Form 8879 C IRS E File Signature Authorization for Form 1120 2020

Understanding the IRS Form 8879 E-File Signature Authorization

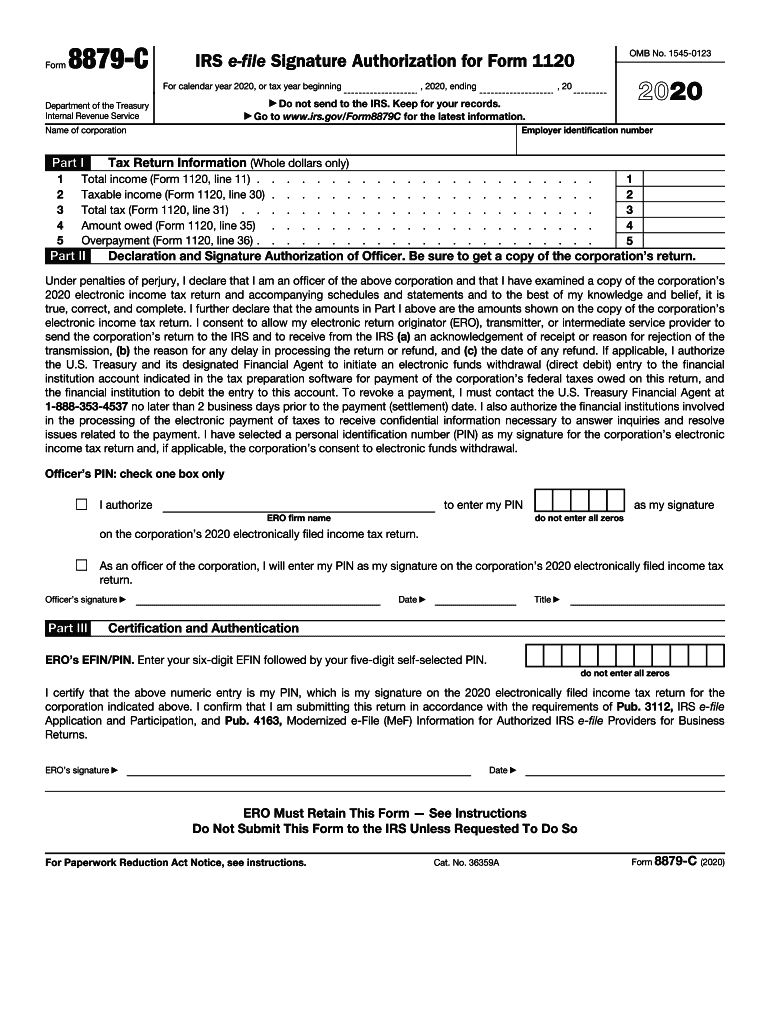

The IRS Form 8879 E-File Signature Authorization is a crucial document for taxpayers and tax professionals. This form authorizes an electronic return originator (ERO) to file your tax return electronically. It serves as a declaration that the taxpayer has reviewed the return and consents to its electronic submission. The form is particularly relevant for those filing Form 1120, as it streamlines the e-filing process while ensuring compliance with IRS regulations.

Steps to Complete the IRS Form 8879 E-File Signature Authorization

Completing the IRS Form 8879 E-File Signature Authorization involves several key steps:

- Gather necessary information, including your tax identification number and details from your tax return.

- Review the completed tax return to ensure accuracy before signing the form.

- Provide your electronic signature, which can be done using a secure e-signature solution.

- Submit the form to your ERO, who will then file your tax return electronically.

Following these steps helps ensure that your submission is both accurate and compliant with IRS requirements.

Legal Use of the IRS Form 8879 E-File Signature Authorization

The IRS Form 8879 E-File Signature Authorization is legally binding when completed correctly. It must meet specific requirements set forth by the IRS, including proper electronic signatures and consent from the taxpayer. Utilizing a compliant e-signature platform enhances the legal standing of the form, ensuring that it meets the standards of the ESIGN Act and UETA. This legal framework supports the validity of electronic signatures in the United States, making them equivalent to traditional handwritten signatures.

IRS Guidelines for the Form 8879 E-File Signature Authorization

The IRS provides specific guidelines for completing the Form 8879 E-File Signature Authorization. Taxpayers should ensure that:

- The form is completed accurately and fully before submission.

- All required fields are filled out, including the taxpayer's name, address, and Social Security number.

- The form is signed by the taxpayer prior to the electronic filing of the tax return.

Adhering to these guidelines helps prevent delays or issues with your tax return submission.

Filing Deadlines for the IRS Form 8879 E-File Signature Authorization

Filing deadlines for the IRS Form 8879 E-File Signature Authorization align with the deadlines for submitting your tax return. Typically, for individuals, the due date is April 15, while corporations may have different deadlines based on their fiscal year. It is essential to complete and submit the form in a timely manner to avoid penalties and ensure that your tax return is filed on schedule.

Examples of Using the IRS Form 8879 E-File Signature Authorization

There are various scenarios in which the IRS Form 8879 E-File Signature Authorization is utilized:

- A small business owner filing Form 1120 for their corporation.

- An individual taxpayer who uses a tax professional to file their returns electronically.

- A partnership that requires authorization from all partners to e-file their tax return.

These examples illustrate the form's versatility and its importance in the electronic filing process.

Quick guide on how to complete 2020 form 8879 c irs e file signature authorization for form 1120

Effortlessly Prepare Form 8879 C IRS E file Signature Authorization For Form 1120 on Any Device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you need to create, amend, and eSign your documents quickly and without interruptions. Handle Form 8879 C IRS E file Signature Authorization For Form 1120 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Alter and eSign Form 8879 C IRS E file Signature Authorization For Form 1120 with Ease

- Obtain Form 8879 C IRS E file Signature Authorization For Form 1120 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark essential sections of your documents or obscure confidential information with the tools that airSlate SignNow specifically provides for such tasks.

- Produce your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your edits.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8879 C IRS E file Signature Authorization For Form 1120 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8879 c irs e file signature authorization for form 1120

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8879 c irs e file signature authorization for form 1120

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is an IRS Form 8879 e file signature authorization?

The IRS Form 8879 e file signature authorization is a document used to authorize e-filing of tax returns. It allows taxpayers to give consent to their tax preparers to electronically submit their returns to the IRS. Understanding how to use this form is essential for efficient tax filing.

-

How can airSlate SignNow help with IRS Form 8879 e file signature authorization?

airSlate SignNow provides a secure and user-friendly platform for obtaining e-signatures on the IRS Form 8879 e file signature authorization. This eliminates the need for paper documents and simplifies the workflow for both tax preparers and clients. With our solution, you can efficiently collect signatures and streamline your e-filing process.

-

Is airSlate SignNow cost-effective for managing IRS Form 8879 e file signature authorization?

Yes, airSlate SignNow offers a cost-effective solution for managing IRS Form 8879 e file signature authorization. With various pricing plans tailored to fit different business needs, you can choose the most suitable option without compromising on features. This affordability makes it accessible for all types of businesses.

-

What features does airSlate SignNow offer for IRS Form 8879 e file signature authorization?

airSlate SignNow offers features such as customizable templates, secure storage, and advanced encryption, which are essential for managing IRS Form 8879 e file signature authorization. Additionally, users can track document status in real-time and receive notifications when signatures are completed. These features enhance the overall user experience and compliance.

-

Can I integrate airSlate SignNow with other tools for IRS Form 8879 e file signature authorization?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows you to manage IRS Form 8879 e file signature authorization within your existing workflows. The integration capabilities enhance productivity and ensure that your documents are managed efficiently.

-

What are the benefits of using airSlate SignNow for IRS Form 8879 e file signature authorization?

Using airSlate SignNow for IRS Form 8879 e file signature authorization offers numerous benefits, including increased efficiency, reduced paperwork, and improved security. The ability to sign documents electronically saves time for both tax preparers and clients. Additionally, our secure platform ensures that sensitive information remains protected.

-

How does airSlate SignNow ensure the security of IRS Form 8879 e file signature authorization?

airSlate SignNow prioritizes security by utilizing advanced encryption methods and secure access controls for IRS Form 8879 e file signature authorization. All documents are stored in a safe environment compliant with industry standards. This commitment to security provides peace of mind for users concerned about the safety of their tax documents.

Get more for Form 8879 C IRS E file Signature Authorization For Form 1120

- Washington assets form

- Essential documents for the organized traveler package washington form

- Essential documents for the organized traveler package with personal organizer washington form

- Postnuptial agreements package washington form

- Letters of recommendation package washington form

- Washington construction or mechanics lien package individual washington form

- Washington construction or mechanics lien package corporation or llc washington form

- Storage business package washington form

Find out other Form 8879 C IRS E file Signature Authorization For Form 1120

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF