Form 8879 C IRS E File Signature Authorization for Form 1120 2016

What is the Form 8879 C IRS E file Signature Authorization For Form 1120

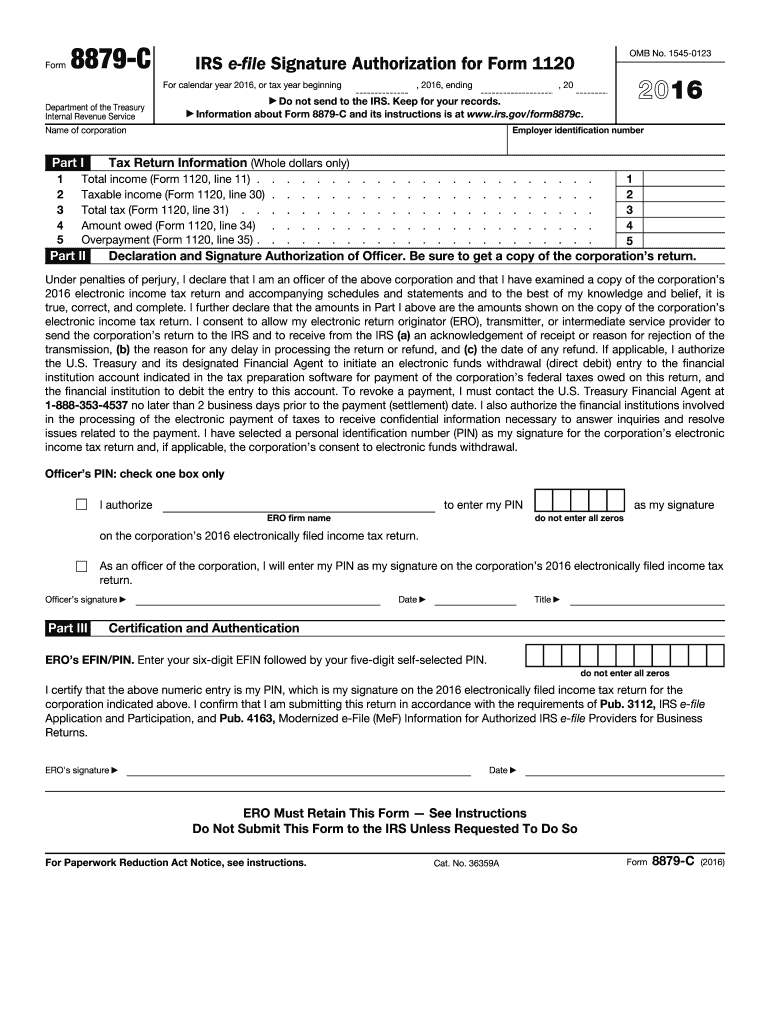

The Form 8879 C IRS E file Signature Authorization for Form 1120 is a crucial document used by corporations to authorize electronic filing of their tax returns. This form allows the taxpayer to give consent for their tax return to be submitted electronically to the IRS. By signing this form, the taxpayer affirms that the information contained in the Form 1120 is accurate and complete. The e-file signature authorization is essential for ensuring compliance with IRS regulations and streamlining the filing process.

How to use the Form 8879 C IRS E file Signature Authorization For Form 1120

Using the Form 8879 C IRS E file Signature Authorization involves several steps. First, the taxpayer must complete their Form 1120, ensuring all necessary information is accurate. Once the Form 1120 is ready, the taxpayer fills out the Form 8879 C, which includes details such as the corporation’s name, Employer Identification Number (EIN), and the signature of the authorized officer. After completing the form, the authorized officer must sign it electronically, which can be done through a secure e-signature platform. This completed form is then submitted along with the Form 1120 to the IRS for processing.

Steps to complete the Form 8879 C IRS E file Signature Authorization For Form 1120

Completing the Form 8879 C involves the following steps:

- Gather necessary information, including the corporation's name, EIN, and tax return details.

- Fill out the Form 8879 C, ensuring all fields are completed accurately.

- Have the authorized officer review the form for accuracy.

- Sign the form electronically using a secure e-signature tool.

- Submit the signed Form 8879 C along with the Form 1120 to the IRS.

