Schedule C Ez Form 2013

What is the Schedule C Ez Form

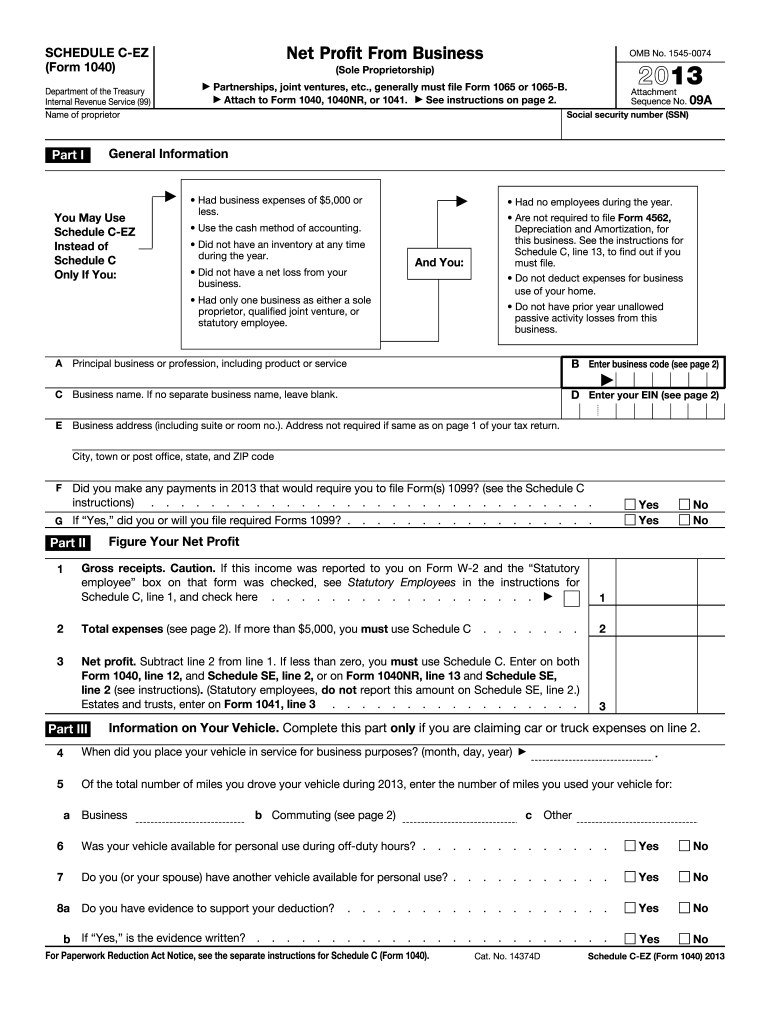

The Schedule C Ez Form is a simplified version of the Schedule C form used by self-employed individuals to report income and expenses related to their business. This form is specifically designed for sole proprietors who meet certain eligibility criteria, making it easier to complete than the standard Schedule C. It allows taxpayers to report their business income, deduct eligible expenses, and calculate their net profit or loss for tax purposes. The Schedule C Ez Form is beneficial for those with straightforward business activities, as it streamlines the reporting process while ensuring compliance with IRS regulations.

How to use the Schedule C Ez Form

Using the Schedule C Ez Form involves a few straightforward steps. First, ensure you meet the eligibility criteria, which typically include having a business with limited expenses and no inventory. Next, gather all necessary financial documents, such as income statements and receipts for deductible expenses. Fill out the form by entering your business income and expenses in the appropriate sections. Finally, calculate your net profit or loss and transfer this information to your personal tax return. It is essential to keep copies of the completed form and any supporting documents for your records.

Steps to complete the Schedule C Ez Form

Completing the Schedule C Ez Form requires careful attention to detail. Follow these steps for accurate submission:

- Verify your eligibility to use the Schedule C Ez Form.

- Collect all relevant financial information, including total income and deductible expenses.

- Begin filling out the form by entering your business name and identifying information.

- Report your total income from your business activities.

- List eligible expenses directly related to your business, ensuring they meet IRS guidelines.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Transfer the net profit or loss to your personal tax return.

Legal use of the Schedule C Ez Form

The Schedule C Ez Form is legally recognized by the IRS as a valid document for reporting self-employment income. To ensure its legal use, taxpayers must adhere to specific guidelines, including accurate reporting of income and expenses. Additionally, the form must be filed by the tax deadline to avoid penalties. It is crucial to maintain proper records and documentation to support the information reported on the form, as the IRS may request these documents during an audit. Utilizing a reliable eSignature platform can enhance the legal validity of your submitted form.

Key elements of the Schedule C Ez Form

The Schedule C Ez Form includes several key elements that are essential for accurate reporting. These elements consist of:

- Business information: Name, address, and type of business.

- Total income: All income generated from business activities.

- Expenses: Deductible costs directly related to the business, such as supplies and utilities.

- Net profit or loss: The final calculation that determines the taxable income from the business.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Ez Form align with the general tax filing deadlines for individuals. Typically, the form must be submitted by April 15 of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also file for an extension, allowing additional time to complete their tax returns, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete 2013 schedule c ez form

Effectively Prepare Schedule C Ez Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, alter, and eSign your documents promptly and without issues. Manage Schedule C Ez Form on any device through airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Schedule C Ez Form effortlessly

- Obtain Schedule C Ez Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your adjustments.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or downloading it to your PC.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or mistakes that require new document printouts. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Edit and eSign Schedule C Ez Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 schedule c ez form

Create this form in 5 minutes!

How to create an eSignature for the 2013 schedule c ez form

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Schedule C Ez Form?

The Schedule C Ez Form is a simplified version of the Schedule C form used for reporting income or loss from a business operated as a sole proprietorship. This form is designed for small business owners who have straightforward income and expenses, making it easier to file taxes accurately.

-

How can airSlate SignNow help with the Schedule C Ez Form?

airSlate SignNow streamlines the process of preparing and signing your Schedule C Ez Form by providing a user-friendly platform for document management. You can easily upload, sign, and share your completed forms securely, ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for managing the Schedule C Ez Form?

With airSlate SignNow, you have access to features such as eSignature capabilities, document templates, and customizable workflows that can simplify your experience when handling the Schedule C Ez Form. These tools allow for quick adjustments and collaborative efforts with other parties involved.

-

Is there a cost associated with using airSlate SignNow for the Schedule C Ez Form?

Yes, there is a cost associated with airSlate SignNow, but it is known for being a cost-effective solution for businesses. Pricing plans vary based on features and usage, but many users find that the benefits of expediting their Schedule C Ez Form process outweigh the costs.

-

Can I integrate airSlate SignNow with other accounting tools while using the Schedule C Ez Form?

Absolutely! airSlate SignNow offers integrations with various accounting software that can help manage your finances while filling out the Schedule C Ez Form. This compatibility ensures seamless data transfer and enhances your overall productivity.

-

What are the benefits of using airSlate SignNow for my Schedule C Ez Form?

Using airSlate SignNow for your Schedule C Ez Form allows you to save time, reduce errors, and increase efficiency in document handling. The electronic signature feature also enhances security, ensuring that your sensitive information remains protected.

-

Is airSlate SignNow user-friendly for beginners handling the Schedule C Ez Form?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible for beginners working on the Schedule C Ez Form. The intuitive interface and helpful resources ensure that even those new to e-signatures can navigate the process with ease.

Get more for Schedule C Ez Form

- Form 9 nevada resale certificatedoc

- New jersey motor vehicle dealer surety bond ioa bonds form

- Nscb industry bulletin nevada state contractors board form

- Nys dos corporations biennial e filing form

- Dec access permit form

- Non represented and eligible represented employees ucm mtabsc form

- Combination storage contract bill of lading written bb milburn printing form

- Form 215 ohio secretary of state boe cuyahogacounty

Find out other Schedule C Ez Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF