Form E File 2018

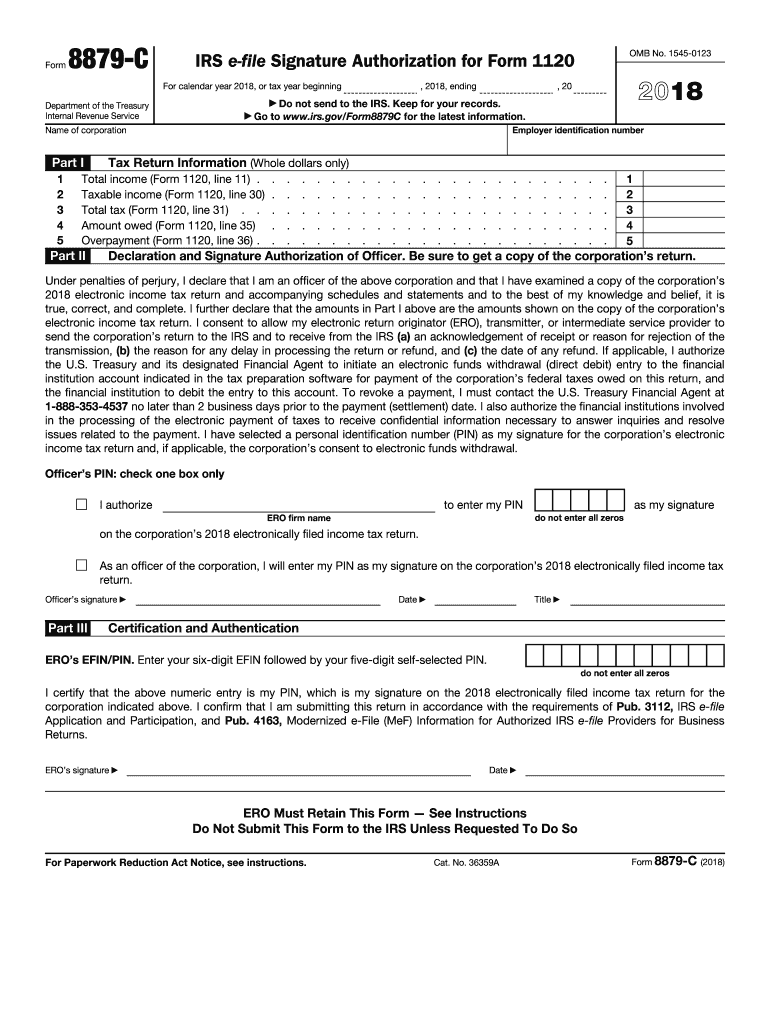

What is the IRS Form 8879 E File Signature Authorization?

The IRS Form 8879 E File Signature Authorization is a crucial document for taxpayers who choose to file their tax returns electronically. This form allows taxpayers to authorize an electronic return originator (ERO) to submit their tax return to the IRS on their behalf. By signing this form, taxpayers confirm that they have reviewed their tax return and agree to the information contained within it. This process streamlines electronic filing, making it more efficient while ensuring compliance with IRS regulations.

Steps to Complete the IRS Form 8879 E File Signature Authorization

Completing the IRS Form 8879 E File Signature Authorization involves several straightforward steps:

- Gather necessary information, including your tax return details and personal identification.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Sign the form electronically, using a secure eSignature solution to ensure its validity.

- Submit the form to your ERO, who will then file your tax return electronically with the IRS.

Legal Use of the IRS Form 8879 E File Signature Authorization

The IRS Form 8879 E File Signature Authorization is legally binding when completed correctly. To ensure its legal validity, the form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, as well as the Uniform Electronic Transactions Act (UETA). Utilizing a reliable eSignature platform that adheres to these regulations is essential for maintaining the integrity of your electronic signature. This legal framework confirms that electronic signatures hold the same weight as traditional handwritten signatures in the eyes of the law.

IRS Guidelines for the Form 8879 E File Signature Authorization

The IRS provides specific guidelines for the use of the Form 8879 E File Signature Authorization. Taxpayers must ensure that the form is completed and signed before their tax return is submitted electronically. The IRS requires that the ERO retains the signed form for three years from the date of the return filing. Additionally, the form should be made available to the IRS upon request. Following these guidelines helps prevent potential issues with your tax filing and ensures compliance with IRS regulations.

Required Documents for Filing with the IRS Form 8879 E File Signature Authorization

When preparing to file your tax return using the IRS Form 8879 E File Signature Authorization, it is important to gather the following documents:

- Your completed tax return (Form 1040 or other applicable forms).

- Any supporting documentation, such as W-2s, 1099s, and other income statements.

- Identification information, including your Social Security number and any relevant tax identification numbers.

- Previous year's tax return, if applicable, for reference.

Form Submission Methods for the IRS Form 8879 E File Signature Authorization

The IRS Form 8879 E File Signature Authorization can be submitted through various methods, primarily focusing on electronic filing. Once the form is completed and signed, it should be sent directly to your ERO. The ERO will then use the information on the form to file your tax return electronically with the IRS. It is important to keep a copy of the signed form for your records, as it serves as proof of authorization for the electronic submission.

Quick guide on how to complete form e file

Complete Form E File effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form E File on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form E File without hassle

- Locate Form E File and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form E File and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form e file

Create this form in 5 minutes!

How to create an eSignature for the form e file

How to make an eSignature for the Form E File in the online mode

How to create an electronic signature for the Form E File in Chrome

How to generate an electronic signature for signing the Form E File in Gmail

How to make an eSignature for the Form E File right from your smart phone

How to create an electronic signature for the Form E File on iOS devices

How to create an eSignature for the Form E File on Android OS

People also ask

-

What is a Form E File and how can airSlate SignNow assist with it?

A Form E File is an electronic document used for various business transactions that require signature verification. airSlate SignNow simplifies the process of creating, sending, and signing Form E Files, ensuring that your documents are securely handled and legally binding.

-

How does the pricing for airSlate SignNow compare for users looking to manage Form E Files?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Whether you're a startup or an established enterprise, you can find a plan that allows you to efficiently manage your Form E Files without breaking the bank.

-

What features does airSlate SignNow offer for creating Form E Files?

airSlate SignNow includes a variety of features for creating Form E Files, such as customizable templates, drag-and-drop functionality, and the ability to add multiple signers. These tools streamline the document preparation process, making it quick and easy to get your Form E Files ready for signature.

-

Can I integrate airSlate SignNow with other software to manage Form E Files?

Yes, airSlate SignNow seamlessly integrates with numerous applications, including CRM systems, cloud storage services, and productivity tools. This allows you to manage your Form E Files and other documents within your existing workflows, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for Form E Files over traditional methods?

Using airSlate SignNow for Form E Files offers several benefits compared to traditional paper methods, including faster processing times, reduced costs, and enhanced security. Electronic signatures are legally recognized, making your Form E Files just as valid as those signed on paper.

-

Is it easy to track the status of Form E Files sent via airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your Form E Files. You can easily monitor when documents are sent, viewed, and signed, ensuring you stay informed throughout the signing process.

-

How secure is the signing process for Form E Files with airSlate SignNow?

The security of your Form E Files is a top priority for airSlate SignNow. The platform uses advanced encryption and secure data storage to protect your documents, ensuring that sensitive information remains confidential throughout the signing process.

Get more for Form E File

- Abstract of driving record release of intrest form

- Personal particulars form consulate general of india cgihk gov

- Lf235 04 form

- Full withdrawal of equity termination of ufacom form

- Teacher preparation program lesson plan format nevada state

- Avianca medical certificate form

- Bapplicationb for stay of enforcement alberta courts form

- Ecers 3 scoresheet aplus education form

Find out other Form E File

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template