8962 Form 2015

What is the 8962 Form

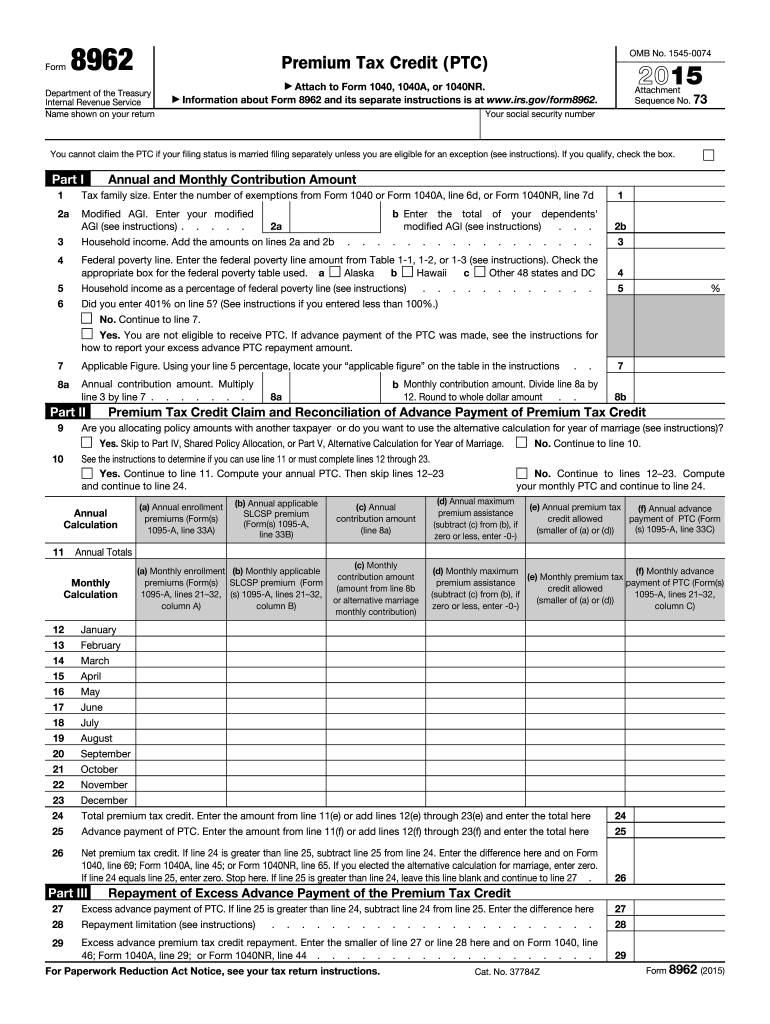

The 2015 Form 8962, also known as the Premium Tax Credit form, is a crucial document for individuals who received health insurance coverage through the Health Insurance Marketplace. This form is used to calculate the premium tax credit that can reduce the cost of health insurance premiums. It also helps determine if an individual or family is eligible for the premium tax credit based on their income and household size. Completing this form accurately is essential for ensuring that taxpayers receive the correct amount of financial assistance for their health coverage.

How to use the 8962 Form

Using the 2015 Form 8962 involves several steps. First, taxpayers must gather necessary information, including details about their health coverage, household income, and family size. Next, they will fill out the form by providing this information in the appropriate sections. It is important to follow the instructions for Form 8962 carefully to ensure that all calculations are correct. Once completed, the form should be submitted alongside the federal tax return to the IRS. This submission can affect the overall tax liability, so accuracy is key.

Steps to complete the 8962 Form

Completing the 2015 Form 8962 involves a systematic approach:

- Gather necessary documents, including Form 1095-A, which provides information about health coverage.

- Enter personal information, including name, Social Security number, and details about household members.

- Calculate the premium tax credit by following the instructions provided on the form.

- Report any advance payments of the premium tax credit received during the year.

- Double-check all entries for accuracy before submission.

Legal use of the 8962 Form

The 2015 Form 8962 is legally binding when completed and submitted correctly. It complies with IRS regulations, and the information provided must be accurate to avoid penalties. The form is essential for reconciling any advance premium tax credits received, ensuring that taxpayers fulfill their obligations under the Affordable Care Act. Legal validity is maintained when the form is signed and dated, confirming that the information is true and complete.

IRS Guidelines

The IRS provides specific guidelines for completing the 2015 Form 8962. Taxpayers should refer to the official IRS instructions for Form 8962, which detail how to fill out each section, what information is required, and how to calculate the premium tax credit. These guidelines are crucial for ensuring compliance with tax laws and for avoiding errors that could lead to delays in processing or potential audits.

Required Documents

To complete the 2015 Form 8962, several documents are necessary:

- Form 1095-A: Health Insurance Marketplace Statement, which provides details about the coverage.

- Income documentation, such as W-2 forms or 1099 forms, to verify household income.

- Social Security numbers for all household members included on the form.

Having these documents ready will streamline the process of filling out the form and ensure accuracy in reporting.

Quick guide on how to complete 2015 8962 form

Manage 8962 Form seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It presents an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle 8962 Form on any platform using airSlate SignNow's Android or iOS apps and simplify any document-related process today.

Effortlessly edit and eSign 8962 Form

- Find 8962 Form and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device of your choice. Edit and eSign 8962 Form and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 8962 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 8962 form

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 8962 Form and why is it important?

The 8962 Form is a crucial document for individuals who receive premium tax credits under the Affordable Care Act. It is used to reconcile the amount of premium tax credit received with the appropriate amount of credit based on your final income. Understanding how to complete the 8962 Form correctly ensures that you meet tax obligations and can avoid potential penalties.

-

How can airSlate SignNow help me with the 8962 Form?

With airSlate SignNow, you can easily create, send, and eSign your 8962 Form electronically. Our user-friendly interface simplifies the process, allowing you to manage your documents seamlessly and securely. By using airSlate SignNow, you can complete your tax documentation efficiently and have peace of mind.

-

Is there a free trial for using airSlate SignNow with the 8962 Form?

Yes, airSlate SignNow offers a free trial that allows you to explore our features without any commitment. During this trial, you can test how our platform can streamline the completion and signing of the 8962 Form. This is a great opportunity to see how airSlate SignNow can enhance your document management process.

-

What features does airSlate SignNow provide for managing the 8962 Form?

airSlate SignNow includes a variety of features that simplify managing the 8962 Form, such as customizable templates, secure eSigning, and cloud storage. You can easily track the status of your document and receive notifications when it’s signed. These features help ensure that your 8962 Form is processed quickly and accurately.

-

Are there any integrations available with airSlate SignNow for handling the 8962 Form?

Absolutely! airSlate SignNow integrates with numerous applications such as Google Drive, Dropbox, and Salesforce, making it easy to manage your documents, including the 8962 Form, from a central location. These integrations enhance your workflow by allowing you to access and send documents without switching between multiple platforms.

-

How secure is airSlate SignNow when handling the 8962 Form?

Security is a top priority at airSlate SignNow. We use industry-leading encryption and compliance measures to ensure that your 8962 Form and other sensitive documents are protected. You can trust that your data is safe and secure while using our platform to manage your electronic signatures.

-

Can I customize the 8962 Form in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the 8962 Form to meet your specific needs. You can add fields, modify layouts, and include branding elements to create a professional document. This customization capability ensures that your 8962 Form reflects your unique requirements.

Get more for 8962 Form

- Current faculty and staffbelmont universitynashville tn form

- Grammar for academic writing the university of form

- Ishp host family application and picture form

- Academic advising contract grambling state university gram form

- Electronic w 2 consent form

- Ascipreporting claims form

- Tuitionremissiontaxwaiverformemployees

- For university employee incidents supervisor and employee must complete form

Find out other 8962 Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe