8453 Ol 2022-2025 Form

What is the California E-file Return Authorization for Corporations Form 8453 C

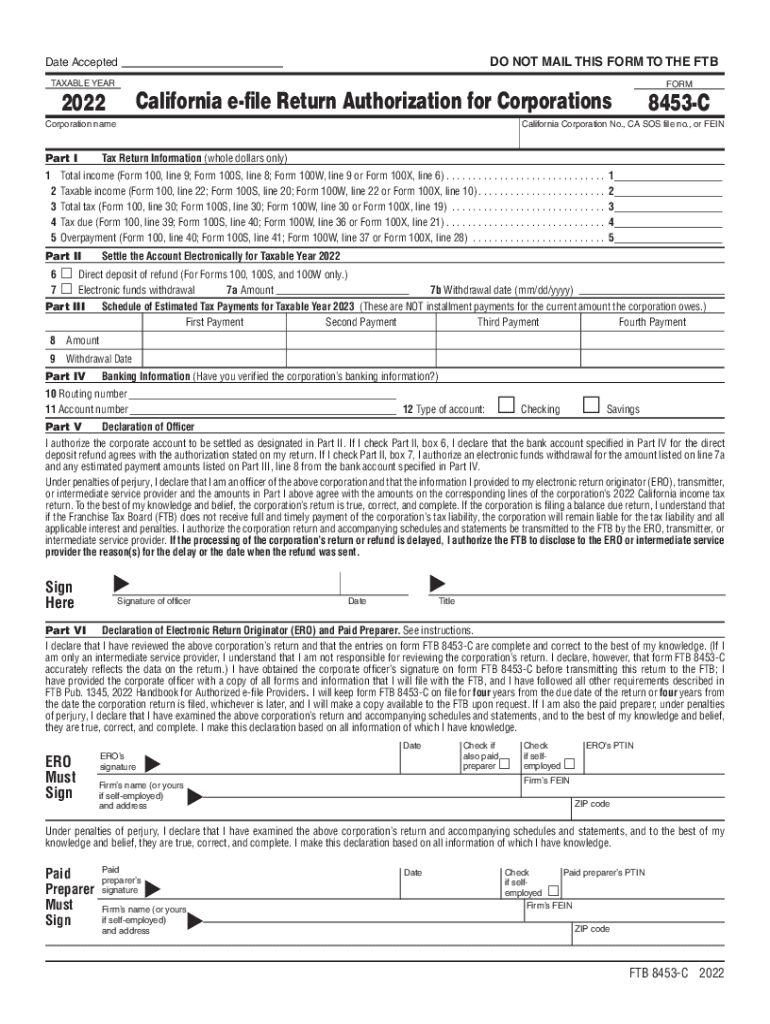

The California E-file Return Authorization for Corporations Form 8453 C serves as a crucial document for corporations filing their tax returns electronically. This form authorizes the electronic submission of a corporation's tax return to the California Franchise Tax Board (FTB). By signing this form, corporations confirm that they have reviewed the return and that it is accurate and complete. It is important for compliance with state tax regulations, ensuring that the electronic filing process is legitimate and recognized by the FTB.

Steps to Complete the California E-file Return Authorization for Corporations Form 8453 C

Completing the California Form 8453 C involves several key steps:

- Gather Required Information: Collect all necessary details, including the corporation's name, address, and tax identification number.

- Review the Tax Return: Ensure that the tax return being filed electronically is accurate and complete before signing the authorization.

- Complete the Form: Fill out the Form 8453 C with the required information, including the signatures of authorized representatives.

- Submit the Form: Follow the specified submission methods to send the form to the FTB along with the electronic tax return.

Legal Use of the California E-file Return Authorization for Corporations Form 8453 C

The legal use of the California Form 8453 C is governed by state tax laws. This form must be signed by an authorized representative of the corporation to be valid. The electronic submission of tax returns, accompanied by this authorization, is considered legally binding as long as it complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. This ensures that the electronically filed documents hold the same legal weight as traditional paper filings.

Key Elements of the California E-file Return Authorization for Corporations Form 8453 C

Several key elements must be included in the Form 8453 C to ensure its validity:

- Corporation Information: Name, address, and tax identification number of the corporation.

- Tax Return Details: Information regarding the specific tax return being authorized for electronic filing.

- Signatures: Signatures of the authorized representatives of the corporation, affirming the accuracy of the return.

- Date of Signature: The date when the form is signed, which is crucial for compliance and record-keeping.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 8453 C align with the due dates for corporate tax returns. Typically, corporations must submit their tax returns by the 15th day of the fourth month after the end of their fiscal year. For most corporations operating on a calendar year, this means the deadline is April 15. It is essential to stay informed about any changes to these deadlines, as extensions or specific circumstances may affect filing dates.

Form Submission Methods

The California Form 8453 C can be submitted through various methods:

- Electronic Submission: The preferred method, where the form is submitted alongside the electronic tax return through authorized e-file providers.

- Mail: In certain cases, the form may be mailed to the FTB, though electronic submission is encouraged for efficiency.

- In-Person: Corporations may also deliver the form in person at designated FTB offices, ensuring immediate processing.

Quick guide on how to complete california 8453 ol

Easily Prepare california 8453 ol on Any Device

Online document management has become increasingly popular among enterprises and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the correct forms and securely store them online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly without any delays. Handle 8453 ol form on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centered process today.

The Simplest Way to Edit and eSign return authorization corporations Effortlessly

- Locate california 8453 c form and click on Get Form to commence.

- Use the tools we offer to fill out your document.

- Mark relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign california return authorization while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca form 8453 ol

Related searches to california 8453 c

Create this form in 5 minutes!

How to create an eSignature for the form 8453 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask ca 8453

-

What is the CA Form 8453 OL and how does it work?

The CA Form 8453 OL is an electronic signature form that allows taxpayers to e-file their California tax returns securely. With airSlate SignNow, you can easily fill out and sign this form digitally, streamlining the submission process.

-

Is there a cost associated with using airSlate SignNow for CA Form 8453 OL?

Yes, airSlate SignNow offers several pricing plans designed to fit various business needs. All plans include access to essential features for managing CA Form 8453 OL and more, ensuring an economical choice for document signing.

-

What features does airSlate SignNow provide for CA Form 8453 OL?

airSlate SignNow provides a variety of features for the CA Form 8453 OL, including secure document storage, customizable signing workflows, and real-time tracking. These tools enhance the efficiency of handling your tax forms.

-

Can I integrate airSlate SignNow with other applications for CA Form 8453 OL?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and Dropbox. This flexibility makes it easier to manage your CA Form 8453 OL alongside other essential tools.

-

How do I ensure the security of my CA Form 8453 OL when using airSlate SignNow?

airSlate SignNow employs advanced encryption protocols to safeguard your CA Form 8453 OL and other documents. Additionally, our platform complies with industry standards to ensure your information remains secure and confidential.

-

Can I access my CA Form 8453 OL from any device?

Yes, airSlate SignNow is a cloud-based solution, allowing you to access your CA Form 8453 OL from any device with an internet connection. This feature enables you to manage your documents on the go without any hassle.

-

What are the benefits of using airSlate SignNow for CA Form 8453 OL?

Using airSlate SignNow for CA Form 8453 OL offers several benefits, including faster processing times, improved accuracy, and reduced paperwork. Plus, the user-friendly interface makes the signing process quick and convenient.

Get more for ca 8453 c

Find out other 8453c form

- eSign New Jersey Accounting Services Proposal Mobile

- How Can I eSign New Hampshire Accounting Services Proposal

- Can I eSign Michigan VAT Invoice

- eSign New Jersey Accounting Services Proposal Now

- eSign New Jersey Accounting Services Proposal Later

- eSign New Jersey Accounting Services Proposal Myself

- eSign New Jersey Accounting Services Proposal Free

- Can I eSign New Hampshire Accounting Services Proposal

- eSign New Jersey Accounting Services Proposal Secure

- eSign New Jersey Accounting Services Proposal Fast

- eSign New Jersey Accounting Services Proposal Simple

- eSign New Jersey Accounting Services Proposal Easy

- eSign Wyoming Codicil to Will Online

- eSign New Jersey Accounting Services Proposal Safe

- eSign Wyoming Codicil to Will Computer

- eSign New Mexico Accounting Services Proposal Online

- eSign Wyoming Codicil to Will Mobile

- eSign New Mexico Accounting Services Proposal Computer

- eSign New Mexico Accounting Services Proposal Mobile

- How To eSign New Jersey Accounting Services Proposal