Schedule C Ez Form 2010

What is the Schedule C Ez Form

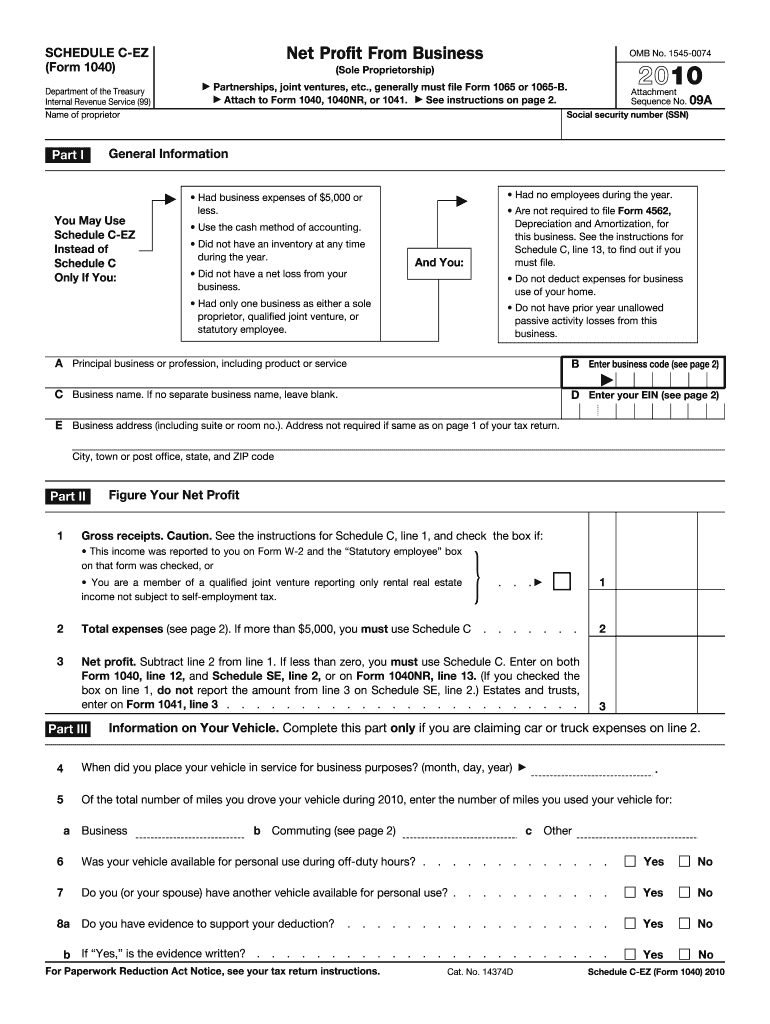

The Schedule C Ez Form is a simplified version of the Schedule C form used by sole proprietors in the United States to report income and expenses from their business activities. This form is specifically designed for small businesses that meet certain criteria, making it easier for taxpayers to file their taxes. The Schedule C Ez Form allows individuals to summarize their business income and deduct eligible expenses, ultimately determining their net profit or loss for the tax year.

How to use the Schedule C Ez Form

Using the Schedule C Ez Form involves several straightforward steps. First, gather all necessary financial documents, including income statements and records of business expenses. Next, fill out the form by entering your business income, which includes gross receipts or sales. Then, list your allowable business expenses, such as advertising, utilities, and supplies. Finally, calculate your net profit or loss by subtracting total expenses from total income. Once completed, the form should be submitted along with your personal tax return.

Steps to complete the Schedule C Ez Form

Completing the Schedule C Ez Form can be done effectively by following these steps:

- Collect all relevant financial documents, including income and expense records.

- Begin filling out the form by entering your business name and identifying details.

- Input your total business income from all sources.

- List your business expenses, ensuring they meet the IRS guidelines for deductibility.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the Schedule C Ez Form

The Schedule C Ez Form is legally recognized as a valid document for reporting business income and expenses. To ensure compliance, it is crucial to accurately report all income and only deduct eligible expenses as outlined by the IRS. Misreporting or failing to provide accurate information can lead to penalties or audits. Using the form correctly helps maintain transparency with tax authorities and supports the legitimacy of your business operations.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Ez Form align with the standard tax return deadlines. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can also request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is essential to stay informed about these dates to ensure timely filing.

Examples of using the Schedule C Ez Form

Examples of using the Schedule C Ez Form include various scenarios where sole proprietors report their business income. For instance, a freelance graphic designer may use the form to report income earned from client projects and deduct expenses for software subscriptions and office supplies. Similarly, a small online retailer can report sales revenue and deduct costs related to inventory and shipping. Each example illustrates how the form simplifies the tax reporting process for small business owners.

Quick guide on how to complete 2010 schedule c ez form

Manage Schedule C Ez Form effortlessly on any gadget

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your papers quickly without delays. Manage Schedule C Ez Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Schedule C Ez Form without hassle

- Obtain Schedule C Ez Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or inaccuracies that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign Schedule C Ez Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 schedule c ez form

Create this form in 5 minutes!

How to create an eSignature for the 2010 schedule c ez form

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is the Schedule C Ez Form and who should use it?

The Schedule C Ez Form is a simplified version of the Schedule C tax form used by sole proprietors to report income and expenses. It's ideal for small business owners and freelancers who meet specific criteria, allowing them to file their taxes more efficiently. Using airSlate SignNow, you can easily eSign your Schedule C Ez Form and streamline your tax preparation process.

-

How can airSlate SignNow help with completing the Schedule C Ez Form?

airSlate SignNow offers a user-friendly platform that simplifies the process of filling out and eSigning the Schedule C Ez Form. With its intuitive interface, you can quickly upload your form, add your information, and send it for eSignature. This ensures that your tax documents are completed accurately and securely.

-

Is there a cost associated with using airSlate SignNow for the Schedule C Ez Form?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs. For individuals and small businesses looking to eSign documents like the Schedule C Ez Form, the costs are competitive and designed to provide a cost-effective solution. Check our pricing page for more details on the available plans.

-

What features does airSlate SignNow offer for the Schedule C Ez Form?

airSlate SignNow provides features such as customizable templates, secure eSignature options, and document tracking to enhance your experience with the Schedule C Ez Form. These features not only improve efficiency but also ensure your documents are securely managed throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for handling my Schedule C Ez Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and other accounting software. This allows you to manage your Schedule C Ez Form alongside your other business tools, making your workflow more efficient.

-

What are the benefits of using airSlate SignNow for the Schedule C Ez Form?

Using airSlate SignNow for your Schedule C Ez Form offers numerous benefits, including time savings, enhanced security, and ease of use. With our electronic signature capabilities, you can sign and send documents quickly, reducing the hassle of traditional paperwork and ensuring compliance with tax regulations.

-

How secure is airSlate SignNow when handling tax documents like the Schedule C Ez Form?

airSlate SignNow prioritizes security, utilizing industry-standard encryption and compliance measures to protect your sensitive tax documents, including the Schedule C Ez Form. You can trust that your information is safe and secure while using our platform to manage your eSignatures.

Get more for Schedule C Ez Form

- Online shopping cart form

- 2019 cuna calendar order form credit union calendars

- 2021 calendar order form credit union calendars

- Participants declaration of consent regarding six exchange regulation ltd and the regulatory bodies form

- Who ishttpwwwscoutmasterbuckycom form

- Request for release time reimbursement request initiated form

- Employment history hearing loss f262 013 000 employment history hearing loss f262 013 000 lni wa form

- Esd number form

Find out other Schedule C Ez Form

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement