Form 1040 V Irs 2024

What is the Form 1040 V Irs

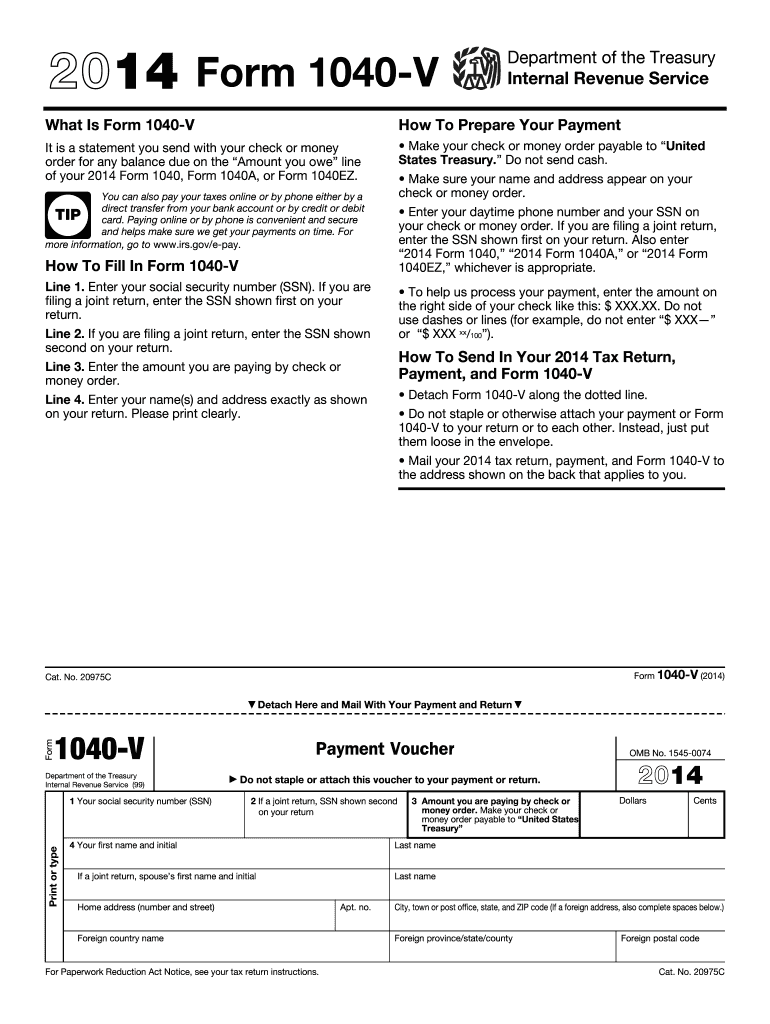

The Form 1040 V is a payment voucher used by taxpayers in the United States when submitting their federal income tax payments to the Internal Revenue Service (IRS). This form is particularly useful for individuals who are making payments that are not included with their tax returns. By using Form 1040 V, taxpayers can ensure that their payments are properly credited to their accounts, helping to avoid any potential issues with payment processing.

How to use the Form 1040 V Irs

To effectively use Form 1040 V, taxpayers should follow a few straightforward steps. First, fill out the form with the required information, including your name, address, and Social Security number. Next, indicate the amount of the payment you are submitting. After completing the form, attach it to your payment and send it to the appropriate IRS address. This ensures that the IRS can accurately apply your payment to your tax account.

Steps to complete the Form 1040 V Irs

Completing Form 1040 V involves several key steps:

- Begin by downloading the form from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Clearly write the payment amount you are submitting.

- Review the form for accuracy to prevent any delays in processing.

- Attach your payment, such as a check or money order, made out to the "United States Treasury."

- Mail the completed form and payment to the designated IRS address based on your location.

Legal use of the Form 1040 V Irs

Form 1040 V is legally recognized by the IRS as a valid method for submitting tax payments. Taxpayers are encouraged to use this form to ensure that their payments are processed correctly and to maintain compliance with federal tax regulations. Using the form helps to document the payment process, providing a clear record for both the taxpayer and the IRS.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with Form 1040 V. Generally, payments should be made by the tax filing deadline, which is typically April fifteenth for most individuals. If this date falls on a weekend or holiday, the deadline may be extended. Timely submission of Form 1040 V along with payments helps avoid penalties and interest charges from the IRS.

Form Submission Methods (Online / Mail / In-Person)

Form 1040 V can be submitted through various methods, depending on the taxpayer's preference. The most common method is mailing the form along with the payment to the IRS. However, taxpayers can also choose to make payments electronically through the IRS website, which may not require the use of Form 1040 V. In-person submissions are less common but can be made at designated IRS offices if necessary.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 v irs

Create this form in 5 minutes!

How to create an eSignature for the form 1040 v irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 V Irs and why do I need it?

Form 1040 V Irs is a payment voucher used when submitting your federal income tax return. It helps ensure that your payment is properly credited to your account. Using airSlate SignNow, you can easily eSign and send this form securely, streamlining your tax filing process.

-

How can airSlate SignNow help me with Form 1040 V Irs?

airSlate SignNow allows you to electronically sign and send Form 1040 V Irs quickly and securely. Our platform simplifies the process, ensuring that your documents are legally binding and easily accessible. This saves you time and reduces the risk of errors in your tax submissions.

-

Is there a cost associated with using airSlate SignNow for Form 1040 V Irs?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solutions provide you with the tools necessary to manage Form 1040 V Irs and other documents efficiently. You can choose a plan that fits your budget while enjoying all the features we offer.

-

What features does airSlate SignNow offer for managing Form 1040 V Irs?

airSlate SignNow provides features such as eSigning, document templates, and secure cloud storage for Form 1040 V Irs. You can also track the status of your documents in real-time, ensuring that you never miss a deadline. These features enhance your productivity and simplify your tax filing process.

-

Can I integrate airSlate SignNow with other applications for Form 1040 V Irs?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage Form 1040 V Irs alongside your other business tools. This seamless integration helps streamline your workflow and ensures that all your documents are in one place.

-

How secure is airSlate SignNow when handling Form 1040 V Irs?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your data when handling Form 1040 V Irs. You can trust that your sensitive information is safe and compliant with industry standards.

-

What are the benefits of using airSlate SignNow for Form 1040 V Irs?

Using airSlate SignNow for Form 1040 V Irs offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the signing process, allowing you to focus on other important tasks. Additionally, our customer support team is always available to assist you.

Get more for Form 1040 V Irs

- Dol id form

- Uniform washington state tow impound 334015694

- Form 6017 oregon department of transportation odot state or

- Stock vehicle donation form cars for charity

- Oregon dmv forms 634801394

- Oregon department of transportation accident reporting and form

- Pdf estimating the united states population at risk from form

- Generalliabilityinsure combusiness directoryflclewiston city building department in clewiston fl form

Find out other Form 1040 V Irs

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe