RI Income Tax from RI 1040, Page 1, Line 8 Less Allowable Federal Credit from 2024-2026

Understanding the RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From

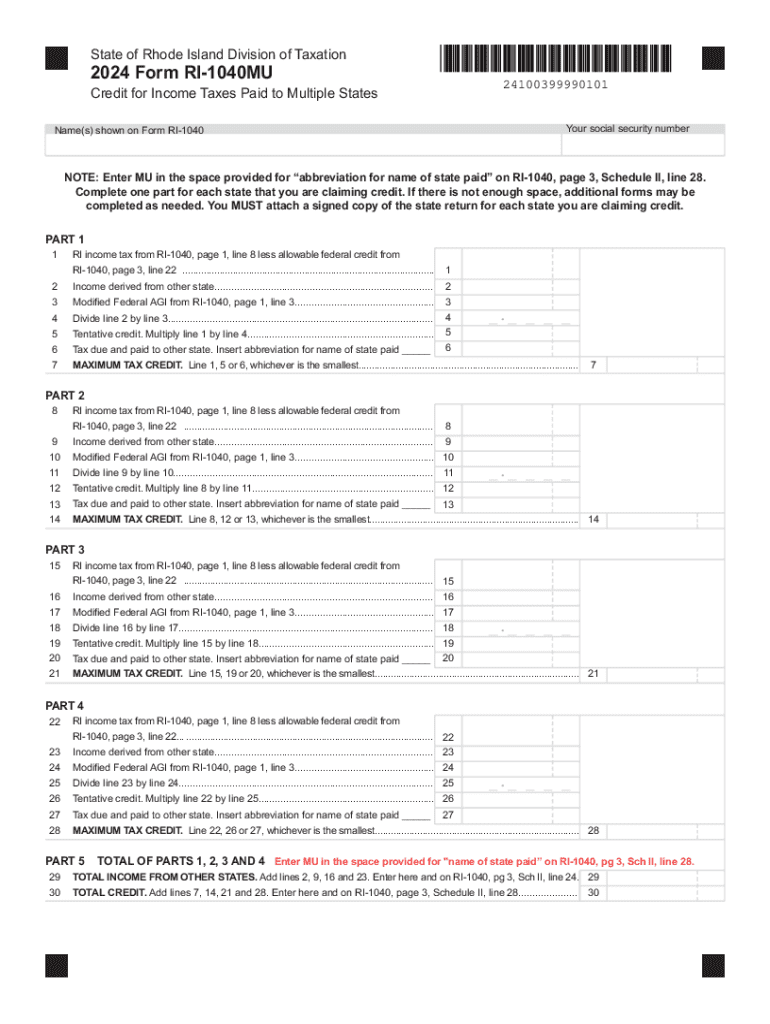

The RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From refers to a specific calculation within the Rhode Island state income tax form. This line represents the amount of income tax that can be reduced by any allowable federal credits. Understanding this line is crucial for accurately determining your state tax liability. It ensures that taxpayers only pay the appropriate amount of tax based on their income and applicable credits.

Steps to Complete the RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From

To complete this section of the RI 1040 form, follow these steps:

- Gather your federal tax return to identify any credits you are eligible for.

- Locate the total income tax calculated on your federal return.

- Determine the allowable federal credit that can be applied to your Rhode Island tax.

- Subtract the allowable federal credit from the total income tax amount.

- Enter the resulting figure on Line 8 of the RI 1040 form.

Ensuring accuracy in these calculations is important to avoid any discrepancies with the Rhode Island Division of Taxation.

Key Elements of the RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From

Several key elements are involved in this calculation:

- Total Income Tax: This is the amount calculated on your federal return that serves as the starting point.

- Allowable Federal Credit: This includes any credits you qualify for, such as the Earned Income Tax Credit or education-related credits.

- Net Tax Liability: This is the final amount after subtracting the allowable federal credit from your total income tax.

Understanding these elements helps ensure that taxpayers accurately report their tax obligations.

State-Specific Rules for the RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From

Rhode Island has specific rules regarding the application of federal credits. Not all federal credits are applicable for state tax purposes. It is essential to review the Rhode Island Division of Taxation guidelines to determine which credits can be used. Additionally, the state may have unique requirements for documentation or proof of eligibility for these credits. Familiarizing yourself with these rules can help avoid potential issues during the filing process.

Filing Deadlines / Important Dates

Taxpayers must be aware of the important deadlines associated with filing the RI 1040 form. Typically, the deadline for filing state income tax returns aligns with the federal tax deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Rhode Island Division of Taxation website for any updates or changes to these dates to ensure timely filing.

Required Documents for the RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From

To accurately complete the RI 1040 form, certain documents are necessary:

- Your federal tax return, which provides the basis for your state tax calculations.

- Documentation supporting any allowable federal credits claimed.

- W-2 forms and any other income statements.

- Records of any deductions or additional credits that may apply to your situation.

Having these documents ready can streamline the filing process and help ensure accuracy.

Create this form in 5 minutes or less

Find and fill out the correct ri income tax from ri 1040 page 1 line 8 less allowable federal credit from

Create this form in 5 minutes!

How to create an eSignature for the ri income tax from ri 1040 page 1 line 8 less allowable federal credit from

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From?

The RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From refers to the specific line on the Rhode Island tax form where taxpayers report their income tax after accounting for any allowable federal credits. Understanding this line is crucial for accurate tax filing and ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with filing RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From?

airSlate SignNow streamlines the document signing process, making it easier to manage tax forms like the RI Income Tax From RI 1040. With our platform, you can securely send, sign, and store your tax documents, ensuring that you have everything you need for accurate filing.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and document tracking. These tools are designed to simplify the management of tax documents, including those related to RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From.

-

Is airSlate SignNow cost-effective for small businesses handling RI Income Tax From RI 1040?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to manage their tax documents. Our pricing plans are designed to fit various budgets, ensuring that you can efficiently handle your RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for tax filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to streamline your tax filing process. This integration is particularly beneficial for managing documents related to RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and improved efficiency. By utilizing our platform, you can ensure that your RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From is handled securely and accurately.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure storage solutions. This ensures that sensitive information related to your RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From remains protected throughout the signing and filing process.

Get more for RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From

Find out other RI Income Tax From RI 1040, Page 1, Line 8 Less Allowable Federal Credit From

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe