Rhode Island Tax Forms and Instructions for Form RI 1040 2020

What is the Rhode Island Tax Forms And Instructions For Form RI 1040

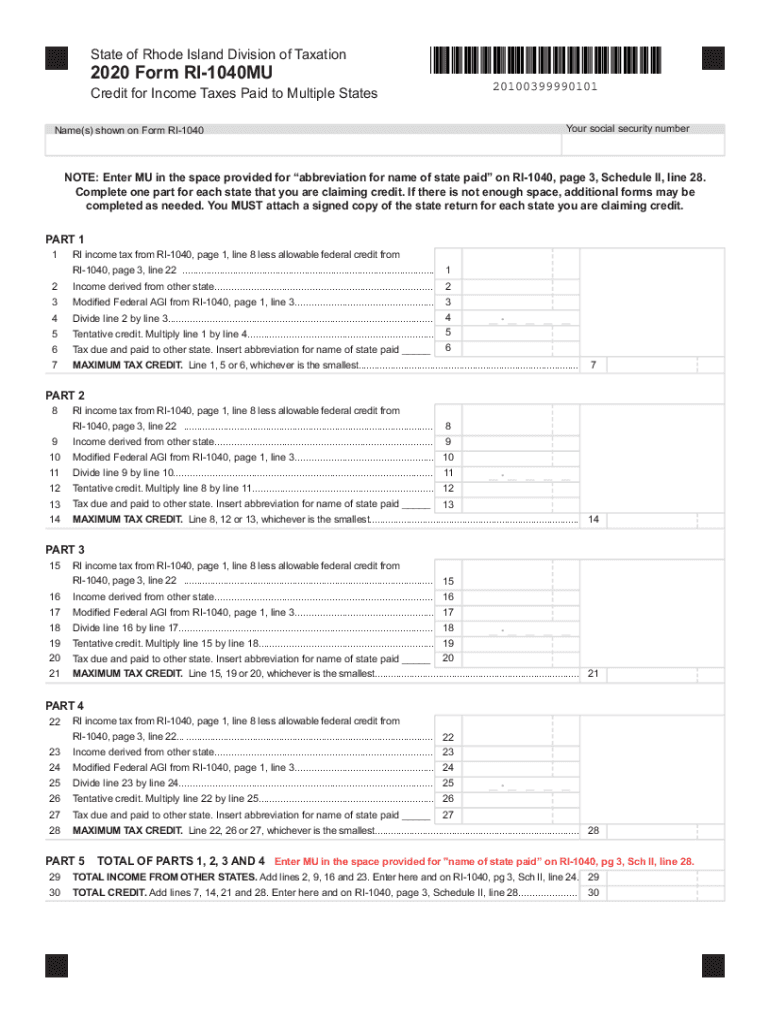

The Rhode Island 1040 is the state income tax form used by residents of Rhode Island to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it ensures compliance with state tax laws. The RI 1040 instructions provide detailed guidance on how to accurately complete the form, including information about deductions, credits, and specific requirements unique to Rhode Island taxpayers.

Steps to complete the Rhode Island Tax Forms And Instructions For Form RI 1040

Completing the Rhode Island 1040 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, follow the instructions provided with the form to fill out each section, ensuring that all income is reported and that applicable deductions are claimed. Pay special attention to the sections regarding Rhode Island-specific credits and adjustments. Finally, review the completed form for accuracy before submitting it.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Rhode Island 1040 to avoid penalties. Typically, the deadline for filing the RI 1040 is April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may be available, which can provide additional time to file but do not extend the deadline for payment of taxes owed.

Legal use of the Rhode Island Tax Forms And Instructions For Form RI 1040

The Rhode Island 1040, when filled out correctly and submitted on time, serves as a legally binding document for state tax purposes. It is important to ensure that all information is accurate and truthful, as providing false information can lead to penalties and legal repercussions. The form must be signed and dated by the taxpayer, affirming that the information provided is correct to the best of their knowledge.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Rhode Island 1040. The form can be filed electronically through approved e-filing services, which often provide a faster processing time and quicker refunds. Alternatively, taxpayers may choose to mail their completed forms to the Rhode Island Division of Taxation. For those who prefer a personal touch, in-person submissions may be made at designated tax offices, though this option may require an appointment.

Required Documents

To complete the Rhode Island 1040, taxpayers need to gather several key documents. These typically include W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documentation for deductions, such as receipts for medical expenses or charitable contributions, should be collected to support claims made on the form. Having all necessary documents on hand will streamline the filing process and help ensure accuracy.

Quick guide on how to complete rhode island tax forms and instructions for 2020 form ri 1040

Effortlessly prepare Rhode Island Tax Forms And Instructions For Form RI 1040 on any device

Digital document management has become a trend among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without hassle. Manage Rhode Island Tax Forms And Instructions For Form RI 1040 on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to modify and electronically sign Rhode Island Tax Forms And Instructions For Form RI 1040 with ease

- Obtain Rhode Island Tax Forms And Instructions For Form RI 1040 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Rhode Island Tax Forms And Instructions For Form RI 1040 to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rhode island tax forms and instructions for 2020 form ri 1040

Create this form in 5 minutes!

How to create an eSignature for the rhode island tax forms and instructions for 2020 form ri 1040

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What are the RI 1040 instructions 2020 for filing taxes?

The RI 1040 instructions 2020 provide guidance on how to accurately complete the Rhode Island personal income tax return. They include information on eligible deductions, credits, and deadlines. It's essential to follow these instructions carefully to ensure compliance and minimize any potential errors in your tax filing.

-

How can airSlate SignNow assist with preparing my RI 1040 instructions 2020?

airSlate SignNow streamlines the process of preparing necessary documents while adhering to the RI 1040 instructions 2020. With our electronic signature capabilities, you can easily gather necessary signatures and finalize tax documents without hassle. This efficiency ensures that you can focus more on your tax preparation rather than administrative work.

-

Are there any costs associated with using airSlate SignNow for RI 1040 instructions 2020?

Yes, airSlate SignNow offers various pricing plans that cater to different needs and budgets. The cost is typically considered reasonable, especially when you factor in the time saved by utilizing our platform per the RI 1040 instructions 2020. You can choose a plan that best suits your document management needs for tax season.

-

What features does airSlate SignNow offer to aid compliance with RI 1040 instructions 2020?

AirSlate SignNow features an intuitive interface, customizable document templates, and secure eSignatures. These functionalities can enhance compliance with RI 1040 instructions 2020 by ensuring all necessary tax forms are completed accurately and securely. Our platform also provides tracking and reminders to keep your filing on schedule.

-

Can I integrate airSlate SignNow with other tax software for RI 1040 instructions 2020?

Yes, airSlate SignNow integrates with popular accounting and tax software, helping you streamline your process while following RI 1040 instructions 2020. This integration enables seamless data transfer and document management. It allows you to work efficiently within your existing systems for added convenience during tax season.

-

How does airSlate SignNow improve the eSigning process for RI 1040 instructions 2020?

AirSlate SignNow simplifies the eSigning process, ensuring it aligns with RI 1040 instructions 2020. Our platform allows users to send documents for signature quickly and securely, reducing the time spent waiting for signatures. This feature enhances your overall tax filing experience by making it faster and more efficient.

-

What benefits can I expect when using airSlate SignNow with RI 1040 instructions 2020?

Using airSlate SignNow while adhering to RI 1040 instructions 2020 offers several benefits, including increased accuracy in document handling and quicker turnaround times. Our solution minimizes the manual labor involved in assembling tax documents. You'll also enjoy enhanced security features that protect sensitive information during the filing process.

Get more for Rhode Island Tax Forms And Instructions For Form RI 1040

Find out other Rhode Island Tax Forms And Instructions For Form RI 1040

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer