Fillable 1040 Schedule C Ez Form 2011

What is the Fillable 1040 Schedule C Ez Form

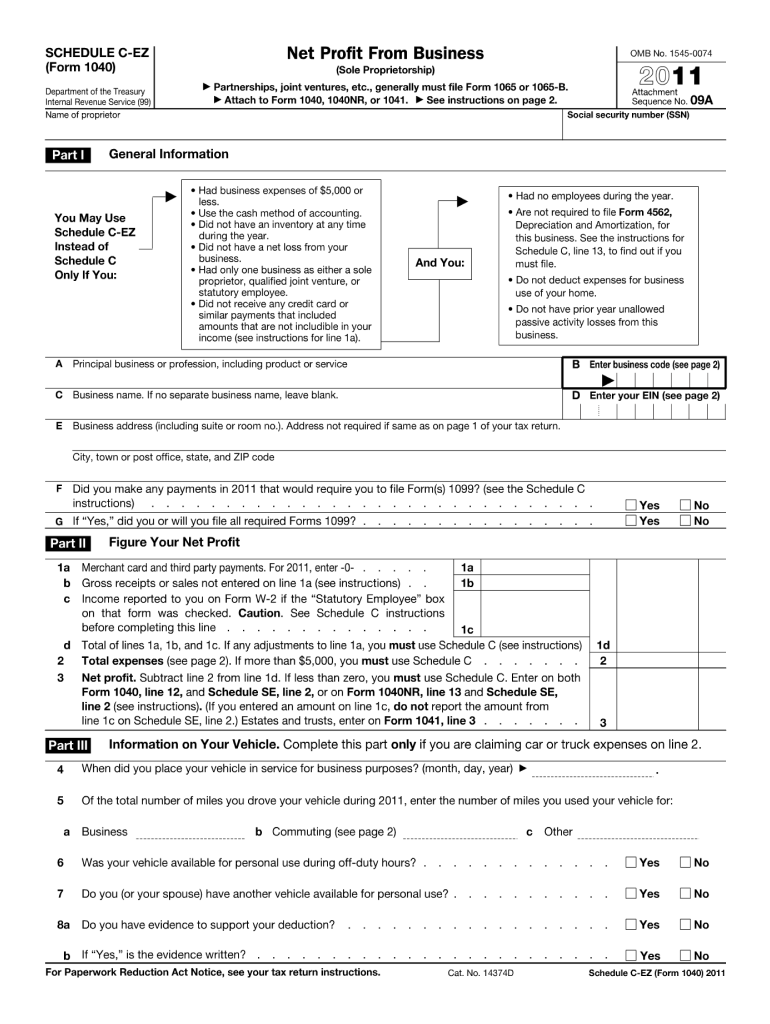

The Fillable 1040 Schedule C Ez Form is a simplified tax form used by self-employed individuals to report income and expenses from their business activities. This form is specifically designed for sole proprietors with straightforward business operations, allowing them to calculate their net profit or loss efficiently. It streamlines the reporting process for those who meet certain eligibility criteria, making it easier to file taxes accurately and on time.

How to use the Fillable 1040 Schedule C Ez Form

Using the Fillable 1040 Schedule C Ez Form involves several straightforward steps. First, gather all necessary financial documents, including income statements and expense receipts. Next, download the fillable form from the IRS website or a trusted source. Fill in the required fields, ensuring all information is accurate. After completing the form, review it for any errors before submitting it with your annual tax return. Utilizing eSignature tools can facilitate the signing process, ensuring your submission is both secure and compliant.

Steps to complete the Fillable 1040 Schedule C Ez Form

Completing the Fillable 1040 Schedule C Ez Form involves the following steps:

- Gather your business income and expense records.

- Download the fillable form from a reliable source.

- Enter your business name and address in the designated fields.

- Report your total income from your business activities.

- List your business expenses, ensuring they are eligible deductions.

- Calculate your net profit or loss by subtracting expenses from income.

- Review all entries for accuracy before finalizing the form.

Legal use of the Fillable 1040 Schedule C Ez Form

The legal use of the Fillable 1040 Schedule C Ez Form is governed by IRS regulations. To ensure compliance, it is essential to provide accurate information and retain supporting documents for your reported income and expenses. The form must be submitted along with your personal income tax return, and any discrepancies can lead to audits or penalties. Utilizing secure digital platforms for filling and signing the form can enhance its legal validity, as they often comply with electronic signature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable 1040 Schedule C Ez Form align with the standard tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes in deadlines, as late submissions can incur penalties and interest on unpaid taxes.

Required Documents

To complete the Fillable 1040 Schedule C Ez Form, you will need several key documents, including:

- Income statements from your business activities.

- Receipts for all business-related expenses.

- Any previous tax returns that may provide context for your current filing.

- Records of any estimated tax payments made throughout the year.

Examples of using the Fillable 1040 Schedule C Ez Form

Common examples of individuals who may use the Fillable 1040 Schedule C Ez Form include freelance graphic designers, independent consultants, and small business owners operating as sole proprietors. Each of these scenarios involves reporting income generated from self-employment and claiming relevant deductions to reduce taxable income. By utilizing this form, these individuals can simplify their tax reporting process while ensuring compliance with IRS requirements.

Quick guide on how to complete 2011 fillable 1040 schedule c ez form

Manage Fillable 1040 Schedule C Ez Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Administer Fillable 1040 Schedule C Ez Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

Steps to modify and eSign Fillable 1040 Schedule C Ez Form with ease

- Locate Fillable 1040 Schedule C Ez Form and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which requires mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fillable 1040 Schedule C Ez Form and guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 fillable 1040 schedule c ez form

Create this form in 5 minutes!

How to create an eSignature for the 2011 fillable 1040 schedule c ez form

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is a Fillable 1040 Schedule C Ez Form?

The Fillable 1040 Schedule C Ez Form is a simplified version of the standard Schedule C used by sole proprietors to report income and expenses. This form allows for a straightforward filling process, making it easier for individuals to complete their tax returns without the complexity of additional forms.

-

How can airSlate SignNow help with the Fillable 1040 Schedule C Ez Form?

AirSlate SignNow allows users to easily create, send, and eSign their Fillable 1040 Schedule C Ez Form securely online. With its user-friendly interface, you can streamline the document workflow, make necessary edits, and ensure a hassle-free submission process.

-

Is there a cost associated with using airSlate SignNow for the Fillable 1040 Schedule C Ez Form?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution for your document management needs. Various pricing plans are available, allowing you to choose one that best fits your budget and requirements for filing the Fillable 1040 Schedule C Ez Form.

-

What features does airSlate SignNow offer for the Fillable 1040 Schedule C Ez Form?

AirSlate SignNow offers features such as document templates, eSignature capabilities, and the ability to collaborate with multiple parties in real-time. These features ensure that you can efficiently manage the Fillable 1040 Schedule C Ez Form while adhering to compliance standards.

-

Can I integrate airSlate SignNow with other software for the Fillable 1040 Schedule C Ez Form?

Absolutely! AirSlate SignNow integrates seamlessly with various third-party applications, allowing you to leverage your existing tools while working on the Fillable 1040 Schedule C Ez Form. Integration with platforms such as Google Drive or Dropbox ensures your documents are stored securely and accessible anytime.

-

What are the benefits of using airSlate SignNow for tax forms like the Fillable 1040 Schedule C Ez Form?

Using airSlate SignNow for tax forms like the Fillable 1040 Schedule C Ez Form simplifies the entire process. It enhances accuracy through electronic signatures, reduces paper waste, and allows quick access to completed forms, thereby saving you time and effort.

-

Is my information safe when using airSlate SignNow for the Fillable 1040 Schedule C Ez Form?

Yes, airSlate SignNow prioritizes the security of your information. When completing the Fillable 1040 Schedule C Ez Form, your data is protected with advanced encryption technologies, ensuring that your information remains confidential and secure.

Get more for Fillable 1040 Schedule C Ez Form

- Delaware landlord notice form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises delaware form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497302059 form

- Delaware landlord notice 497302060 form

- Letter from tenant to landlord containing notice that doors are broken and demand repair delaware form

- Letter from tenant to landlord with demand that landlord repair broken windows delaware form

- Letter from tenant to landlord with demand that landlord repair plumbing problem delaware form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497302064 form

Find out other Fillable 1040 Schedule C Ez Form

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple