Ri 1040mu 2019

What is the Ri 1040mu

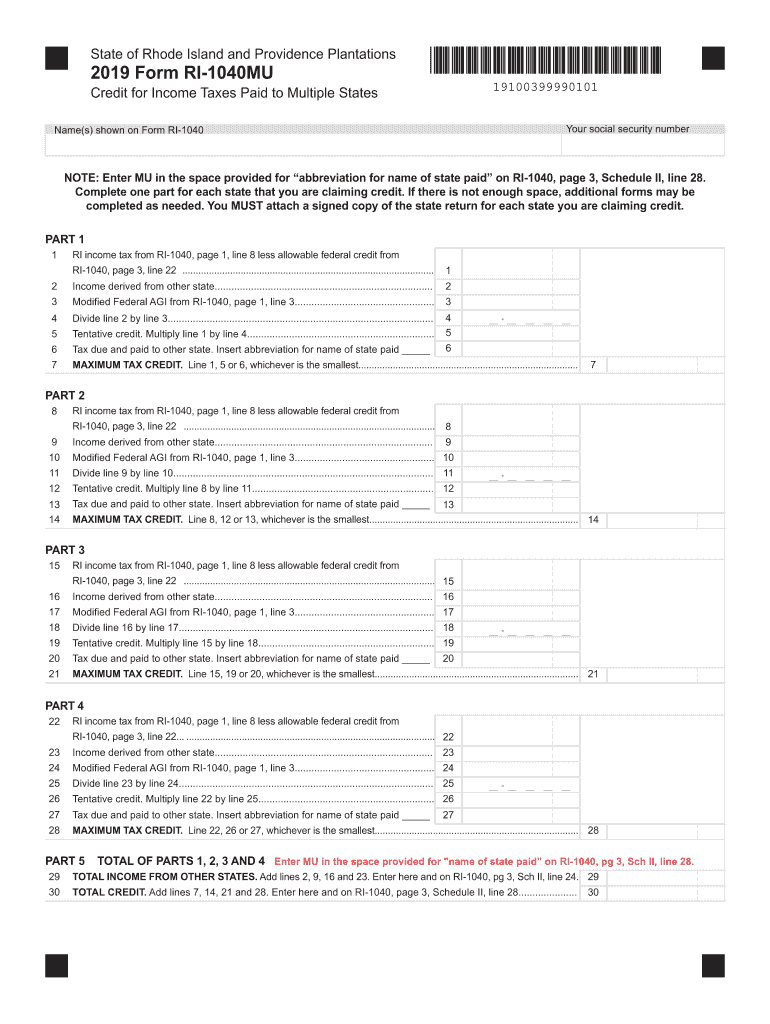

The Ri 1040mu is a state income tax form used by residents of Rhode Island to report their income and calculate their tax liability. This form is specifically designed for individuals and is part of the state's tax filing requirements. The Ri 1040mu captures various types of income, deductions, and credits, ensuring that taxpayers comply with Rhode Island tax laws. Understanding this form is essential for accurate tax reporting and to avoid potential penalties.

How to use the Ri 1040mu

Using the Ri 1040mu involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering personal information, income details, and applicable deductions. It is important to review the instructions provided with the form for specific guidelines on each section. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Ri 1040mu

Completing the Ri 1040mu requires careful attention to detail. Here are the key steps:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Fill in personal details such as name, address, and Social Security number.

- Report all sources of income accurately, including wages, self-employment income, and any other taxable income.

- Claim deductions and credits applicable to your situation, ensuring you have documentation to support these claims.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Ri 1040mu

The Ri 1040mu is legally binding when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must provide accurate information and sign the form as required. Utilizing electronic signature solutions can enhance the security and legality of the submission process. Compliance with Rhode Island tax laws is crucial to avoid penalties and ensure that the form is accepted by the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Ri 1040mu are critical for compliance. Generally, the form must be submitted by April fifteenth of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available for filing and payment, which can provide additional time to complete the form without incurring penalties.

Required Documents

To complete the Ri 1040mu, taxpayers need several key documents:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or self-employment income.

- Documentation for deductions, such as receipts for charitable contributions or medical expenses.

- Any other relevant tax documents that may affect income or deductions.

Quick guide on how to complete 2019 form ri 1040nr mu state of rhode island division of

Complete Ri 1040mu effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Ri 1040mu on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to edit and eSign Ri 1040mu with ease

- Locate Ri 1040mu and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sharing your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Ri 1040mu and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form ri 1040nr mu state of rhode island division of

Create this form in 5 minutes!

How to create an eSignature for the 2019 form ri 1040nr mu state of rhode island division of

How to create an electronic signature for the 2019 Form Ri 1040nr Mu State Of Rhode Island Division Of online

How to create an electronic signature for your 2019 Form Ri 1040nr Mu State Of Rhode Island Division Of in Chrome

How to make an electronic signature for putting it on the 2019 Form Ri 1040nr Mu State Of Rhode Island Division Of in Gmail

How to generate an electronic signature for the 2019 Form Ri 1040nr Mu State Of Rhode Island Division Of right from your mobile device

How to create an eSignature for the 2019 Form Ri 1040nr Mu State Of Rhode Island Division Of on iOS devices

How to make an eSignature for the 2019 Form Ri 1040nr Mu State Of Rhode Island Division Of on Android devices

People also ask

-

What is the ri 1040mu form and how does it relate to airSlate SignNow?

The ri 1040mu form is used for filing personal income tax returns in Rhode Island. airSlate SignNow provides a seamless way to fill out, sign, and send the ri 1040mu electronically, ensuring that your tax documents are managed efficiently and securely.

-

How does airSlate SignNow simplify the process of completing the ri 1040mu?

airSlate SignNow simplifies the completion of the ri 1040mu by providing a user-friendly interface that allows users to easily input their information. With its intuitive design, you can quickly navigate through the form and ensure that all required fields are filled out correctly, saving you time and effort.

-

Is there a pricing plan for using airSlate SignNow with the ri 1040mu?

Yes, airSlate SignNow offers competitive pricing plans that cater to various needs, making it a cost-effective solution for managing the ri 1040mu. Users can choose from monthly or annual subscriptions, depending on their usage and business requirements.

-

What features does airSlate SignNow provide for managing documents like the ri 1040mu?

airSlate SignNow provides a range of features for managing documents, including eSignature capabilities, document templates, and cloud storage. These features ensure that you can manage your ri 1040mu efficiently while maintaining compliance and security.

-

Are there any integrations available for those using the ri 1040mu with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various platforms like Google Drive, Dropbox, and more. This allows users working with the ri 1040mu to easily access, share, and store their documents in a centralized location.

-

Can I track the status of my ri 1040mu documents sent through airSlate SignNow?

Absolutely! airSlate SignNow includes a tracking feature that allows you to monitor the status of your ri 1040mu documents in real-time. You can see when recipients have viewed and signed the document, providing you with peace of mind.

-

What benefits does airSlate SignNow offer for businesses handling the ri 1040mu?

airSlate SignNow offers signNow benefits for businesses handling the ri 1040mu, including increased efficiency, reduced processing time, and enhanced security. Its digital signature capabilities streamline workflows and ensure compliance with legal standards.

Get more for Ri 1040mu

Find out other Ri 1040mu

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF