Www Irs Govforms Pubsabout Form 8879 CAbout Form 8879 C, IRS E File Signature Authorization for 2021-2026

Understanding IRS Form 8879-C: E-File Signature Authorization

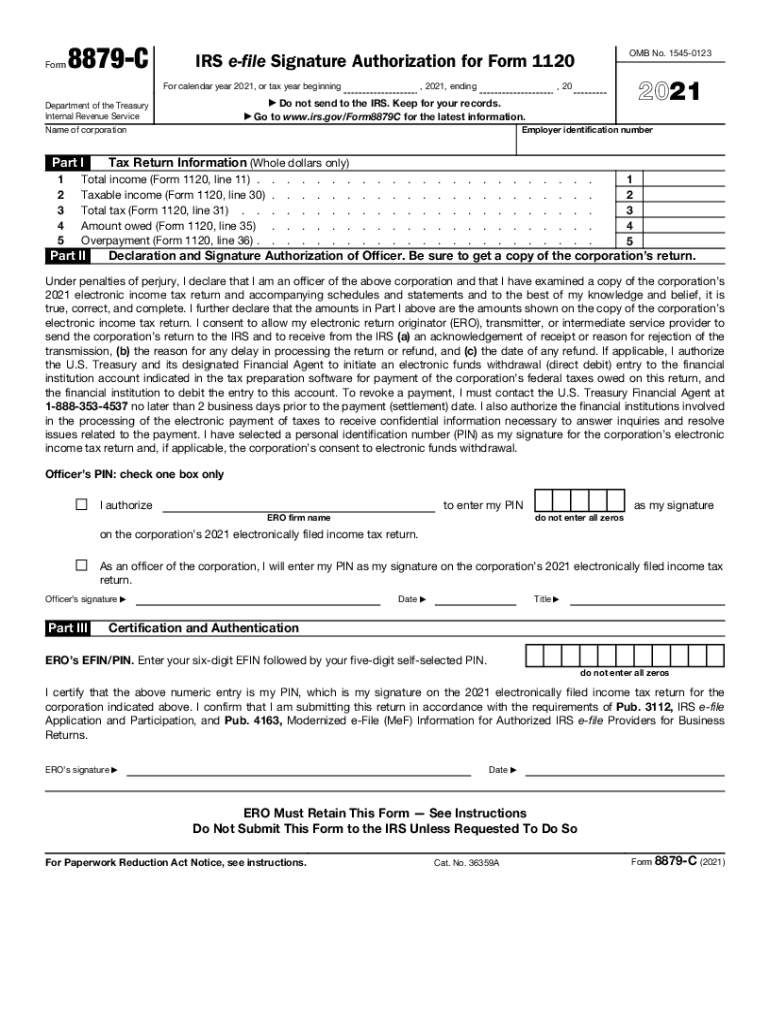

IRS Form 8879-C, known as the E-File Signature Authorization for corporations, is a crucial document that allows corporate taxpayers to authorize an electronic return. This form is essential for ensuring that the IRS can process e-filed returns securely and efficiently. By signing this form, the corporate officer confirms that the information provided in the electronic tax return is accurate and complete. This authorization is necessary for the submission of various corporate tax forms, including the 1120 series.

Steps to Complete IRS Form 8879-C

Completing IRS Form 8879-C involves several straightforward steps. First, ensure that all relevant information is gathered, including the corporation's name, address, and Employer Identification Number (EIN). Next, the corporate officer must review the electronic return for accuracy. Once verified, the officer can sign the form electronically, which will then be submitted alongside the e-filed return. It is important to retain a copy of the signed form for your records, as it serves as proof of authorization.

Legal Use of IRS Form 8879-C

The legal use of IRS Form 8879-C is governed by federal regulations that ensure the authenticity and integrity of electronically filed returns. By signing this form, the corporate officer affirms that they have the authority to act on behalf of the corporation. This form complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), which recognize electronic signatures as legally binding. Proper use of this form helps prevent fraud and ensures compliance with IRS regulations.

Filing Deadlines for IRS Form 8879-C

Filing deadlines for IRS Form 8879-C align with the deadlines for the corporate tax return it authorizes. Generally, corporations must file their tax returns by the 15th day of the fourth month after the end of their tax year. For calendar year corporations, this typically means April 15. If an extension is filed, the deadline for submitting the form and the corresponding return may be extended. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Required Documents for IRS Form 8879-C

To complete IRS Form 8879-C, several documents are typically required. These include the corporation's electronic tax return, which contains all necessary financial information, and any supporting documentation that verifies the accuracy of the information provided. Additionally, the corporate officer must have access to the corporation's EIN and other identifying details. Ensuring that all required documents are in order will facilitate a smooth filing process.

IRS Guidelines for E-File Signature Authorization

The IRS provides specific guidelines for the use of Form 8879-C to ensure compliance with e-filing regulations. These guidelines outline the responsibilities of both the taxpayer and the e-file provider. Taxpayers must ensure that the electronic return is accurate and complete before signing the form. E-file providers must maintain security measures to protect the integrity of the e-filing process. Familiarizing oneself with these guidelines is essential for a successful e-filing experience.

Quick guide on how to complete wwwirsgovforms pubsabout form 8879 cabout form 8879 c irs e file signature authorization for

Prepare Www irs govforms pubsabout form 8879 cAbout Form 8879 C, IRS E file Signature Authorization For effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the capabilities needed to create, amend, and eSign your documents swiftly and without delays. Manage Www irs govforms pubsabout form 8879 cAbout Form 8879 C, IRS E file Signature Authorization For on any device using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to modify and eSign Www irs govforms pubsabout form 8879 cAbout Form 8879 C, IRS E file Signature Authorization For with ease

- Find Www irs govforms pubsabout form 8879 cAbout Form 8879 C, IRS E file Signature Authorization For and click on Get Form to begin.

- Make use of the instruments we offer to complete your document.

- Emphasize pertinent sections of the documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Www irs govforms pubsabout form 8879 cAbout Form 8879 C, IRS E file Signature Authorization For and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovforms pubsabout form 8879 cabout form 8879 c irs e file signature authorization for

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovforms pubsabout form 8879 cabout form 8879 c irs e file signature authorization for

The way to generate an e-signature for your PDF document in the online mode

The way to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is IRS e-file signature authorization?

IRS e-file signature authorization is a process that allows taxpayers to electronically sign and submit their tax returns using an eSignature. This method simplifies the filing process and ensures that your submissions are secure and compliant with IRS regulations.

-

How does airSlate SignNow facilitate IRS e-file signature authorization?

airSlate SignNow provides an intuitive platform for businesses to electronically sign documents, including IRS e-file signature authorization forms. With our easy-to-use features, you can streamline the signing process and ensure that your tax documents are filed quickly and securely.

-

What are the pricing options for airSlate SignNow related to IRS e-file signature authorization?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those requiring IRS e-file signature authorization. Our competitive pricing ensures that you only pay for the features you need, making it a cost-effective solution for eSigning documents.

-

Are there any benefits of using airSlate SignNow for IRS e-file signature authorization?

Using airSlate SignNow for IRS e-file signature authorization provides numerous benefits, including faster processing times and enhanced document security. You can easily track your signatures and keep your workflows organized, reducing the potential for errors in your tax filings.

-

Can airSlate SignNow integrate with other tax software for IRS e-file signature authorization?

Yes, airSlate SignNow integrates seamlessly with various tax software solutions to streamline the IRS e-file signature authorization process. This integration allows users to easily access, sign, and submit their tax documents directly from their preferred software.

-

Is airSlate SignNow compliant with IRS regulations for e-signatures?

Absolutely! airSlate SignNow is fully compliant with IRS regulations regarding e-signatures, particularly for IRS e-file signature authorization. Our platform ensures that all documents signed electronically meet the necessary legal requirements to be considered valid.

-

How secure is the airSlate SignNow platform for IRS e-file signature authorization?

The airSlate SignNow platform employs advanced security measures, including end-to-end encryption and secure cloud storage. This ensures that your IRS e-file signature authorization processes are protected from unauthorized access, keeping your sensitive information safe.

Get more for Www irs govforms pubsabout form 8879 cAbout Form 8879 C, IRS E file Signature Authorization For

- Certificate change name 497304049 form

- Georgia name change online form

- Ga consent form

- Georgia unsecured installment payment promissory note for fixed rate georgia form

- Georgia note form

- Georgia installments fixed rate promissory note secured by personal property georgia form

- Ga promissory note form

- Notice of option for recording georgia form

Find out other Www irs govforms pubsabout form 8879 cAbout Form 8879 C, IRS E file Signature Authorization For

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe