6251 Instructions Form 2015

What is the 6251 Instructions Form

The 6251 Instructions Form is a crucial document used by taxpayers in the United States to calculate the Alternative Minimum Tax (AMT). This form provides guidance on how to determine whether an individual or business is subject to AMT and outlines the necessary calculations to ensure compliance with tax regulations. Understanding the 6251 Instructions Form is essential for accurately reporting income and deductions while adhering to IRS guidelines.

How to use the 6251 Instructions Form

Using the 6251 Instructions Form involves several steps to ensure that taxpayers correctly assess their AMT liability. First, individuals should gather their financial information, including income, deductions, and credits. Next, taxpayers will follow the instructions provided on the form to calculate their AMT by adjusting their taxable income. This process may require additional documentation, such as prior year tax returns and supporting schedules. Properly utilizing the form can help prevent costly mistakes and ensure accurate tax filing.

Steps to complete the 6251 Instructions Form

Completing the 6251 Instructions Form requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any relevant deductions.

- Review the income section of the form and input your total income accurately.

- Adjust your income by adding back certain deductions that are not allowed under AMT rules.

- Calculate your AMT using the provided tax rates and thresholds.

- Double-check all calculations and ensure that all relevant information is included before submission.

Legal use of the 6251 Instructions Form

The legal use of the 6251 Instructions Form is governed by IRS regulations. For the form to be considered valid, it must be filled out accurately and submitted by the required deadlines. Taxpayers should ensure that they comply with all applicable laws, including those related to the Alternative Minimum Tax. Utilizing electronic signature solutions can also enhance the legal standing of the completed form, ensuring that it meets the necessary requirements for submission.

Filing Deadlines / Important Dates

Filing deadlines for the 6251 Instructions Form align with the overall tax filing schedule in the United States. Typically, individual taxpayers must submit their forms by April fifteenth of each year. However, if additional time is needed, taxpayers may file for an extension, which generally allows for an additional six months. It is crucial to be aware of these deadlines to avoid penalties and interest associated with late submissions.

Key elements of the 6251 Instructions Form

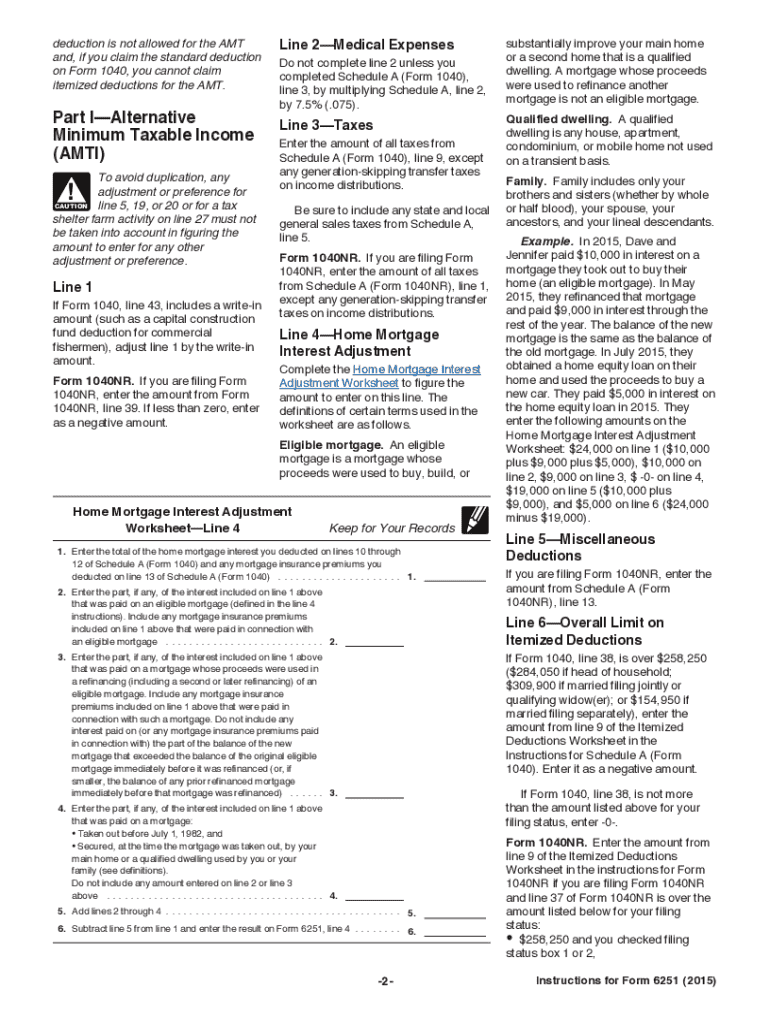

The 6251 Instructions Form contains several key elements that are vital for accurate completion. These include:

- Income adjustments, which detail how to modify taxable income for AMT calculations.

- Tax rates applicable to AMT, which differ from regular income tax rates.

- Exemptions and deductions specific to AMT, which may affect the overall tax liability.

- Instructions for reporting AMT on the standard tax return.

Quick guide on how to complete 2015 6251 instructions form

Complete 6251 Instructions Form effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage 6251 Instructions Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and electronically sign 6251 Instructions Form without difficulty

- Find 6251 Instructions Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing out new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from a device of your preference. Edit and electronically sign 6251 Instructions Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 6251 instructions form

Create this form in 5 minutes!

How to create an eSignature for the 2015 6251 instructions form

How to generate an eSignature for the 2015 6251 Instructions Form in the online mode

How to generate an eSignature for the 2015 6251 Instructions Form in Chrome

How to make an electronic signature for putting it on the 2015 6251 Instructions Form in Gmail

How to make an electronic signature for the 2015 6251 Instructions Form straight from your mobile device

How to generate an electronic signature for the 2015 6251 Instructions Form on iOS

How to generate an eSignature for the 2015 6251 Instructions Form on Android

People also ask

-

What is the 6251 Instructions Form and how is it used?

The 6251 Instructions Form is a crucial document used to calculate your Alternative Minimum Tax (AMT) liability. It provides detailed guidelines on how to complete your tax return while ensuring compliance with IRS regulations. Understanding this form can help you maximize your tax benefits and avoid potential penalties.

-

How can airSlate SignNow help with the 6251 Instructions Form?

Using airSlate SignNow, you can easily upload, sign, and share your 6251 Instructions Form securely online. Our platform streamlines the document signing process, allowing you to manage your tax forms efficiently and ensuring that your documents are legally binding. This saves time and reduces the hassle of traditional paperwork.

-

Is airSlate SignNow compatible with other tax software for the 6251 Instructions Form?

Yes, airSlate SignNow integrates seamlessly with various tax software programs, making it easier to work with the 6251 Instructions Form. Whether you're using popular accounting platforms or tax preparation software, our solution enhances your workflow by allowing you to sign and send documents directly from those applications.

-

What are the pricing options for using airSlate SignNow with the 6251 Instructions Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting from a free trial to a range of paid subscriptions. Each plan provides access to features that can help streamline the signing process for documents like the 6251 Instructions Form. You can choose a plan that best fits your volume of document handling and budget.

-

What features does airSlate SignNow offer for managing the 6251 Instructions Form?

airSlate SignNow provides a variety of features tailored for managing documents like the 6251 Instructions Form, including customizable templates, secure cloud storage, and real-time tracking of document status. Additionally, you can set reminders for document signing to ensure that your tax forms are completed on time.

-

Can I access the 6251 Instructions Form from my mobile device using airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile-friendly interface that allows you to access, sign, and manage the 6251 Instructions Form from your smartphone or tablet. This mobile capability ensures that you can handle important tax documents anytime and anywhere, providing flexibility for your busy schedule.

-

How secure is airSlate SignNow for signing the 6251 Instructions Form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure authentication methods to protect your sensitive information when signing the 6251 Instructions Form. This means you can confidently manage your documents knowing that they are safeguarded against unauthorized access.

Get more for 6251 Instructions Form

- Odometer discrepancy affidavit form

- Firearms transfer form

- Form 3233

- Bcbsm subrogation form

- Homeowners recovery fund attorneys north carolina form

- Usability test observation coding form

- Before judging your first debate the world scholars cup form

- Mc 012 memorandum of costs after judgment acknowledgement of credit and declaration of accrued interest form

Find out other 6251 Instructions Form

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form