X 5 Part 2002-2026

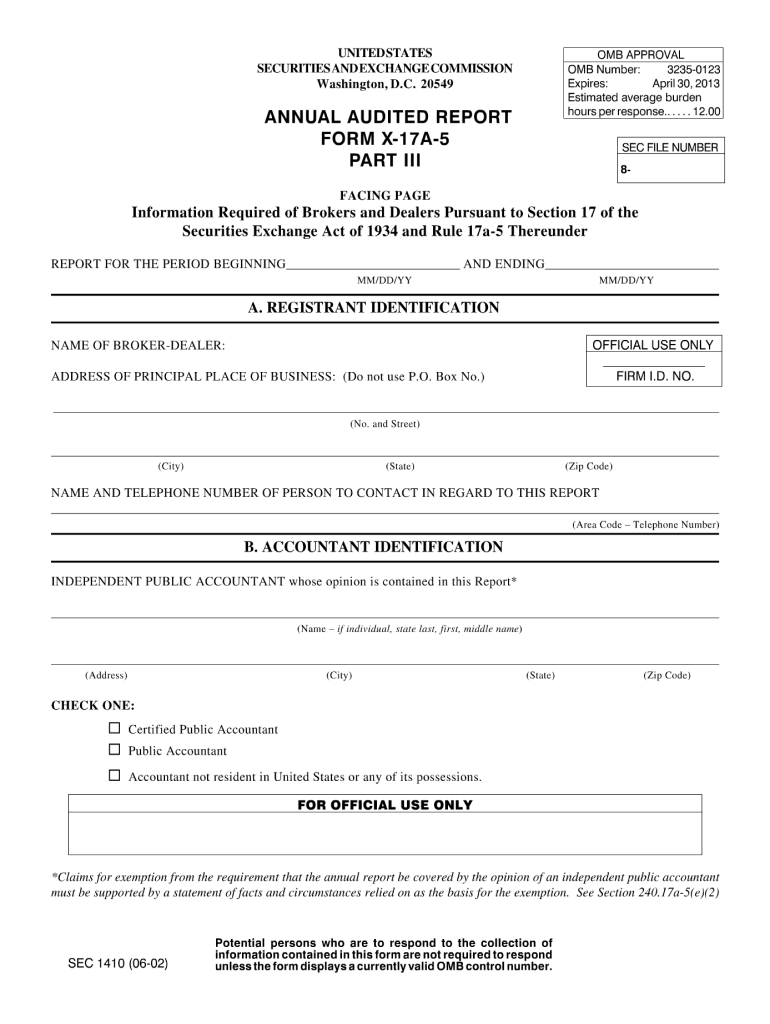

What is the 17a 5 Part?

The 17a 5 Part is a crucial section of the 17a form, which is used primarily in the financial sector for regulatory compliance. This part of the form outlines specific information that financial institutions must disclose regarding their operations and practices. It is essential for ensuring transparency and accountability within the industry. The 17a 5 Part includes details about the entity's structure, financial performance, and compliance with applicable regulations, making it a vital component for both the institutions and regulatory bodies.

How to use the 17a 5 Part

Using the 17a 5 Part effectively involves understanding its requirements and accurately completing each section. Begin by gathering all necessary financial documents and records related to your institution. Carefully review the instructions provided with the form to ensure compliance with the latest regulations. Fill out the 17a 5 Part by inputting accurate and truthful information. It is important to double-check all entries for accuracy, as errors can lead to compliance issues and potential penalties.

Steps to complete the 17a 5 Part

Completing the 17a 5 Part requires a systematic approach to ensure all information is accurate and compliant:

- Gather necessary financial documents, including balance sheets and income statements.

- Review the latest guidelines related to the 17a 5 Part to understand the required disclosures.

- Fill out the form, ensuring that all sections are completed with precise information.

- Verify the accuracy of the information provided, checking for any discrepancies.

- Submit the completed form through the appropriate channels, whether online or via mail.

Legal use of the 17a 5 Part

The legal use of the 17a 5 Part is essential for compliance with federal regulations governing financial institutions. This part of the form must be completed truthfully and accurately to avoid legal repercussions. Misrepresentation or failure to disclose required information can lead to significant penalties, including fines and legal action. Institutions should ensure they are familiar with the legal implications of the information submitted and maintain accurate records to support their disclosures.

Required Documents

To complete the 17a 5 Part, several documents are typically required. These may include:

- Recent financial statements, such as balance sheets and profit and loss statements.

- Documentation of compliance with relevant regulations.

- Records of internal policies and procedures related to financial operations.

- Any additional disclosures mandated by regulatory authorities.

Having these documents readily available will facilitate the accurate completion of the 17a 5 Part.

Filing Deadlines / Important Dates

Timely filing of the 17a 5 Part is critical to ensure compliance with regulatory requirements. Institutions must be aware of specific deadlines for submission, which can vary based on the reporting period and regulatory guidelines. Typically, these deadlines are set annually, but institutions should verify the exact dates for their specific circumstances. Late submissions can result in penalties, so it is advisable to mark these important dates on a calendar and prepare the necessary documentation in advance.

Quick guide on how to complete audited form

A simple manual on how to prepare X 5 Part

Filling out electronic forms has demonstrated greater efficiency and security compared to conventional pen-and-paper techniques. Unlike when you physically write on paper forms, correcting a typo or inputting information in the incorrect field is swift. Such errors can be a signNow disadvantage when you are preparing applications and petitions. Consider utilizing airSlate SignNow for filling out your X 5 Part. Our all-encompassing, user-friendly, and compliant electronic signature solution will streamline this process for you.

Follow our steps on how to quickly complete and endorse your X 5 Part with airSlate SignNow:

- Review the purpose of your chosen document to ensure it fits your needs, and click Get Form if it meets your requirements.

- Find your template loaded into our editor and investigate what our tool provides for form modification.

- Fill in empty sections with your information and check boxes using Check or Cross options.

- Add Text boxes, replace existing content, and insert Images wherever necessary.

- Utilize the Highlight button to emphasize what you wish to draw attention to, and conceal irrelevant parts to your recipient using the Blackout tool.

- In the right pane, insert additional fillable fields designated for specific parties if necessary.

- Safeguard your document with watermarks or set a password once you are done with editing.

- Add Date, click Sign → Add signature and select your preferred signing method.

- Sketch, type, upload, or generate your legally binding electronic signature with a QR code or utilizing your device's camera.

- Review your entries and click Done to complete editing and proceed with file sharing.

Employ airSlate SignNow to prepare your X 5 Part and manage other professional fillable templates securely and efficiently. Sign up now!

Create this form in 5 minutes or less

FAQs

-

How do you fill up the application form in a JYP online audition?

You mean this?What is meaning of “forum”?You mean application form?JYPE Audition ::

-

If you were filling out an audition form for a K-pop audition, would you use your Korean age or your real age?

A2A The rest of the world uses your real age not your Korean age. The Korean age is nine months earlier than real age. That will save confusion in the future.

-

How do I join the JYPE online audition? Is there an application form needed? What is it?

JYP has probably one of the best formats for an online audition. The website is easy to navigate and there are multiple language settings.To walk you through, here is a step by step.This is their most recent home page. I know because I’m literally taking screenshots right now.On the top, you can see four options, “company”, “artist”, “audition”, and “actors”.Click on the audition tab.It should bring you to this page.I already scrolled down on this page, but make sure you scroll down to the bottom of the page to see the blue button shown above.Then, click on the blue button and it will bring you to the following pageIf you are a foreigner, click on the gray foreigner button. It should bring you to the same page but in english.Then, click on number four as shown above.At this point, you should see this page if you aren’t logged in or don’t have an account.This is when you should create an account. You have to create an account for you to be able to apply. In my case, I already have an account so I’m just going ahead and log in.After you have created an account and logged in, it should take you to the page that is shown above the most recent picture.Click on number 4 again.This should bring you to the following audition form page.Fill in your personal information, click “apply” and you are entered into their system for auditions.Good luck!

-

What is the most unreasonable customer complaint you've heard?

I’ve had too many to count. Working at customer service at Walmart you will see just about anything. I’ll give you a few.• A woman comes up with a bag of what appears to be red mud. She plops it on my counter with a wet sploosh. The customer shoved a receipt in my face while explaining she needs to exchange her dress for a new one. She’d only gotten to wear it to church once before she tripped and landed in a mud puddle.I blinked before prodding the muddy dress in the bag. I took a deep breath before explaining, as nicely as I could, that clothing exchanges just don’t work that way. The only way we could exchange or refund an article of clothing was if there was a factory defect or if the clothing was in new condition.The woman insisted that she had always exchanged her ‘stained’ clothing with us. I explained that after items left the store, they belonged to the customer, unless damaged by the manufacturer, or in new condition, and we did not exchange stained clothing. She blew up and went through two CSMs and a front end manager before grabbing her muddy dress and storming from the store.• A woman came in with a totally empty cake box and demanded another cake and her money back. The cake, she said, had been for her daughter’s birthday party and it had been stale and was disgusting. I asked her where the cake was and she huffed and rolled her eyes, telling me that it was a party and they HAD to eat it. I turned it over to the bakery manager. She took great pleasure in telling the customer she had to have at least a bit of the cake to do anything.• A man came in with a swimming pool that he claimed was two years old because grass had grown through the liner. It smelled so bad all the customers in line left. I was gagging too much to do anything until a coworker shrink wrapped the nasty thing.The customer had no receipt but claimed he paid $500 for it. I told him that even with a receipt, we could only do an exchange within 90 days. I had a CSM over ride me on this one, even though we didn’t even carry the same pool. There was no way to even ring it into the system.I told my CSM that I would have nothing to do with the transaction and made her sign everything. I warned her someone would get fired over this transaction and it would not be me. True to my words, I was called into the store manager’s office and told to explain myself. I explained that the whole thing was the CSM’s fault and she was fired.• A lady brought in an opened DVD and wanted her money back. Copyright law prohibits this. We can exchange for the exact same title but no refunds or title swaps. I told her I was sorry and explained the law. She goes into a full blown rant because she wanted the same movie she saw in the theater but this one was modified.I asked the customer what she was talking about and she tells me it says it’s been modified right at the beginning of the movie and she wanted the same one from the theater, not some modified crap. Obviously, she was talking about the screen that tells you the film has been modified to fit your tv screen. I asked her if she had watched the movie. No. She hadn’t wanted to bother since she knew it wasn’t what she wanted. I explained the modification was only to the size of the film, not the content. She gives me this blank stare and tells me not to blow smoke up her butt. Okay. I try again. Telling her to just take the movie home and watch it, promising that it’s the same movie.The customer became so upset that I had to call in both a CSM and the Electronics manager. They pulled her aside and tried to explain things to her with no success. The customer threw the DVD at us and stormed off.• A customer came in with a desktop computer to exchange. I asked him what was wrong with it and he told me it was an oversized paper weight. He said it did nothing and would not even turn on. I pulled it out of the box, plugged it up, hit the power button, and it immediately started booting up. The guy gapes at me for a moment before asking what I did. I told him I had plugged it in and pushed the power button. He said he hadn’t realized there was a power button. We packed it back up and he took it back home.

Create this form in 5 minutes!

How to create an eSignature for the audited form

How to generate an eSignature for your Audited Form in the online mode

How to make an electronic signature for the Audited Form in Google Chrome

How to make an eSignature for signing the Audited Form in Gmail

How to make an eSignature for the Audited Form right from your smart phone

How to create an electronic signature for the Audited Form on iOS devices

How to create an electronic signature for the Audited Form on Android devices

People also ask

-

What is the X 5 Part solution offered by airSlate SignNow?

The X 5 Part solution from airSlate SignNow is a comprehensive e-signature platform designed to streamline document signing processes for businesses. It enables users to send, sign, and manage documents efficiently, ensuring a smooth workflow and improved productivity. With its user-friendly interface, the X 5 Part solution is suitable for businesses of all sizes.

-

How does the X 5 Part solution improve document management?

The X 5 Part solution enhances document management by providing a centralized platform where users can easily send, sign, and store documents securely. It minimizes the risk of errors and delays associated with traditional paperwork. By automating the signing process, the X 5 Part solution helps businesses save time and resources while maintaining compliance.

-

What are the pricing options for the X 5 Part solution?

airSlate SignNow offers flexible pricing plans for the X 5 Part solution to accommodate different business needs. Plans include various features and user limits, allowing you to choose the one that best fits your requirements. For more detailed pricing information, visit our website or contact our sales team for a personalized quote.

-

Can the X 5 Part solution be integrated with other software?

Yes, the X 5 Part solution is designed for seamless integration with a variety of third-party applications, including CRM and project management tools. This allows businesses to streamline their workflows and enhance productivity by connecting their existing systems with airSlate SignNow. Explore our integration options to see how the X 5 Part solution can fit into your tech stack.

-

What are the benefits of using the X 5 Part solution for businesses?

Using the X 5 Part solution provides numerous benefits, including increased efficiency, reduced turnaround times, and improved document security. Businesses can easily track the status of their documents and obtain legally binding signatures quickly. Additionally, the cost-effective nature of the X 5 Part solution makes it accessible for businesses of all sizes.

-

Is the X 5 Part solution secure for sensitive documents?

Absolutely, the X 5 Part solution prioritizes security and compliance, employing advanced encryption methods to protect sensitive documents. It adheres to industry standards, ensuring that your data remains confidential and secure throughout the signing process. With airSlate SignNow, you can confidently manage and sign your important documents.

-

How easy is it to use the X 5 Part solution?

The X 5 Part solution is designed with user-friendliness in mind, making it easy for anyone to navigate and utilize its features. With a simple interface, businesses can quickly send documents for signing without extensive training. Whether you're tech-savvy or not, the X 5 Part solution allows users to manage documents effortlessly.

Get more for X 5 Part

- Form ct 3992019depreciation adjustment schedulect399

- Form ct 3 s2019new york s corporation franchise tax returnct3s

- Business registration certificate requirement form

- Form rp 6704 a1719joint statement of school tax levy for the 2019 2020 fiscal yearrp6704a1

- Special tax notice for uc retirement plan distributions ucnet form

- Form ct 2482019claim for empire state film production creditct248

- Form ct 2222018underpayment of estimated taxnygov

- Form ct 512019request for additional extension of time to file for franchisebusiness taxes mta surcharge or bothct51

Find out other X 5 Part

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now