Each section of the form must be filled out carefully to avoid errors that may lead to penalties.

Required Documents for Form 8960

To accurately complete Form 8960, you will need several documents that reflect your income and investment activities. These include:

- W-2 forms for any wages earned.

- 1099 forms for interest, dividends, and other investment income.

- Statements for capital gains and losses from the sale of assets.

- Records of any rental income and expenses.

Having these documents on hand will streamline the process of filling out the form and help ensure that all income sources are accounted for.

Filing Deadlines for Form 8960

Form 8960 must be filed along with your individual income tax return. For the 2021 tax year, the deadline for filing is April 18, 2022. If you require additional time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is important to stay aware of these dates to ensure timely compliance with IRS requirements.

Legal Use of Form 8960

The legal use of Form 8960 is essential for compliance with tax laws regarding net investment income. The form must be filled out accurately to avoid potential audits or penalties. The IRS requires that taxpayers report their net investment income correctly, and failure to do so can result in fines or additional taxes owed. Understanding the legal implications of this form helps ensure that taxpayers fulfill their obligations while minimizing risks associated with non-compliance.

Examples of Using Form 8960

Form 8960 is particularly relevant for high-income earners and those with significant investment income. For example, a single taxpayer with a modified adjusted gross income of $250,000 and net investment income of $50,000 would be subject to the NIIT. This taxpayer would calculate the tax owed by applying the three point eight percent rate to the net investment income. Such examples illustrate the importance of understanding how the form applies to individual financial situations and the potential tax implications involved.

Quick guide on how to complete form 8960 net investment income tax individuals estates an

Complete Form 8960 Net Investment Income Tax Individuals Estates An effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely conserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Form 8960 Net Investment Income Tax Individuals Estates An on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

The easiest method to modify and eSign Form 8960 Net Investment Income Tax Individuals Estates An without hassle

- Obtain Form 8960 Net Investment Income Tax Individuals Estates An and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Form 8960 Net Investment Income Tax Individuals Estates An and ensure outstanding communication at every stage of your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8960 net investment income tax individuals estates an

Create this form in 5 minutes!

How to create an eSignature for the form 8960 net investment income tax individuals estates an

How to create an e-signature for your PDF in the online mode

How to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF on Android OS

People also ask

-

What are the form 8960 instructions 2021 for reporting net investment income?

The form 8960 instructions 2021 provide detailed guidance on how to report your net investment income and calculate the net investment income tax. These instructions help individuals understand the requirements for reporting various types of income, making compliance easier and more efficient.

-

How can airSlate SignNow assist with submitting form 8960?

With airSlate SignNow, you can easily prepare and eSign your form 8960 documents directly within the platform. Our solution streamlines the signing process, ensuring that you can effortlessly complete and submit your form 8960 instructions 2021 without any hassle.

-

What features does airSlate SignNow offer for managing form 8960?

AirSlate SignNow offers comprehensive features such as document templates, secure eSignatures, and cloud storage, specifically designed to help you manage your form 8960 efficiently. Your documents are accessible from anywhere, making it easy to stay organized and compliant with the form 8960 instructions 2021.

-

Is airSlate SignNow a cost-effective solution for handling form 8960?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to handle form 8960 and other document management tasks. Our affordable pricing plans enable you to access essential features to meet the requirements outlined in the form 8960 instructions 2021 without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for form 8960?

Absolutely! AirSlate SignNow seamlessly integrates with various applications, allowing you to enhance your workflow with ease. These integrations ensure that you can effortlessly gather and manage the information needed for your form 8960 instructions 2021 from your preferred applications.

-

What are the benefits of using airSlate SignNow for form 8960?

Using airSlate SignNow for your form 8960 provides numerous benefits, including enhanced efficiency and reduced paperwork. The platform allows you to easily eSign and manage your documents, ensuring you complete the form 8960 instructions 2021 accurately and quickly.

-

How does airSlate SignNow ensure the security of form 8960 documents?

AirSlate SignNow prioritizes the security of your documents by implementing robust encryption and secure storage measures. This ensures that all form 8960 instructions 2021 and related documents are safe and compliant with industry regulations.

Get more for Form 8960 Net Investment Income Tax Individuals Estates An

- Legal last will and testament for civil union partner with minor children from prior marriage colorado form

- Legal last will and testament for domestic partner with minor children from prior marriage colorado form

- Legal last will and testament form for married person with adult children from prior marriage colorado

- Legal last will and testament form for divorced person not remarried with adult children colorado

- Legal last will and testament form for domestic partner with adult children from prior marriage colorado

- Legal last will and testament form for civil union partner with adult children from prior marriage colorado

- Legal last will and testament form for divorced person not remarried with no children colorado

- Legal last will and testament form for divorced person not remarried with minor children colorado

Find out other Form 8960 Net Investment Income Tax Individuals Estates An

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe