California E File Return Authorization for Corporations Form 8453 C California E File Return Authorization for Corpor 2019

What is the California E-file Return Authorization for Corporations Form 8453 C?

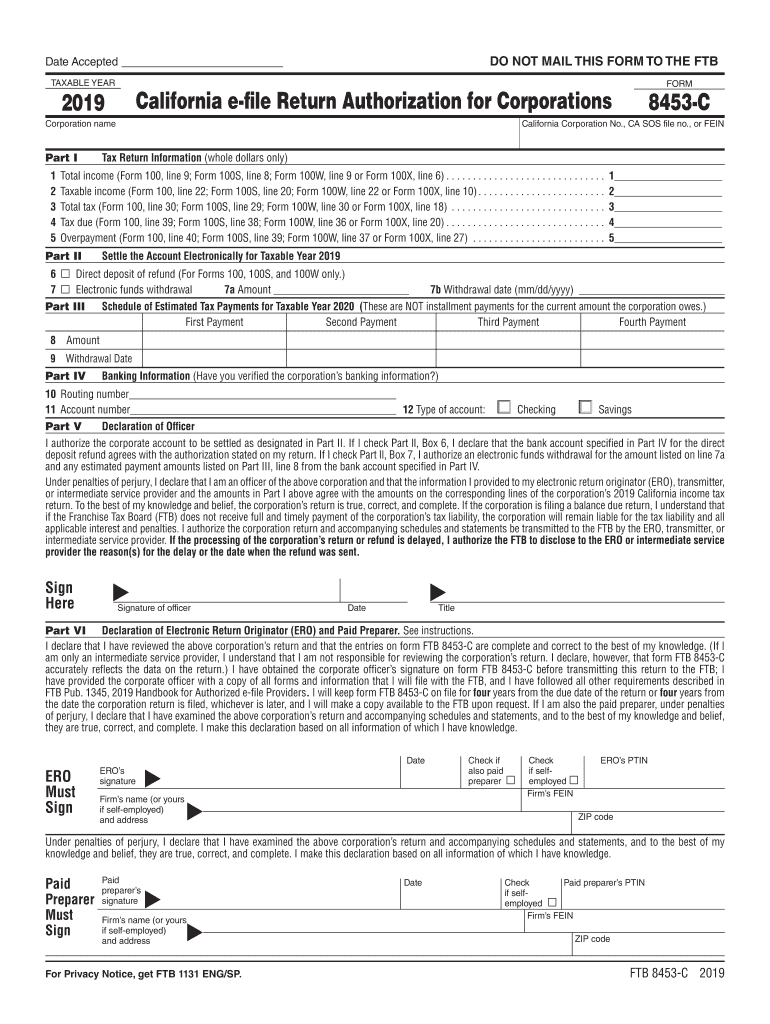

The California E-file Return Authorization for Corporations Form 8453 C is a crucial document used by corporations filing their tax returns electronically. This form serves as an authorization for the electronic submission of the corporation's tax return to the California Franchise Tax Board (FTB). It is essential for ensuring that the tax return is filed correctly and that the corporation has granted permission for the electronic filing process.

This form is specifically designed for use by corporations, including S corporations, and is part of the California tax filing requirements. By completing and submitting Form 8453 C, corporations can streamline their filing process while maintaining compliance with state regulations.

Steps to Complete the California E-file Return Authorization for Corporations Form 8453 C

Completing the California E-file Return Authorization for Corporations Form 8453 C involves several important steps:

- Download the Form: Obtain the latest version of Form 8453 C from the California Franchise Tax Board website or through authorized tax software.

- Fill in the Corporation Information: Enter the corporation's name, address, and federal employer identification number (FEIN).

- Provide Tax Return Details: Indicate the tax year and type of return being filed, ensuring accuracy to avoid delays.

- Sign the Form: An authorized officer of the corporation must sign and date the form, affirming that the information provided is accurate.

- Submit the Form: Follow the instructions for submitting the form electronically alongside the tax return, ensuring compliance with submission guidelines.

Key Elements of the California E-file Return Authorization for Corporations Form 8453 C

Understanding the key elements of Form 8453 C is essential for proper completion and submission. The form includes:

- Corporation Identification: Essential details such as the corporation's name, address, and FEIN.

- Tax Year: The specific year for which the tax return is being filed.

- Authorized Signature: A signature from an authorized corporate officer, indicating consent for electronic filing.

- Declaration: A statement affirming that the information provided is true and complete.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with Form 8453 C to avoid penalties. The general deadline for filing corporate tax returns in California is the 15th day of the third month following the close of the corporation's fiscal year. For most corporations operating on a calendar year, this means the due date is March 15. However, if the deadline falls on a weekend or holiday, the due date may be extended to the next business day. It is crucial to check for any specific extensions or changes in deadlines each tax year.

Penalties for Non-Compliance

Failure to properly file Form 8453 C can result in significant penalties for corporations. Non-compliance may lead to:

- Late Filing Penalties: Corporations may incur penalties for failing to file their tax returns by the due date.

- Interest Charges: Unpaid taxes may accrue interest, increasing the total amount owed.

- Legal Consequences: Persistent non-compliance can lead to further legal actions by the California Franchise Tax Board.

To avoid these penalties, it is essential for corporations to ensure timely and accurate filing of Form 8453 C along with their tax returns.

Quick guide on how to complete 2019 california e file return authorization for corporations form 8453 c 2019 california e file return authorization for

Complete California E file Return Authorization For Corporations Form 8453 C California E file Return Authorization For Corpor effortlessly on any device

Web-based document management has gained immense popularity among companies and individuals. It serves as a perfect environmentally-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage California E file Return Authorization For Corporations Form 8453 C California E file Return Authorization For Corpor on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign California E file Return Authorization For Corporations Form 8453 C California E file Return Authorization For Corpor with ease

- Obtain California E file Return Authorization For Corporations Form 8453 C California E file Return Authorization For Corpor and click Get Form to begin.

- Make use of the tools we offer to finish your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specially designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method for sending your form, either via email, SMS, an invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Alter and eSign California E file Return Authorization For Corporations Form 8453 C California E file Return Authorization For Corpor and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 california e file return authorization for corporations form 8453 c 2019 california e file return authorization for

Create this form in 5 minutes!

How to create an eSignature for the 2019 california e file return authorization for corporations form 8453 c 2019 california e file return authorization for

How to create an electronic signature for the 2019 California E File Return Authorization For Corporations Form 8453 C 2019 California E File Return Authorization For in the online mode

How to create an eSignature for your 2019 California E File Return Authorization For Corporations Form 8453 C 2019 California E File Return Authorization For in Google Chrome

How to create an electronic signature for putting it on the 2019 California E File Return Authorization For Corporations Form 8453 C 2019 California E File Return Authorization For in Gmail

How to make an eSignature for the 2019 California E File Return Authorization For Corporations Form 8453 C 2019 California E File Return Authorization For straight from your smart phone

How to generate an eSignature for the 2019 California E File Return Authorization For Corporations Form 8453 C 2019 California E File Return Authorization For on iOS

How to create an electronic signature for the 2019 California E File Return Authorization For Corporations Form 8453 C 2019 California E File Return Authorization For on Android devices

People also ask

-

What is the form 8453 OL California?

The form 8453 OL California is a declaration for electronic filing of your California tax return. It allows you to submit your tax documents electronically while confirming that you've reviewed and approved the submission. Understanding this form is crucial for ensuring compliance with California tax regulations.

-

How can airSlate SignNow help with the form 8453 OL California?

airSlate SignNow simplifies the process of managing the form 8453 OL California by allowing you to electronically sign and send the document seamlessly. With our platform, you can ensure that your form is securely handled and that you remain compliant with California's electronic filing requirements. Save time and effort with our user-friendly interface.

-

What features does airSlate SignNow offer for processing form 8453 OL California?

airSlate SignNow provides features like eSignature, document templates, and secure storage, all tailored for processing the form 8453 OL California. These tools ensure that your form is filled out correctly and signed, reducing the likelihood of errors. Our platform makes managing your documents efficient and straightforward.

-

Is airSlate SignNow cost-effective for electronically filing form 8453 OL California?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to electronically file the form 8453 OL California. With competitive pricing and flexible plans, you can choose an option that best fits your budget and needs. You benefit from professional-grade features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for form 8453 OL California?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your experience while handling the form 8453 OL California. This means you can connect with popular software to streamline your workflows and keep all your documents organized in one place.

-

What benefits can I expect from using airSlate SignNow for form 8453 OL California?

Using airSlate SignNow for the form 8453 OL California provides numerous benefits such as enhanced efficiency, increased security, and a better user experience. Our platform allows for quick signing and processing, reducing turnaround time on your filings. Experience hassle-free document management and superior customer support.

-

Is airSlate SignNow suitable for both individuals and businesses handling form 8453 OL California?

Yes, airSlate SignNow is designed to meet the needs of both individuals and businesses dealing with form 8453 OL California. Our platform caters to various user requirements, whether you are an independent contractor or a large organization. Everyone can take advantage of our flexible and efficient eSigning solution.

Get more for California E file Return Authorization For Corporations Form 8453 C California E file Return Authorization For Corpor

Find out other California E file Return Authorization For Corporations Form 8453 C California E file Return Authorization For Corpor

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form