Schedule C Ez 2018-2026

What is the Schedule C Ez

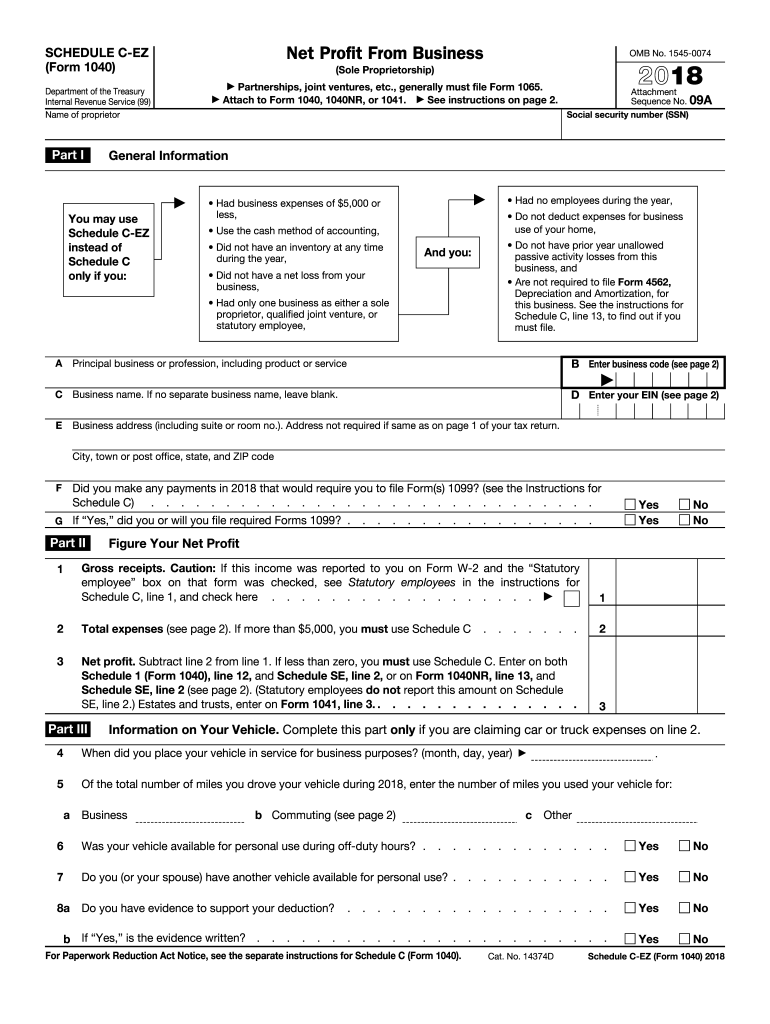

The Schedule C Ez is a simplified tax form used by self-employed individuals to report their income and expenses. This form is specifically designed for sole proprietors who have uncomplicated business operations. It allows for a streamlined reporting process, making it easier to calculate net profit or loss from a business venture. The Schedule C Ez is typically utilized by those who meet specific eligibility criteria, such as having a limited number of expenses and not needing to report inventory or depreciation.

How to use the Schedule C Ez

Using the Schedule C Ez involves several straightforward steps. First, gather all necessary financial documents, including income records and expense receipts. Next, fill out the form by entering your total income, followed by your allowable business expenses. Ensure that you provide accurate figures to avoid discrepancies. After completing the form, it should be attached to your Form 1040 when filing your federal income tax return. It is important to keep copies of the submitted form for your records.

Steps to complete the Schedule C Ez

Completing the Schedule C Ez requires careful attention to detail. Follow these steps:

- Begin by entering your business name and address at the top of the form.

- Report your gross receipts or sales in the designated section.

- List your business expenses, ensuring that they fall within the allowable categories.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Transfer the net profit or loss to your Form 1040.

Legal use of the Schedule C Ez

The Schedule C Ez must be used in compliance with IRS regulations. It is essential to ensure that all information provided is accurate and complete. Misrepresentation or inaccuracies can lead to penalties or audits. Additionally, only eligible taxpayers should use this form; those with more complex business situations should consider the standard Schedule C form instead. Understanding the legal implications of using the Schedule C Ez is crucial for maintaining compliance with tax laws.

Eligibility Criteria

To qualify for using the Schedule C Ez, taxpayers must meet specific criteria. These include:

- Operating as a sole proprietor with no employees.

- Having a total income of $100,000 or less.

- Claiming no more than $5,000 in business expenses.

- Not needing to report inventory or depreciation.

Meeting these criteria allows for the use of the simplified form, which can expedite the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Ez align with the general tax filing deadlines for individual taxpayers. Typically, the deadline is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete 1040 schedule c ez 2018 2019 form

Discover the most efficient method to complete and endorse your Schedule C Ez

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow presents a superior approach to complete and endorse your Schedule C Ez and similar forms for public services. Our intelligent electronic signature solution equips you with all necessary tools to manage documentation swiftly while adhering to formal standards - comprehensive PDF editing, administration, safeguarding, signing, and sharing tools available through a user-friendly interface.

Only a few simple steps are required to complete and endorse your Schedule C Ez:

- Upload the editable template to the editor using the Get Form button.

- Verify what information is needed in your Schedule C Ez.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the gaps with your information.

- Modify the content with Text boxes or Images from the toolbar above.

- Emphasize what is essential or Obscure fields that are no longer relevant.

- Click on Sign to generate a legally recognized electronic signature using your preferred method.

- Add the Date next to your signature and finalize your task by clicking the Done button.

Store your completed Schedule C Ez in the Documents section within your account, download it, or export it to your preferred cloud storage. Our service also offers versatile file sharing options. There's no need to print your templates when you have to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS "snail mail" dispatch from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 1040 schedule c ez 2018 2019 form

FAQs

-

When filing a 1040 Schedule C-EZ form does it matter what my job description is (Part 1, Line A)? How accurate or descriptive should it be?

The job description on the tax return is apparently not very important. A word or two is sufficient - like manager, physician, route sales, clerical services or whatever is appropriate is all that is needed on that form. Include enough that the IRS can see the relationship to any signNow expenses you have, like a lot of mileage. But if you have such signNow expenses you would be filing Schedule C. We do not always include the business code and have had no issues with that from the IRS.If you have an EIN for your business you should include that so the IRS knows the business return has been filed.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

Create this form in 5 minutes!

How to create an eSignature for the 1040 schedule c ez 2018 2019 form

How to make an eSignature for the 1040 Schedule C Ez 2018 2019 Form online

How to create an electronic signature for the 1040 Schedule C Ez 2018 2019 Form in Google Chrome

How to generate an eSignature for putting it on the 1040 Schedule C Ez 2018 2019 Form in Gmail

How to create an electronic signature for the 1040 Schedule C Ez 2018 2019 Form from your mobile device

How to create an eSignature for the 1040 Schedule C Ez 2018 2019 Form on iOS

How to generate an electronic signature for the 1040 Schedule C Ez 2018 2019 Form on Android

People also ask

-

What is ez net and how does it relate to airSlate SignNow?

ez net is a streamlined solution designed for businesses to easily send and eSign documents. With airSlate SignNow, you can utilize ez net to enhance collaboration and improve workflow efficiency by securely managing document signings digitally.

-

How does airSlate SignNow pricing work for ez net users?

airSlate SignNow offers competitive pricing plans tailored for ez net users, ensuring cost-effectiveness. Each plan includes essential features for document management and eSigning at various levels, allowing businesses to choose what best fits their needs.

-

What are the key features of airSlate SignNow for ez net users?

Key features for ez net users include real-time document tracking, customizable templates, and a user-friendly interface. These features help streamline the signing process and enhance the overall user experience for both senders and signers.

-

Can I integrate airSlate SignNow with other tools while using ez net?

Yes, airSlate SignNow easily integrates with various third-party applications, enhancing the functionality of ez net. This allows businesses to connect their document management processes with tools they already use, such as CRMs and cloud storage solutions.

-

What are the benefits of using airSlate SignNow's ez net solution?

The benefits of using the ez net solution include improved efficiency, secure document handling, and faster turnaround times for contract signings. By leveraging airSlate SignNow, businesses can simplify their workflows and enhance productivity.

-

Is airSlate SignNow secure for handling sensitive documents in ez net?

Absolutely, airSlate SignNow is designed to handle sensitive documents securely. The platform employs advanced encryption measures and complies with industry standards, ensuring that your documents remain safe while using the ez net service.

-

How can I get started with airSlate SignNow and ez net?

Getting started with airSlate SignNow and ez net is simple. You can sign up for a free trial on the website, which will give you immediate access to the features available for eSigning and document management, allowing you to explore all the benefits.

Get more for Schedule C Ez

Find out other Schedule C Ez

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later