1040 Schedule C Ez Form 2016

What is the 1040 Schedule C Ez Form

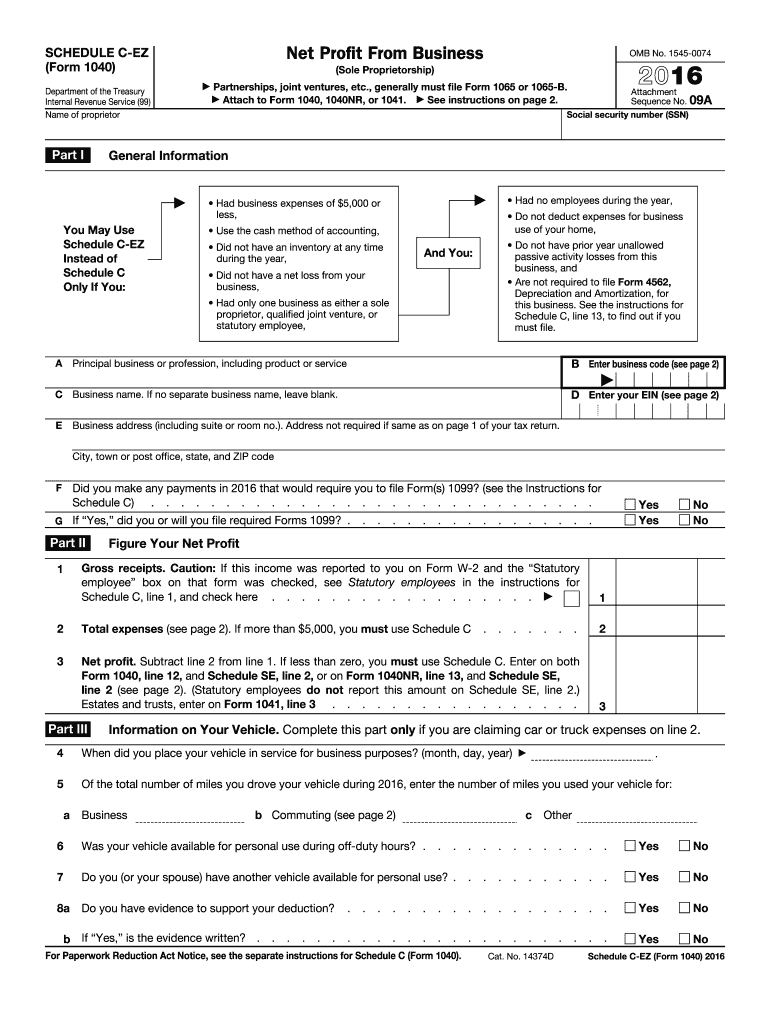

The 1040 Schedule C Ez Form is a simplified version of the Schedule C form used by self-employed individuals to report income and expenses from their business. This form is ideal for sole proprietors who have a straightforward business structure and meet specific criteria. It allows for a more streamlined reporting process, making it easier to file taxes for individuals with uncomplicated business operations.

How to use the 1040 Schedule C Ez Form

To use the 1040 Schedule C Ez Form, you must first ensure that you qualify to use this simplified version. Eligible taxpayers should fill out the form to report income from self-employment, calculate net profit or loss, and determine tax obligations. The form requires basic information about your business, such as income earned and allowable expenses. After completing the form, it should be submitted along with your Form 1040 during tax filing.

Steps to complete the 1040 Schedule C Ez Form

Completing the 1040 Schedule C Ez Form involves several key steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Fill in your business name and address at the top of the form.

- Report your gross income from self-employment in the appropriate section.

- List any allowable business expenses, ensuring they meet IRS guidelines.

- Calculate your net profit or loss by subtracting total expenses from gross income.

- Transfer the net profit or loss to your Form 1040.

Legal use of the 1040 Schedule C Ez Form

The 1040 Schedule C Ez Form is legally valid when completed accurately and submitted on time. It is essential to maintain compliance with IRS regulations to avoid penalties. Electronic filing options are available, and using a reliable eSignature solution can enhance the legal standing of your submitted documents. Ensuring that all information is truthful and substantiated by records is crucial for legal use.

Key elements of the 1040 Schedule C Ez Form

Key elements of the 1040 Schedule C Ez Form include:

- Gross Income: Total income earned from self-employment activities.

- Business Expenses: Deductions for ordinary and necessary expenses incurred while running your business.

- Net Profit or Loss: The difference between gross income and total expenses, which affects your overall tax liability.

- Signature: Required to validate the form, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Schedule C Ez Form align with the standard tax filing deadlines in the United States. Typically, individual tax returns are due on April fifteenth. If you need additional time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is advisable to check for any changes in deadlines each tax year.

Quick guide on how to complete 1040 schedule c ez 2016 form

Complete 1040 Schedule C Ez Form seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage 1040 Schedule C Ez Form on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign 1040 Schedule C Ez Form effortlessly

- Find 1040 Schedule C Ez Form and click on Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Select important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that use.

- Create your signature with the Sign tool, which takes only a moment and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1040 Schedule C Ez Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 schedule c ez 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1040 schedule c ez 2016 form

How to create an electronic signature for the 1040 Schedule C Ez 2016 Form online

How to make an electronic signature for the 1040 Schedule C Ez 2016 Form in Google Chrome

How to make an electronic signature for putting it on the 1040 Schedule C Ez 2016 Form in Gmail

How to create an electronic signature for the 1040 Schedule C Ez 2016 Form right from your mobile device

How to create an electronic signature for the 1040 Schedule C Ez 2016 Form on iOS devices

How to generate an electronic signature for the 1040 Schedule C Ez 2016 Form on Android

People also ask

-

What is the 1040 Schedule C Ez Form and who should use it?

The 1040 Schedule C Ez Form is a simplified version of the Schedule C used by sole proprietors to report income and expenses from their business. It is designed for individuals with uncomplicated business activities, making it easier to file taxes. If you earn self-employment income and meet specific criteria, this form is ideal for you.

-

How can airSlate SignNow help me with the 1040 Schedule C Ez Form?

airSlate SignNow provides a user-friendly platform to securely send and eSign the 1040 Schedule C Ez Form electronically. Our solution streamlines the document signing process, ensuring that you can complete your tax filings quickly and efficiently. With airSlate SignNow, you will save time and reduce the hassle associated with traditional paper forms.

-

What features does airSlate SignNow offer for managing the 1040 Schedule C Ez Form?

With airSlate SignNow, you can easily upload, edit, and send the 1040 Schedule C Ez Form for eSignature. Our platform includes features such as document templates, customizable workflows, and real-time tracking, allowing you to manage your tax documents effectively. These features enhance your productivity and ensure compliance with tax regulations.

-

Is airSlate SignNow compatible with accounting software for filing the 1040 Schedule C Ez Form?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enabling you to import and export your 1040 Schedule C Ez Form data effortlessly. This integration helps streamline your tax preparation process, making it easier to manage your financial documents in one place. You can focus more on your business and less on paperwork.

-

What are the pricing options for using airSlate SignNow with the 1040 Schedule C Ez Form?

airSlate SignNow offers flexible pricing plans to suit different business needs, starting with a free trial to evaluate our services. Our plans include features specifically designed for managing documents like the 1040 Schedule C Ez Form, ensuring you get the best value for your investment. You can choose a plan that aligns with your budget and requirements.

-

Can I track the status of my 1040 Schedule C Ez Form once it's sent for signature?

Absolutely! airSlate SignNow allows you to track the status of your 1040 Schedule C Ez Form in real time. You will receive notifications when the document is viewed, signed, or completed, ensuring that you stay informed throughout the signing process. This feature helps you manage your documents efficiently.

-

What security measures does airSlate SignNow have in place for the 1040 Schedule C Ez Form?

airSlate SignNow prioritizes the security of your documents, including the 1040 Schedule C Ez Form, with advanced encryption and secure cloud storage. We comply with industry standards to protect your sensitive information, ensuring that your data remains confidential and secure. You can trust airSlate SignNow for safe document handling.

Get more for 1040 Schedule C Ez Form

Find out other 1040 Schedule C Ez Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors