355sbc 2019-2026

What is the 355sbc

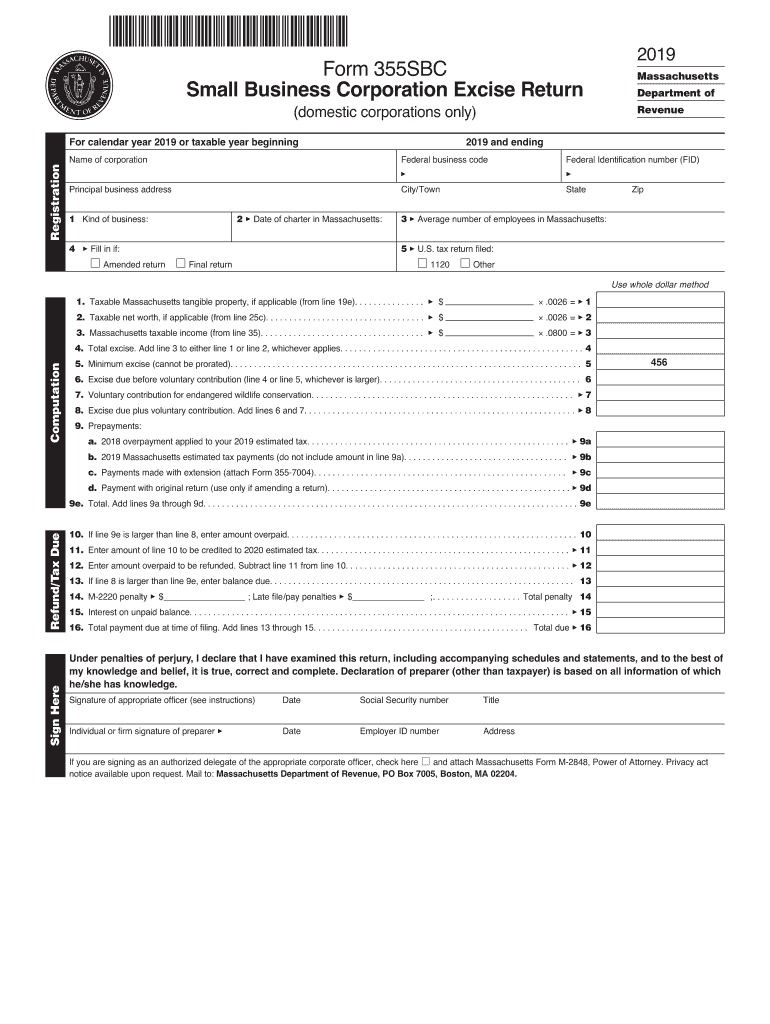

The 355sbc form is a corporate excise tax return used in Massachusetts. It is specifically designed for corporations to report their income, deductions, and credits to the state. This form is crucial for ensuring compliance with state tax regulations and for calculating the appropriate tax liability. The 355sbc is part of the Massachusetts Department of Revenue's requirements for businesses operating within the state.

How to use the 355sbc

Using the 355sbc form involves several steps. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, complete the form by accurately entering your business's financial information. Ensure that all calculations are correct to avoid any potential issues with the Massachusetts Department of Revenue. After completing the form, you can submit it electronically or by mail, depending on your preference.

Steps to complete the 355sbc

Completing the 355sbc form requires careful attention to detail. Follow these steps:

- Gather financial records, including income and expenses for the tax year.

- Fill out the identification section with your business information.

- Report total income and allowable deductions in the appropriate sections.

- Calculate your tax liability based on the provided rates.

- Review the form for accuracy before submission.

Legal use of the 355sbc

The legal use of the 355sbc form is governed by Massachusetts tax laws. It is essential for businesses to file this form accurately and on time to avoid penalties. The form serves as a declaration of your business's financial activities and is used by the state to assess tax obligations. Compliance with filing deadlines and regulations is critical to maintain good standing with the Massachusetts Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the 355sbc form are typically aligned with the corporate tax calendar. Corporations must file their returns by the fifteenth day of the fourth month following the end of their fiscal year. For most businesses operating on a calendar year, this means the deadline is April fifteenth. It is important to be aware of these dates to ensure timely submission and avoid late fees.

Required Documents

To complete the 355sbc form, several documents are necessary. These include:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets and liabilities.

- Any documentation supporting deductions and credits claimed.

- Prior year tax returns for reference.

Penalties for Non-Compliance

Failure to file the 355sbc form on time can result in significant penalties. Businesses may incur late filing fees, interest on unpaid taxes, and potential legal action from the Massachusetts Department of Revenue. It is crucial to adhere to filing deadlines and ensure that the form is completed accurately to avoid these consequences.

Quick guide on how to complete 2018 2020 form ma dor 355sbc fill online printable

Complete 355sbc effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Handle 355sbc on any device with the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign 355sbc with ease

- Find 355sbc and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal standing as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign 355sbc and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 2020 form ma dor 355sbc fill online printable

Create this form in 5 minutes!

How to create an eSignature for the 2018 2020 form ma dor 355sbc fill online printable

How to create an electronic signature for the 2018 2020 Form Ma Dor 355sbc Fill Online Printable online

How to make an eSignature for your 2018 2020 Form Ma Dor 355sbc Fill Online Printable in Chrome

How to generate an eSignature for putting it on the 2018 2020 Form Ma Dor 355sbc Fill Online Printable in Gmail

How to generate an eSignature for the 2018 2020 Form Ma Dor 355sbc Fill Online Printable right from your smart phone

How to generate an eSignature for the 2018 2020 Form Ma Dor 355sbc Fill Online Printable on iOS devices

How to generate an eSignature for the 2018 2020 Form Ma Dor 355sbc Fill Online Printable on Android OS

People also ask

-

What is the difference between ma form 355s and 355sbc?

The primary difference between ma form 355s and 355sbc lies in their applicability and purpose. The 355s form is typically used by certain corporations, while the 355sbc is designed specifically for small businesses. Understanding the distinctions can ensure you choose the appropriate form for your business needs.

-

How do I know which form to use, ma form 355s or 355sbc?

Choosing between ma form 355s and 355sbc depends on the size and structure of your business. If you are a small business, the 355sbc may offer more tailored benefits. Consulting a tax professional can provide clarity on which form suits your situation best.

-

Are there any cost differences when filing ma form 355s vs 355sbc?

While both ma form 355s and 355sbc are typically associated with different businesses, the filing costs may vary based on the complexity of your financial situation. It's essential to consider additional factors such as tax credits or deductions that could impact overall expenses.

-

What features can I expect from airSlate SignNow when handling ma form 355s or 355sbc?

airSlate SignNow offers a streamlined electronic signature solution, allowing users to efficiently manage and sign ma form 355s or 355sbc documents. The platform features templates, reminders, and secure signing, ensuring compliance and ease of use.

-

What are the benefits of using airSlate SignNow for ma form 355s and 355sbc?

Using airSlate SignNow for your ma form 355s vs 355sbc allows you to save time and reduce errors in the signing process. The platform's user-friendly interface and secure environment enhance the overall experience and assist in ensuring legal compliance.

-

Can airSlate SignNow integrate with my accounting software for filing ma form 355s or 355sbc?

Yes, airSlate SignNow can integrate with various accounting software programs, making it easier to file your ma form 355s or 355sbc directly from your financial systems. This integration streamlines the documentation process, enhancing efficiency in managing your forms.

-

Is airSlate SignNow secure for signing important tax documents like ma form 355s and 355sbc?

Absolutely! airSlate SignNow prioritizes security through encryption and compliance with e-signature regulations, ensuring that your ma form 355s and 355sbc are signed securely and confidentially. Trust in our platform for handling sensitive tax documents.

Get more for 355sbc

- Dmap 3113 ffs provider enrollment short form apps state or

- Clinician addchange form provider express

- Community service documentation form

- Fit test form

- Hw to fill personal memoranda form

- Timbercorp securities limited abn 12 092 311 469 application form

- Mcps form 560 51 student service learning activity verification montgomeryschoolsmd

- Smart recovery attendance sheet form

Find out other 355sbc

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now