Legal use of the Form 8879 C IRS E file Signature Authorization For Form 1120

The legal use of the Form 8879 C is governed by federal regulations that outline the requirements for electronic signatures. To be considered legally binding, the e-signature must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN), the Uniform Electronic Transactions Act (UETA), and other applicable laws. By using a compliant e-signature solution, businesses can ensure that their Form 8879 C is executed legally, providing the necessary authorization for the electronic submission of their tax return.

Key elements of the Form 8879 C IRS E file Signature Authorization For Form 1120

Key elements of the Form 8879 C include:

- The corporation's name and EIN, which identify the taxpayer.

- The name and title of the authorized officer who is signing the form.

- A declaration that the information provided in the Form 1120 is accurate and complete.

- The date of signature, which is essential for record-keeping and compliance.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120 and the corresponding Form 8879 C are critical for compliance. Generally, the Form 1120 is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to ensure that both forms are submitted by these deadlines to avoid penalties.

Quick guide on how to complete form 8879 c irs e file signature authorization for form 1120

Easily Prepare Form 8879 C IRS E file Signature Authorization For Form 1120 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8879 C IRS E file Signature Authorization For Form 1120 on any device using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

The Simplest Way to Modify and Electronically Sign Form 8879 C IRS E file Signature Authorization For Form 1120 Effortlessly

- Locate Form 8879 C IRS E file Signature Authorization For Form 1120 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Form 8879 C IRS E file Signature Authorization For Form 1120 to ensure effective communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8879 c irs e file signature authorization for form 1120

Create this form in 5 minutes!

How to create an eSignature for the form 8879 c irs e file signature authorization for form 1120

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is Form 8879 C IRS E file Signature Authorization For Form 1120?

Form 8879 C IRS E file Signature Authorization For Form 1120 is an important document that allows business taxpayers to electronically sign and file Form 1120. This authorization facilitates a streamlined filing process, ensuring compliance with IRS regulations while saving time. By using this form, businesses can enhance efficiency and reduce manual errors in their tax submissions.

-

How does airSlate SignNow facilitate the signing of Form 8879 C IRS E file Signature Authorization For Form 1120?

airSlate SignNow provides a user-friendly platform that simplifies the signing process for Form 8879 C IRS E file Signature Authorization For Form 1120. Users can easily upload the form, request signatures, and track the signing status in real-time. This eliminates the hassle of paper forms and speeds up the filing process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses, including options for individual users and teams. Each plan provides access to essential features, including eSignature capabilities for Form 8879 C IRS E file Signature Authorization For Form 1120. Competitive pricing ensures you get the most value out of your electronic signing solution.

-

Can I integrate airSlate SignNow with other software for filing Form 8879 C IRS E file Signature Authorization For Form 1120?

Yes, airSlate SignNow seamlessly integrates with a variety of business applications and accounting software, enhancing workflows related to Form 8879 C IRS E file Signature Authorization For Form 1120. These integrations allow for easy data transfer and document management, making it a powerful tool for businesses to streamline their tax filing processes.

-

What are the benefits of using airSlate SignNow for eSigning tax forms?

Using airSlate SignNow for eSigning tax forms like Form 8879 C IRS E file Signature Authorization For Form 1120 offers numerous advantages, including enhanced security, efficiency, and cost savings. The platform ensures that your documents are securely signed and stored, reducing the risk of fraud while expediting the filing process. This efficiency can lead to improved compliance and timely tax submissions.

-

Is airSlate SignNow compliant with IRS regulations for Form 8879 C?

Yes, airSlate SignNow is fully compliant with IRS regulations for electronic signatures, including those required for Form 8879 C IRS E file Signature Authorization For Form 1120. The platform adheres to the guidelines set forth by the IRS, ensuring that your eSigned documents are legally valid and accepted for electronic filing. This compliance provides peace of mind for businesses during tax season.

-

How secure is airSlate SignNow when handling Form 8879 C IRS E file Signature Authorization For Form 1120?

airSlate SignNow employs advanced security measures to protect sensitive documents, including Form 8879 C IRS E file Signature Authorization For Form 1120. The platform uses encryption, secure access controls, and robust authentication methods to safeguard your data against unauthorized access. This dedication to security ensures that your tax documents remain confidential and secure.

Get more for Form 8879 C IRS E file Signature Authorization For Form 1120

Find out other Form 8879 C IRS E file Signature Authorization For Form 1120

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online