6251 Instructions Form 2015

What is the 6251 Instructions Form

The 6251 Instructions Form is a crucial document used by taxpayers in the United States to calculate the Alternative Minimum Tax (AMT). This form provides guidance on how to determine whether an individual or business is subject to AMT and outlines the necessary calculations to ensure compliance with tax regulations. Understanding the 6251 Instructions Form is essential for accurately reporting income and deductions while adhering to IRS guidelines.

How to use the 6251 Instructions Form

Using the 6251 Instructions Form involves several steps to ensure that taxpayers correctly assess their AMT liability. First, individuals should gather their financial information, including income, deductions, and credits. Next, taxpayers will follow the instructions provided on the form to calculate their AMT by adjusting their taxable income. This process may require additional documentation, such as prior year tax returns and supporting schedules. Properly utilizing the form can help prevent costly mistakes and ensure accurate tax filing.

Steps to complete the 6251 Instructions Form

Completing the 6251 Instructions Form requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any relevant deductions.

- Review the income section of the form and input your total income accurately.

- Adjust your income by adding back certain deductions that are not allowed under AMT rules.

- Calculate your AMT using the provided tax rates and thresholds.

- Double-check all calculations and ensure that all relevant information is included before submission.

Legal use of the 6251 Instructions Form

The legal use of the 6251 Instructions Form is governed by IRS regulations. For the form to be considered valid, it must be filled out accurately and submitted by the required deadlines. Taxpayers should ensure that they comply with all applicable laws, including those related to the Alternative Minimum Tax. Utilizing electronic signature solutions can also enhance the legal standing of the completed form, ensuring that it meets the necessary requirements for submission.

Filing Deadlines / Important Dates

Filing deadlines for the 6251 Instructions Form align with the overall tax filing schedule in the United States. Typically, individual taxpayers must submit their forms by April fifteenth of each year. However, if additional time is needed, taxpayers may file for an extension, which generally allows for an additional six months. It is crucial to be aware of these deadlines to avoid penalties and interest associated with late submissions.

Key elements of the 6251 Instructions Form

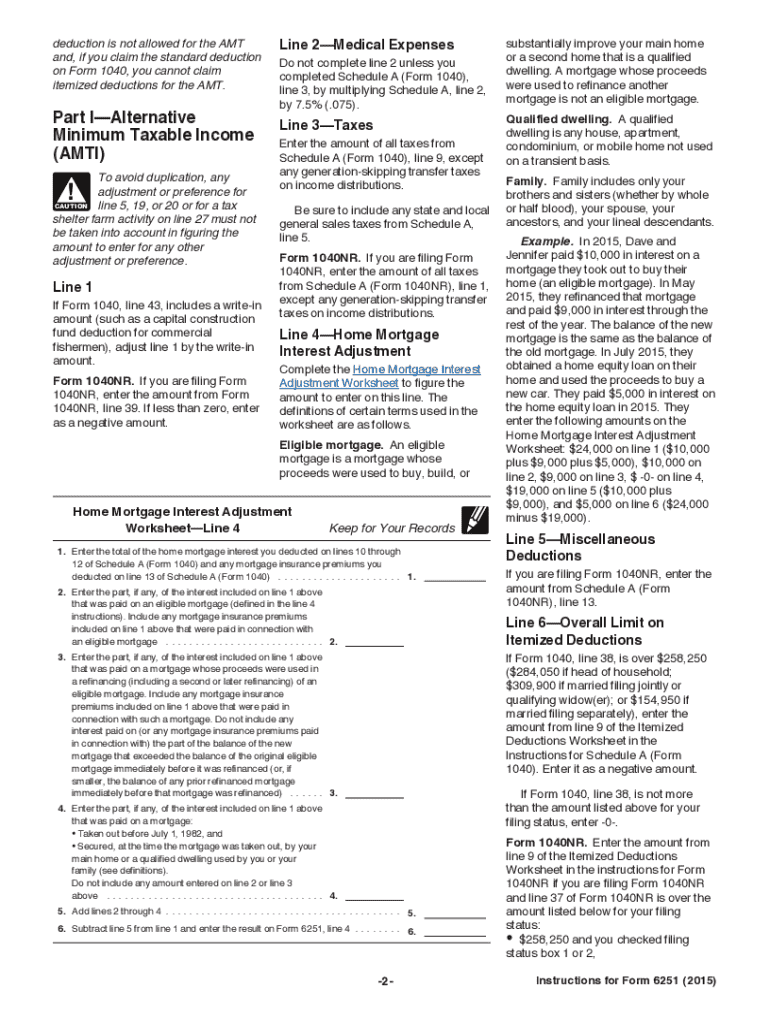

The 6251 Instructions Form contains several key elements that are vital for accurate completion. These include:

- Income adjustments, which detail how to modify taxable income for AMT calculations.

- Tax rates applicable to AMT, which differ from regular income tax rates.

- Exemptions and deductions specific to AMT, which may affect the overall tax liability.

- Instructions for reporting AMT on the standard tax return.

Quick guide on how to complete 2015 6251 instructions form

Complete 6251 Instructions Form effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage 6251 Instructions Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and electronically sign 6251 Instructions Form without difficulty

- Find 6251 Instructions Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing out new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from a device of your preference. Edit and electronically sign 6251 Instructions Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 6251 instructions form

Create this form in 5 minutes!

How to create an eSignature for the 2015 6251 instructions form

How to generate an eSignature for the 2015 6251 Instructions Form in the online mode

How to generate an eSignature for the 2015 6251 Instructions Form in Chrome

How to make an electronic signature for putting it on the 2015 6251 Instructions Form in Gmail

How to make an electronic signature for the 2015 6251 Instructions Form straight from your mobile device

How to generate an electronic signature for the 2015 6251 Instructions Form on iOS

How to generate an eSignature for the 2015 6251 Instructions Form on Android

People also ask

-

What is the 6251 Instructions Form and how does it work?

The 6251 Instructions Form is a document used for calculating alternative minimum tax for individual taxpayers. airSlate SignNow simplifies the process of accessing, completing, and sending this form electronically. With our solution, you can easily fill out the 6251 Instructions Form, collect electronic signatures, and send it securely.

-

How much does it cost to use airSlate SignNow for the 6251 Instructions Form?

Pricing for airSlate SignNow varies depending on the plan selected, but it is designed to be cost-effective, especially for businesses needing to manage multiple documents like the 6251 Instructions Form. You can choose from different subscription models that best suit your business needs, with options for monthly or annual billing.

-

What features does airSlate SignNow offer for the 6251 Instructions Form?

airSlate SignNow offers features that enhance the eSigning process for the 6251 Instructions Form, including customizable templates, real-time tracking, and notifications. Users can also integrate various CRMs and storage solutions to streamline document management and ensure compliance with tax-related submissions.

-

Is airSlate SignNow secure for sending the 6251 Instructions Form?

Yes, airSlate SignNow prioritizes user security, implementing robust encryption and authentication processes for sending the 6251 Instructions Form. All data is stored securely, and you can track who has accessed the document, ensuring confidentiality and compliance.

-

Can I sign the 6251 Instructions Form on my mobile device?

Absolutely! airSlate SignNow allows you to access and sign the 6251 Instructions Form on any mobile device. Our mobile-friendly platform ensures you can complete your documents anytime, anywhere, providing flexibility for both individual users and businesses.

-

How can I integrate airSlate SignNow with other tools for the 6251 Instructions Form?

airSlate SignNow offers integration with various tools, including Google Drive, Salesforce, and Dropbox, for efficient management of the 6251 Instructions Form. This connectivity simplifies storing, sending, and accessing your documents across platforms, enhancing your productivity.

-

What benefits does airSlate SignNow provide for businesses using the 6251 Instructions Form?

Using airSlate SignNow for the 6251 Instructions Form offers signNow benefits, including reduced processing time and the elimination of paper forms. It enhances workflow efficiency, improves accuracy through electronic signatures, and aids in maintaining compliance with tax regulations.

Get more for 6251 Instructions Form

Find out other 6251 Instructions Form

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy