Form 122a 2015

What is the Form 122a

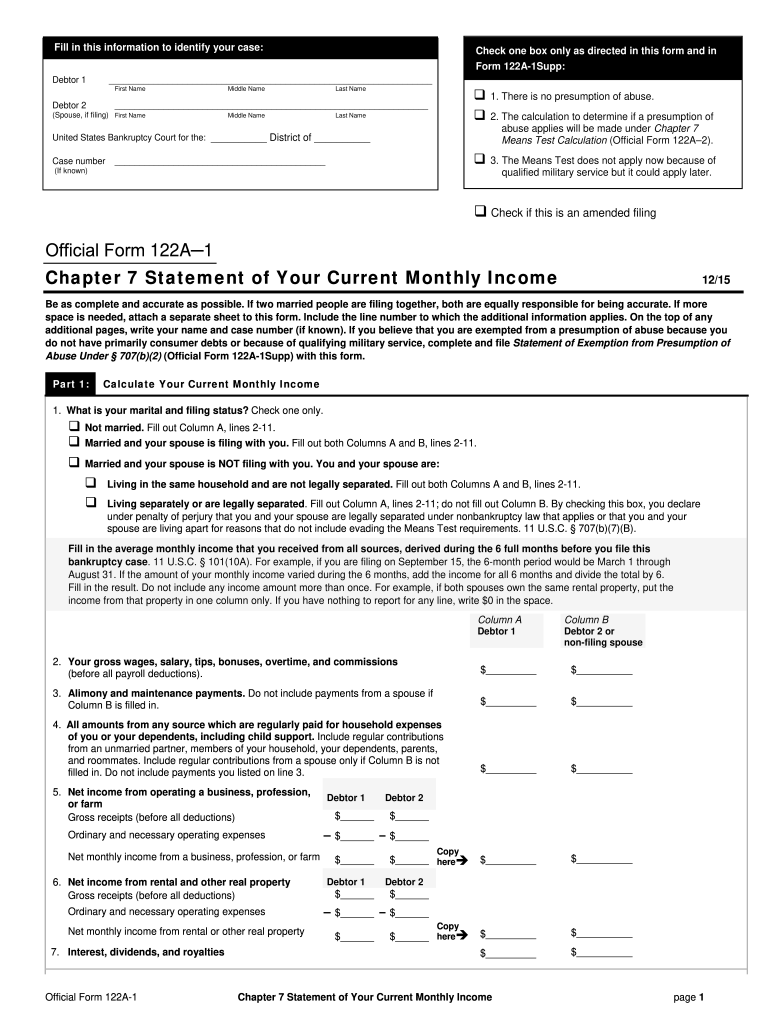

The Form 122a, often referred to as the official form 122a, is a legal document used in bankruptcy proceedings. Specifically, it is utilized to report a debtor's monthly income and expenses as part of a Chapter 7 bankruptcy filing. This form is essential for determining eligibility for bankruptcy relief under Chapter 7, which allows individuals to discharge certain debts and start afresh financially. The information provided in the 122a is crucial for the court to assess the debtor's financial situation and make informed decisions regarding the bankruptcy case.

Steps to complete the Form 122a

Completing the Form 122a involves several key steps to ensure accuracy and compliance with legal requirements. Begin by gathering all necessary financial documents, including pay stubs, bank statements, and tax returns. Next, follow these steps:

- Fill out personal information: Include your name, address, and case number at the top of the form.

- Report monthly income: List all sources of income, such as wages, bonuses, and other earnings, ensuring to provide accurate figures for the last six months.

- Detail monthly expenses: Include necessary living expenses like housing, utilities, food, and transportation. Be thorough to reflect your actual financial situation.

- Calculate the total: Sum up your monthly income and expenses to determine your financial standing.

- Sign and date: Ensure you sign the form, verifying that all information is complete and accurate.

Legal use of the Form 122a

The legal use of the Form 122a is paramount in bankruptcy proceedings. It serves as a formal declaration of a debtor's financial status, which the court reviews to determine eligibility for Chapter 7 bankruptcy. To be legally valid, the form must be filled out accurately and submitted within the required timeframe. Additionally, the information disclosed must comply with federal bankruptcy laws and regulations, ensuring that all financial data is truthful and complete. Misrepresentation on the form can lead to serious legal consequences, including dismissal of the bankruptcy case.

How to obtain the Form 122a

The Form 122a can be obtained through various channels to ensure accessibility for individuals filing for bankruptcy. It is available on the official U.S. Courts website, where individuals can download and print the form directly. Additionally, bankruptcy attorneys often provide this form to their clients as part of the filing process. Local bankruptcy courts may also have copies available for those who prefer to obtain the form in person. It is important to use the most current version of the form to ensure compliance with legal standards.

Key elements of the Form 122a

Understanding the key elements of the Form 122a is essential for accurate completion. The form typically includes sections for:

- Personal Information: Basic details about the debtor, including name and address.

- Income Sources: A comprehensive list of all income streams, including wages and any additional earnings.

- Expense Categories: Detailed sections for necessary monthly expenses, such as housing, food, and transportation.

- Signature and Declaration: A section where the debtor certifies the accuracy of the information provided.

Each element plays a crucial role in presenting a clear financial picture to the court, aiding in the bankruptcy process.

Form Submission Methods

The Form 122a can be submitted through various methods, depending on the preferences of the debtor and the requirements of the local bankruptcy court. Common submission methods include:

- Online submission: Many courts allow electronic filing of bankruptcy forms, including the Form 122a, through their online systems.

- Mail: Debtors can print the completed form and mail it to the appropriate bankruptcy court.

- In-person filing: Individuals may also choose to deliver the form directly to the court clerk's office.

It is essential to verify the preferred submission method of the local court to ensure compliance and avoid delays in the bankruptcy process.

Quick guide on how to complete form 122a

Complete Form 122a effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Form 122a on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to alter and eSign Form 122a with ease

- Access Form 122a and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 122a and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 122a

Create this form in 5 minutes!

How to create an eSignature for the form 122a

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is Form 122a and how can airSlate SignNow assist with it?

Form 122a is a specific document used for various business needs, and airSlate SignNow streamlines the eSigning process for this form. By using our platform, you can easily upload, send, and track the status of Form 122a, ensuring a smooth workflow for your business.

-

How does airSlate SignNow enhance the process of filling out Form 122a?

With airSlate SignNow, filling out Form 122a becomes effortless. Our intuitive interface allows you to add fields, sign, and share the document electronically, signNowly reducing the time spent on manual paperwork.

-

Is airSlate SignNow a cost-effective solution for managing Form 122a?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution for managing Form 122a helps you save on printing and mailing costs while enhancing productivity.

-

Can I integrate airSlate SignNow with other tools for handling Form 122a?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form 122a alongside your favorite tools. This integration enhances your workflow and keeps all relevant documents in sync.

-

What features does airSlate SignNow offer for Form 122a management?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for Form 122a. These tools ensure that you can handle your documents efficiently and securely.

-

How does eSigning Form 122a with airSlate SignNow improve security?

eSigning Form 122a with airSlate SignNow enhances security through advanced encryption and authentication methods. Your sensitive information is protected, ensuring that only authorized individuals can access and sign the document.

-

What are the benefits of using airSlate SignNow for Form 122a?

Using airSlate SignNow for Form 122a brings numerous benefits, including increased efficiency, reduced turnaround times, and improved document management. Our platform allows you to focus on what matters most while we handle the paperwork.

Get more for Form 122a

Find out other Form 122a

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template