Instructions for Form 6251 Instructions for Form 6251, Alternative Minimum TaxIndividuals 2022-2026

Understanding the Instructions for Form 6251

The Instructions for Form 6251 provide detailed guidance on how to navigate the complexities of the Alternative Minimum Tax (AMT). This form is essential for taxpayers who may be subject to AMT, which is designed to ensure that individuals with higher incomes pay a minimum amount of tax. The instructions outline eligibility criteria, necessary calculations, and the specific lines on the form that need to be filled out. Understanding these instructions helps in accurately determining tax liability and ensuring compliance with IRS regulations.

Steps to Complete Form 6251

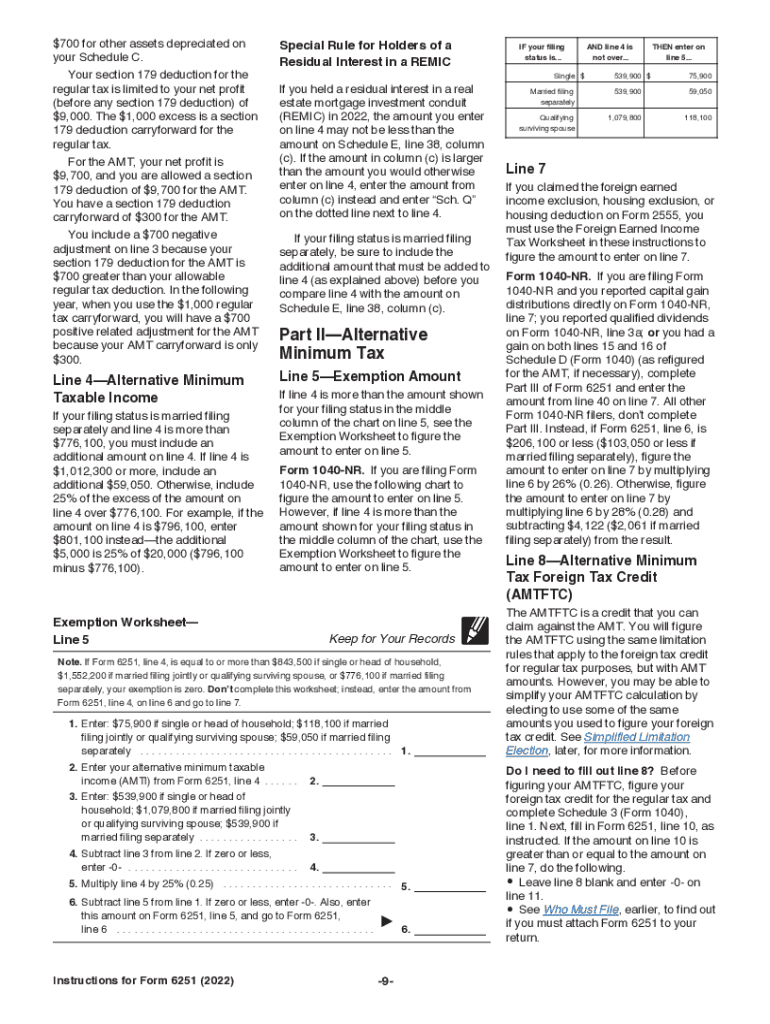

Completing Form 6251 involves several key steps. First, gather all necessary financial documents, including your income statements and any deductions you plan to claim. Next, follow the instructions carefully, starting with Part I, where you will calculate your Alternative Minimum Taxable Income (AMTI). This involves adjusting your regular taxable income by adding back certain tax preferences. After calculating your AMTI, proceed to Part II to determine your AMT using the provided tax rates. Finally, ensure that all calculations are accurate before submitting the form with your tax return.

Filing Deadlines for Form 6251

Form 6251 must be filed along with your annual tax return, typically due on April 15 of the following year. If you require additional time, you may file for an extension, which allows you to submit your return by October 15. However, it is important to note that any taxes owed must still be paid by the original due date to avoid penalties and interest. Keeping track of these deadlines is crucial for maintaining compliance with IRS regulations.

Legal Use of Form 6251

Form 6251 is legally binding when completed accurately and submitted in accordance with IRS guidelines. The form serves as an official declaration of your Alternative Minimum Tax calculations and must be filed with your federal tax return. Failure to file or inaccuracies in the form can lead to penalties, including interest on unpaid taxes. Therefore, it is essential to ensure that all information is correct and that the form is submitted on time to avoid legal complications.

Examples of Using Form 6251

Consider a taxpayer who has a high income and significant deductions. They may find themselves subject to the Alternative Minimum Tax, requiring them to complete Form 6251. For instance, if this individual has substantial investment income and claims various deductions, the form helps determine if their tax liability exceeds the minimum threshold set by the IRS. By following the instructions carefully, they can accurately calculate their AMT and fulfill their tax obligations.

Eligibility Criteria for Form 6251

To determine eligibility for filing Form 6251, taxpayers should assess their income levels and the nature of their deductions. Generally, individuals with higher incomes, particularly those exceeding certain thresholds, may be required to complete this form. Specific criteria include the presence of tax preference items, such as certain deductions and credits that may trigger AMT liability. Understanding these eligibility requirements is vital for proper tax planning and compliance.

Quick guide on how to complete 2022 instructions for form 6251 instructions for form 6251 alternative minimum taxindividuals

Effortlessly Prepare Instructions For Form 6251 Instructions For Form 6251, Alternative Minimum TaxIndividuals on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Handle Instructions For Form 6251 Instructions For Form 6251, Alternative Minimum TaxIndividuals on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Instructions For Form 6251 Instructions For Form 6251, Alternative Minimum TaxIndividuals with Minimal Effort

- Locate Instructions For Form 6251 Instructions For Form 6251, Alternative Minimum TaxIndividuals and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important parts of your documents or obscure sensitive information with the tools that airSlate SignNow provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Instructions For Form 6251 Instructions For Form 6251, Alternative Minimum TaxIndividuals to ensure smooth communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 instructions for form 6251 instructions for form 6251 alternative minimum taxindividuals

Create this form in 5 minutes!

People also ask

-

What is the amt exemption 2021 in relation to airSlate SignNow?

The amt exemption 2021 refers to specific tax provisions that can affect your business's operational costs. By utilizing airSlate SignNow, businesses can ensure they have accurate documentation for tax purposes, including compliance with the amt exemption 2021.

-

How does airSlate SignNow help with compliance related to amt exemption 2021?

airSlate SignNow simplifies the process of signing and archiving documents necessary for tax compliance, including those affected by the amt exemption 2021. This ensures that your records are accurate, easily accessible, and organized for any audits.

-

What pricing plans are available for airSlate SignNow, and how do they relate to amt exemption 2021?

airSlate SignNow offers flexible pricing plans designed to suit various business needs. Choosing the right plan can help you manage your documentation related to amt exemption 2021 effectively while optimizing your budget.

-

Can airSlate SignNow integrate with other software for tax filing related to amt exemption 2021?

Yes, airSlate SignNow integrates seamlessly with other accounting and tax software. This integration allows businesses to streamline their documentation processes for the amt exemption 2021, making sure all necessary paperwork is submitted efficiently.

-

What are the main features of airSlate SignNow that assist with managing amt exemption 2021 documents?

Key features include eSignature capabilities, document templates, and secure storage. These features help ensure that your documents related to amt exemption 2021 are signed quickly and stored securely, simplifying your compliance efforts.

-

How can using airSlate SignNow benefit my business with the amt exemption 2021?

Using airSlate SignNow can reduce the time and resources spent on document management with respect to amt exemption 2021. This efficiency translates into cost savings, allowing you to focus on more strategic aspects of your business.

-

Is there support available for businesses using airSlate SignNow to navigate amt exemption 2021?

Absolutely! airSlate SignNow provides comprehensive customer support to guide businesses through the documentation requirements related to amt exemption 2021. You can access resources and assistance to ensure compliance and proper documentation.

Get more for Instructions For Form 6251 Instructions For Form 6251, Alternative Minimum TaxIndividuals

- Legal last will and testament form for widow or widower with minor children new mexico

- Legal last will form for a widow or widower with no children new mexico

- Legal last will and testament form for a widow or widower with adult and minor children new mexico

- Legal last will and testament form for divorced and remarried person with mine yours and ours children new mexico

- Legal last will and testament form with all property to trust called a pour over will new mexico

- Written revocation of will new mexico form

- Last will and testament for other persons new mexico form

- Notice to beneficiaries of being named in will new mexico form

Find out other Instructions For Form 6251 Instructions For Form 6251, Alternative Minimum TaxIndividuals

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template